| | In this edition, all sides rush to defend Fed Chair Jerome Powell, and Meta strengthens its Gulf amb͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- Rallying around Powell

- Pentagon makes a deal

- Home investors’ open hand

- Meta sharpens Gulf ambitions

- Rebooting Venezuela’s oilfields

|

|

You can disagree with President Donald Trump’s policies while understanding their political logic. Many Americans have real concerns about immigration. Promising to revive manufacturing is popular. But a criminal investigation into Federal Reserve Chair Jerome Powell — who is this for? No normal person understands monetary policy. Anyone who decides to learn between now and May, when Powell’s term as chair expires and Trump can appoint a more pliant replacement, will be wary of interest-rate cuts that could rekindle inflation. Worse, the mortgage rates that voters care about don’t even track the overnight rates that Trump wants the Fed to cut faster. They generally follow long-term rates that haven’t budged — partly due to inflation fears that this very type of meddling creates. The whole thing is financially and politically self-defeating: Republican senators have already criticized the investigation, my Washington colleagues reported. One, Sen. Thom Tillis, said he won’t confirm Powell’s replacement “until this is settled.” The investigation could also steel Powell to stay on as a member of the Fed’s board after he hands over the gavel, which he is allowed to do until 2028. This counterproductive score-settling (which even Treasury Secretary Scott Bessent knows was a mistake, per Axios) might explain why financial markets mostly shrugged. That’s the glass-half-full assessment of economist Justin Wolfers, who I joined on today’s Prof G Markets podcast. He thinks this makes it harder for Trump to install a yes-man at the Fed, which investors took as a positive. My gloomier take is that investors have gone numb to chaos and the feedback loop that forced Trump to walk back his tariffs last spring is getting dangerously fuzzy. On that cheerful note, sign up for our pop-up newsletter from Davos! In another puzzling bit of political messaging, Trump is taking his affordability kick to the billionaire-infested Swiss Alps. |

|

Nathan Howard/Reuters Nathan Howard/ReutersWall Street executives, international central banks, meme-stock traders, and even Republican senators are defending Powell. Every living Fed chair and five former Treasury Secretaries denounced the probe in a joint statement (on Substack!). Bessent privately told the president the probe was a mistake — though not yet a costly one, as markets shrugged. The Justice Department official who authorized the subpoena, which relates to the Fed’s headquarters renovations, appeared to downplay it as backlash grew Monday. At least six Republican senators have expressed concerns. “We need this like we need a hole in the head,” said one key vote. News of the investigation landed uncomfortably into Wall Street’s quarterly earnings cycle, forcing CEOs to weigh in. JPMorgan’s Jamie Dimon did so cautiously: “Anything that chips away” at the central bank’s independence “is not a good idea,” he said, adding that Powell had made some policy mistakes (presumably over the Fed’s 2022 response to inflation, not marble selection). “Questioning one of the tenets that underlies the bond market runs the risk of actually doing the opposite of” tackling affordability, Bank of New York Mellon CEO Robin Vince said. |

|

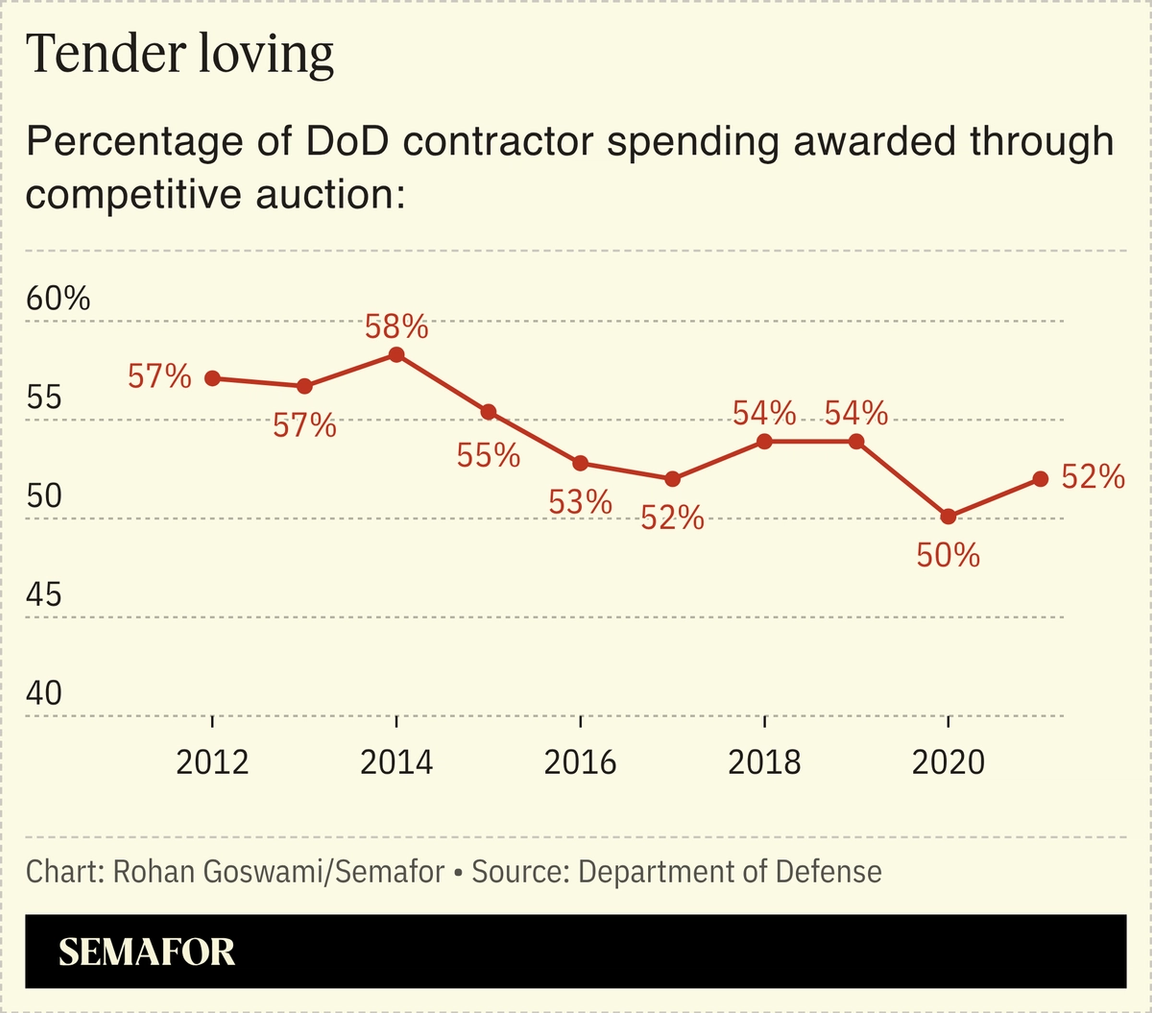

Revisiting the defense industry’s ‘Last Supper’ |

The Pentagon’s $1 billion investment in a new spinoff from defense contractor L3Harris could be a first step to making the industry more competitive. What looks like another leg in an increasingly state-directed economy could actually spur an overconsolidated industry to find its entrepreneurial bent, L3Harris CEO Chris Kubasik said in an interview. Since the 1990s, fifty-one contractors have consolidated into five, largely at the urging of a Clinton administration keen to move on from the Cold War. “It all goes back to the Last Supper in ’93,” he said, referring to the Pentagon dinner that set off a wave of mergers. “The consolidation went too far.” L3Harris, itself formed by a 2019 merger, “makes six — maybe five and a half” defense contractors, given its smaller footprint and lack of a signature program like a fighter jet, Kubasik said, “and we’re creating another new one [with this spinoff]. You’ve got your Andurils and your Palantirs and maybe we get up to 12. This could be the first step of deconsolidating the defense-industrial base.” “I guarantee every banker in America is calling every other company in this industry saying, ‘hey, I did a sum-of-the-parts this morning and have an idea.’” |

|

There isn’t yet an easy way to invest in all the companies that the Trump administration has taken stakes in. Matthew Tuttle, the king of niche ETFs, has tried.  |

|

Private capital’s olive-branch moment |

Mike Blake/Reuters Mike Blake/ReutersWall Street investment firms in the housing space want to work with the White House to defuse Trump’s proposed ban. “The notion that we are crowding out the individual homebuyer, I think, is an old view,” Stephen Scherr, co-president of investment firm Pretium, said in an interview. “Anything we can do to… accelerate people’s path into home ownership, we’re game to play,” he said. Trump’s proposal to ban institutional investors from owning single-family homes — which would likely require help from congressional Republicans — is the president’s latest acknowledgment of an affordability gap he’s previously shrugged off or blamed on Democrats. Investment firms own less than 5% of the nation’s homes, though they have higher footprints in many local markets where they have drawn criticism from local and state officials. A grand bargain that brings in private capital — still a mystery to most people outside Manhattan — along with homebuilders, banks, and the soon-to-be-public government mortgage giants, Fannie Mae and Freddie Mac, is a political opportunity worth seizing. |

|

Meta sharpens Gulf ambitions |

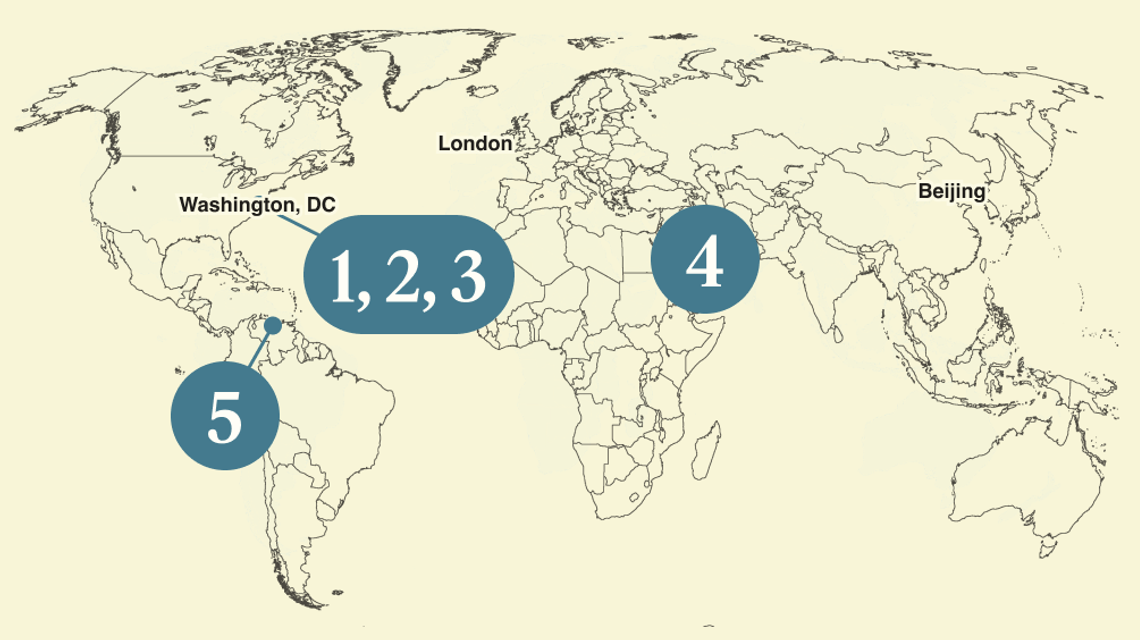

Courtesy of Future Investment Initiative Courtesy of Future Investment InitiativeMeta signaled a deeper push into the Gulf’s AI race with a high-profile hire. The company tapped former Trump adviser Dina Powell McCormick as president and vice chair, responsible for overseeing a planned $600 billion infrastructure buildout. The move is a bet on both Trump and the Middle Eastern governments, where Powell McCormick has deep ties from her time in government and on Wall Street. Unlike Google, Nvidia, and OpenAI, Meta hasn’t yet struck a signature partnership in the Gulf, where Saudi Arabia, the UAE, and Qatar are keen to be conduits for Silicon Valley’s ambitions. Meta is also hunting for new ways to pay for its AI buildout, tapping financing schemes that keep its balance sheet light. One place it might look: Abu Dhabi’s newest sovereign wealth fund is taking shape, Semafor’s Mohammed Sergie reports. L’IMAD, which launched hazily in October and popped up as a financier of Paramount Skydance’s bid for Warner Bros. Discovery, joins an alphabet soup of Emirati investment funds that together control roughly $2 trillion in assets. It will be chaired by Abu Dhabi’s crown prince, with Khaldoon Al Mubarak, the head of UAE sovereign-wealth fund Mubadala (who flew in to fête Powell at a recent awards dinner in New York) on its board. |

|

Winners and losers in Venezuela |

Evelyn Hockstein/Reuters Evelyn Hockstein/ReutersThe rebooting of Venezuela’s oil industry is taking shape — and favors the bold. Small, risk-tolerant Texan wildcatters and service companies like Halliburton are emerging as potential winners, edging out drilling giants still smarting over the big losses they suffered in the country, Semafor’s Tim McDonnell writes. ExxonMobil CEO Darren Woods called Venezuela “uninvestable” for the time being, a comment which Trump later said left him “inclined to keep Exxon out” of any consortium. Trump also told ConocoPhillips’ CEO to give up on trying to recover the $12 billion the company says it’s owed by Venezuela, a disconcerting message to the big European drillers in the room, Eni and Repsol, which are also owed billions. “Oil companies are going to be worried about the concessions,” said Neil McMahon, CEO of oil investment firm Kimmeridge. “Someone needs to guarantee the contracts.” One notable winner is the consumer: Goldman Sachs lowered its oil price forecast for the next two years, citing more drilling in the US and Venezuela. |

|

Semafor has expanded the Semafor World Economy Global Advisory Board, a group of visionary business leaders representing nearly every sector across the US and G20 — who will help guide the largest gathering of global CEOs in the United States of America. Our co-chairs — Ken C. Griffin, founder and CEO of Citadel; Henry R. Kravis, co-founder and co-executive chairman of KKR; Penny S. Pritzker, former US Secretary of Commerce; and David M. Rubenstein, co-founder and co-chairman of the Carlyle Group, continue to lead this effort joined by a broadened roster shaping this year’s program. Joining the Advisory Board at this year’s convening will be our inaugural cohort of Semafor World Economy Principals — an editorially curated community of innovators, policymakers, and changemakers shaping the new world economy with front-row access to Semafor’s world-class journalism, meaningful opportunities for dialogue, and touchpoints designed for connection-building. Applications are now open here. |

|

➚ BUY: Curry. A minority stake in the Golden State Warriors is up for sale, valuing the NBA team’s parent company at $11 billion. ➘ SELL: Rice. India’s decision to lift all export restrictions on the crop in 2025 saw exports surge to a near-record, slashing the flow of rice from Thailand and Vietnam and sending prices tumbling across Asia to a near-decade low. |

|

|