|

Howard Marks is the co-founder of Oaktree Capital and one of the most respected investors in the world.

Even Warren Buffett says, “When I see memos from Howard Marks in my mail, they’re the first thing I open and read.”

Most investors focus only on returns - how much they can make.

Marks focuses almost entirely on risk - how much you can lose.

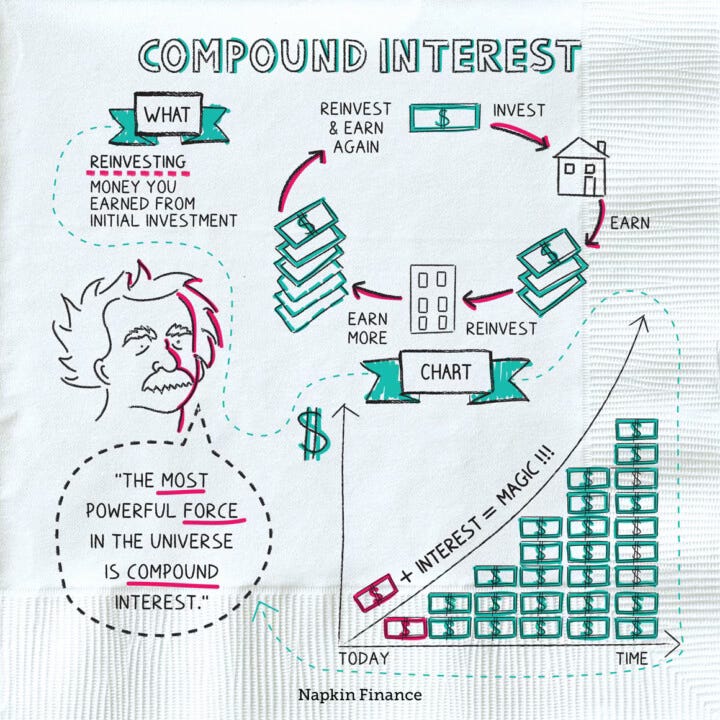

As dividend investors, our goal is to buy great companies and let them grow our income.

That means they have to survive a long time.

Let’s dive in to 7 lessons on risk from Howard Marks to help us make sure that happens.

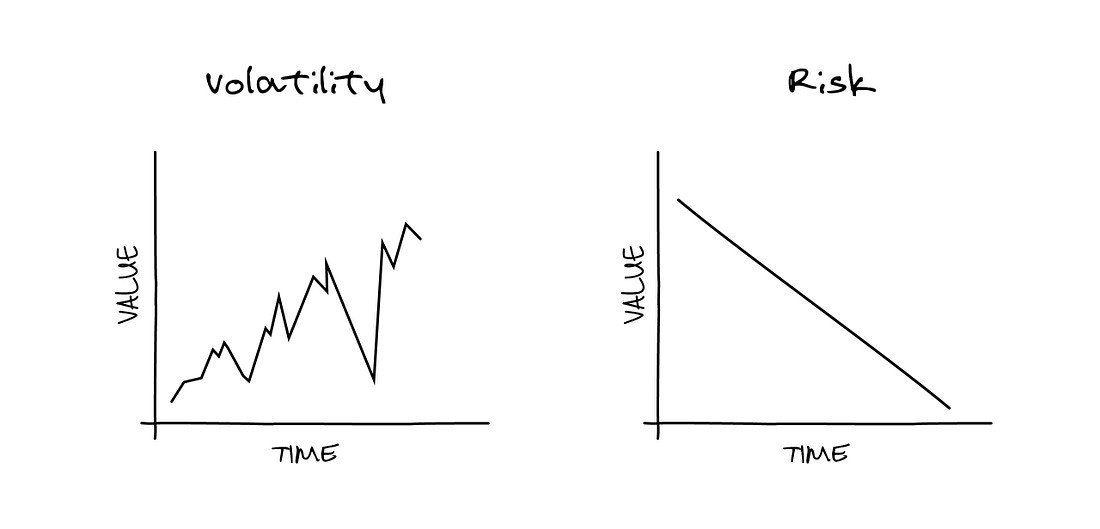

1. Risk is not volatility

“Academicians settled on volatility as the proxy for risk as a matter of convenience... but I just don’t think volatility is the risk most investors care about.”

- Risk (January 19, 2006)

Wall Street defines risk as volatility, or how much a stock price wiggles up and down.

That’s because it’s easy to measure and easy to put into a spreadsheet.

But as a dividend investor, do you really care if your stock price drops 10% this month if the business is healthy and the dividend check clears?

Probably not.

To Marks, the only risk that truly matters is the permanent loss of capital.

Price changes are temporary, but a bankrupt company is a permanent disaster.

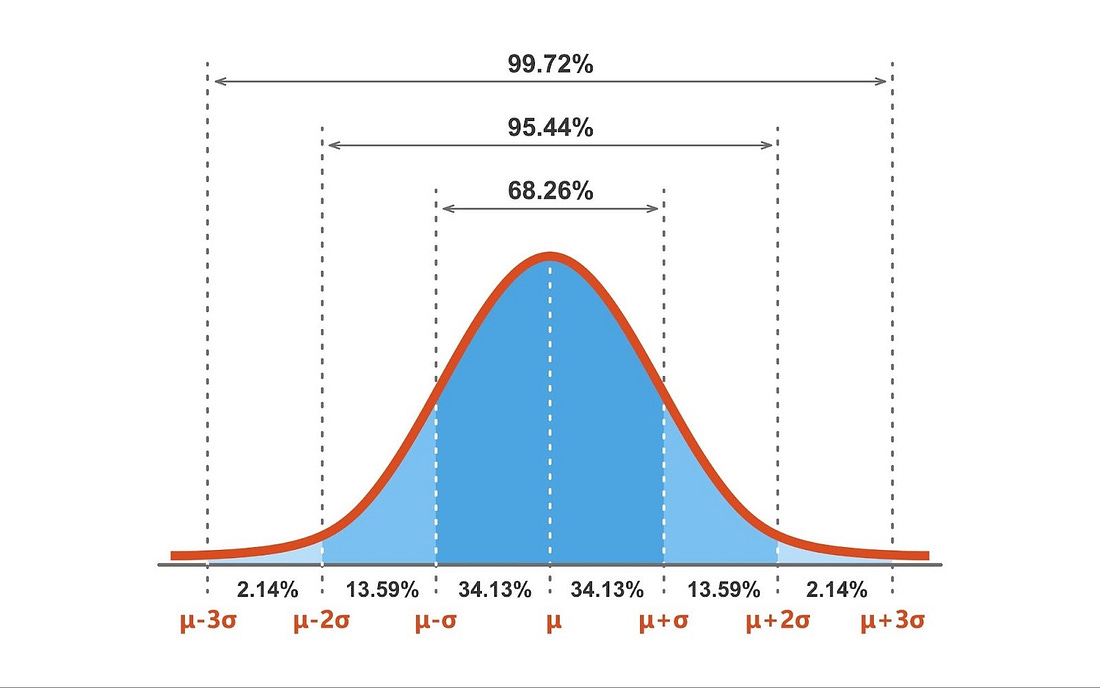

2. More things can happen than will happen

“Risk means more things can happen than will happen.”

-Risk Revisited (September 3, 2014)

We tend to look at the past and think it was inevitable.

But just because something did happen, doesn't mean that it had to.

Likewise, the future isn’t a single fixed path. It is a range of possibilities.

Marks (and mathematicians) call this a probability distribution.

You might have a 90% chance of being right, but that ‘alternative history’ with a 10% chance can still happen.

Remember that almost nothing about the future is certain.

3. The “Negative Art” of avoiding losers

“Improving performance... not through what they buy, but through what they exclude, not by finding winners, but by avoiding losers.”

-Fewer Losers, or More Winners? (September 12, 2023)

Marks describes bond investing as a “negative art.”

If you buy a bunch of 8% bonds, you know what your return is going to be if you hold them to maturity and none of them default.

You don’t need to find a superstar bond that will outperform, you just need to avoid the ones that default.

Dividend investing is similar.

You don’t need to find the next Amazon to get rich.

If you simply build a portfolio of quality companies and