Two of the best microcap investors on the planet? Ian Cassel and Paul Andreola.

They find stars like Lebron James when he was still playing high school basketball.

Let’s learn the secrets from the world’s top microcap investors.

Tiny Titans

Tiny Titans is all about finding small companies with 10x potential.

It sold out in just 36 hours.

The good news? You can now put yourself on the application list.

If you do so, you will receive immediate access to a list of 93 (!) companies with 10x potential.

Put yourself on the application list here:

Why microcaps?

My crazy friend

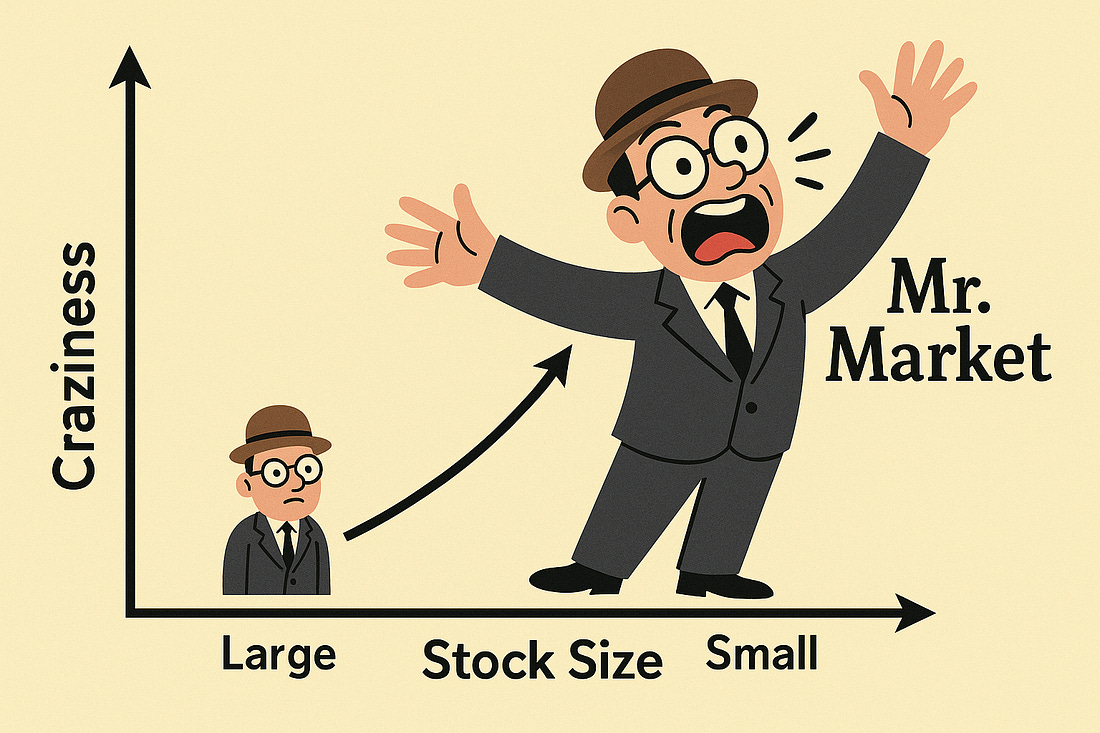

You know the name of one of my closest friends? His name is Mr. Market.

What I love about him is that he is incredibly generous. He makes me trillions of offers daily.

But what’s even better? Sometimes he is completely irrational.

Some of his offers are just absurd.

In November 2022, you could have bought Meta ($META) at a Price-to-Earnings ratio of 8.6x. Since then, the stock has gone up over 600%.

But honestly, he doesn’t frequently make these kinds of offers in the large-cap space.

Small caps on the other hand …

The smaller the stock, the less efficient the market.

Or in other words, the crazier my friend Mr. Market becomes.

That’s exactly why there are big opportunities in this space.

The data proves it

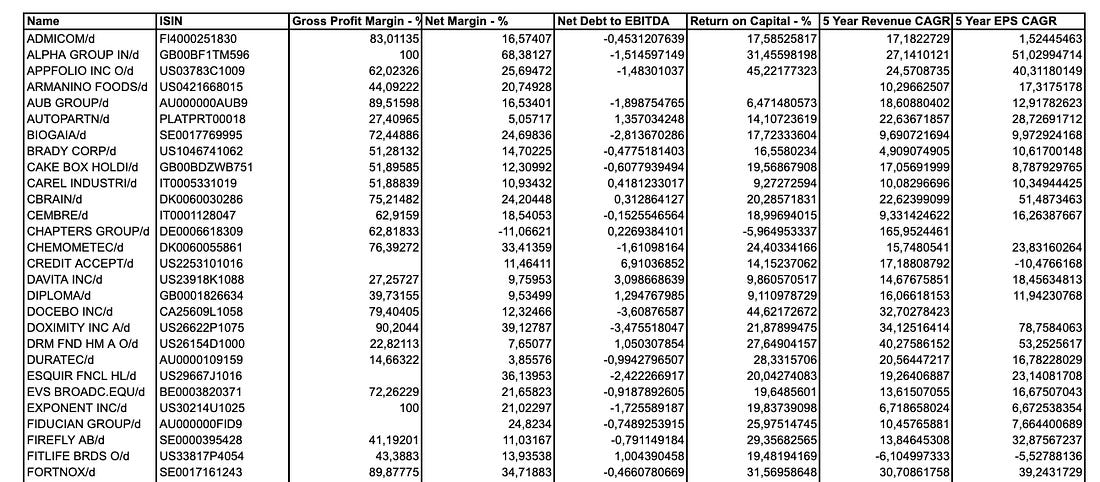

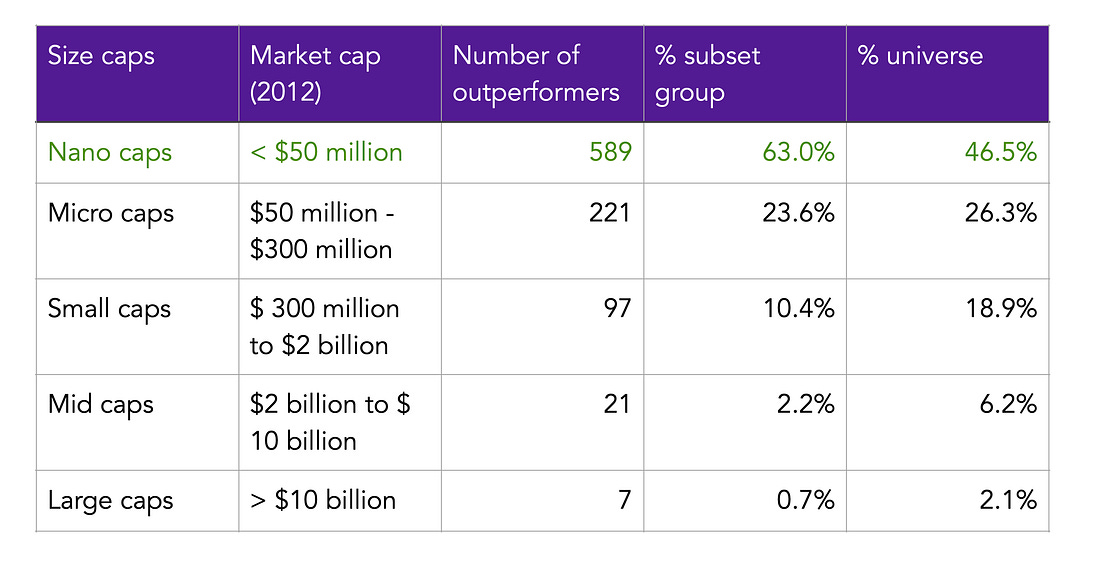

A big study by Jenga Investment Partners found something interesting.

86.6% (!) of all stocks that went up 10x from 2012 to 2022 were microcaps.

The Big Four

Microcap investors don’t like to waste time.

They want to say no to a potential investment as quickly as possible.

That’s why they will always check ‘The Big Four’ first:

Profitability

Low dilution

Low liquidity

High growth

If you check these four things, you will already have a reason not to invest in 95 out of 100 cases:

"In the microcap and nanocap market, there are typically two types of stocks: those that have solid fundamentals, are growing, and the other 95%." - Paul Andreola1. Profitability

The study by Jenga Investment Partners is very long.

The document has 287 pages.

But here’s everything you need to know in two sentences:

87% of all stocks that went up 1,000% from 2012 to 2022 were microcaps

82% of all these 10-baggers were already profitable from the beginning

Profitability is your priority.

2. Low dilution

MicroCapClub is the community of Ian Cassel where a lot of microcap investorsgather.

They found a clear pattern:

"The losers, those whose stock values have declined 50-99% since being posted in Our Community at least 5 years ago, diluted their shareholders on average 61%.

When we look at the winners, those companies whose stock values have increased at rates higher than the market and were profiled in Our Community. These companies diluted their shareholders on average 22%, or 64% less than the losers." - MicroCapClubThe key lesson? We don’t want the outstanding shares to increase too much as it hurts existing shareholders.

3. Low liquidity

The best time to buy as a large-cap investor? When there’s blood in the streets.

And as a microcap investor? When there’s no one in the streets.

“I don’t want to buy when there’s blood in the streets, I want to buy when there is no one in the streets.” - Paul AndreolaYou can measure the amount of blood in the streets by looking at the Fear & Greed Index.

The more fear, the more blood, and the greater the potential opportunity.

But how do you measure if there’s no one in the streets? That’s where low liquidity comes in.

The lower the liquidity, the fewer people are in the streets.

Low liquidity matters because it keeps out the institutional investors.

During bear markets, these less institutionalized stocks often outperform because there’s less selling pressure from large institutional investors.

And once the institutions do come in, multiples usually expand, leading to significantly higher stock prices.

4. High growth

If a business is not growing, it is dying.

And guess what? If the business is dying, your investment in it will slowly die too.

On the other hand, if a business can grow its intrinsic value over decades, so will your investment.

In the long run, stock prices always reflect the growth of the underlying business: