| | In today’s edition: Venture capital boom in Saudi Arabia, and Abu Dhabi’s latest sovereign wealth fu͏ ͏ ͏ ͏ ͏ ͏ |

| |   Abu Dhabi Abu Dhabi |   Riyadh Riyadh |   Menlo Park Menlo Park |

| | | Global Capital Edition |

| |

|

- Saudi leads in VC

- Flurry of Gulf bonds

- Abu Dhabi’s new SWF

- Meta eyes Gulf AI

Another record year for $25 million homes. |

|

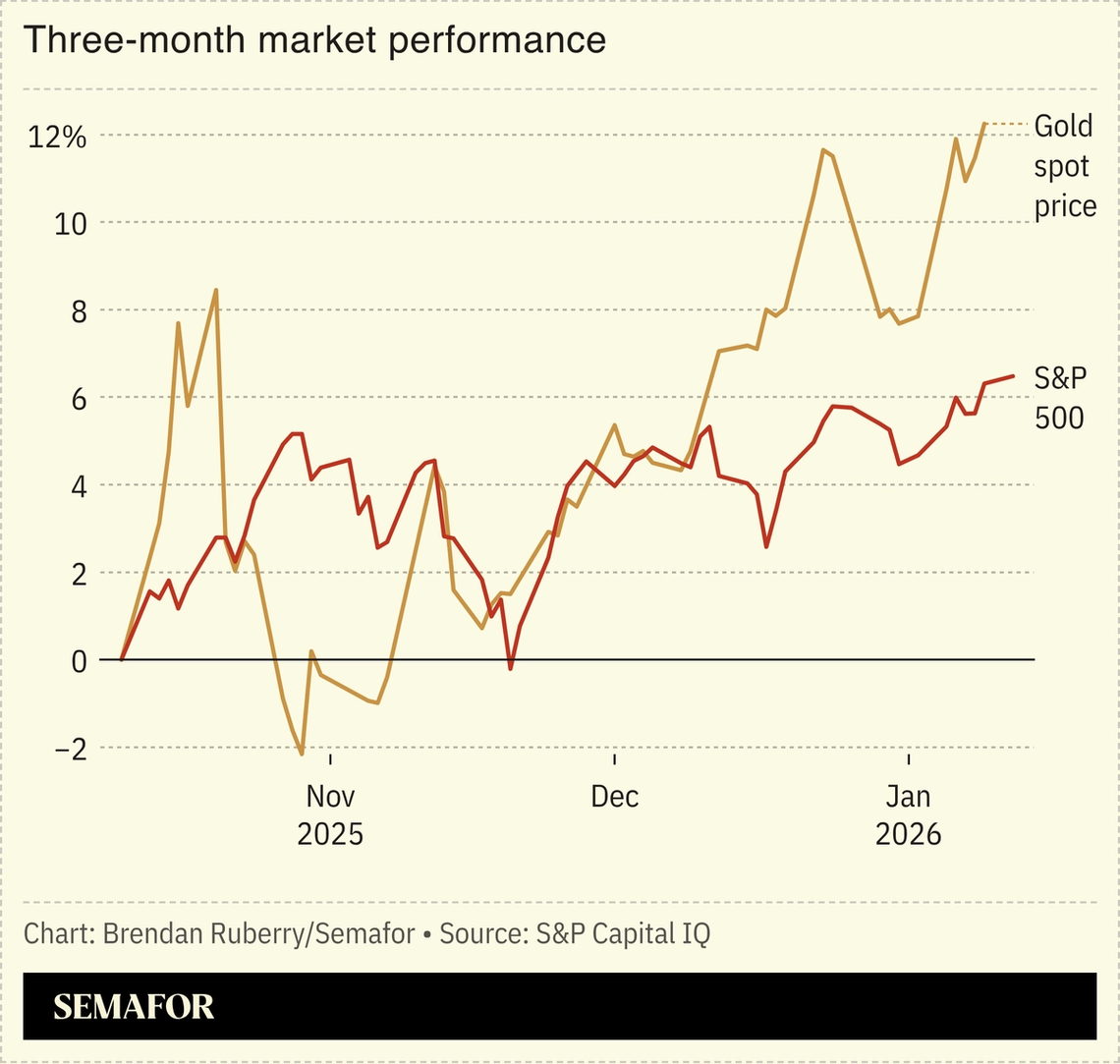

Geopolitical news is characteristically dark, and it’s easy to conclude the world is on the brink. In the region, Iran is teetering, the Gulf of Aden is unstable, and talk of new security blocs is accelerating. In the Western Hemisphere, heads of state are plucked in the dead of night and the US Federal Reserve chair is under criminal investigation. The Doomsday Clock — the barometer of nuclear armageddon — has ticked one second closer to midnight. So, risk off? Not quite. US stocks indexes are at record highs and oil prices remain low, brushing aside threats to the Fed’s independence and the growing risks from sanctions, tariffs, and supply-chain disruptions. Some investors are heeding the warning signs, sending gold soaring, but those flows appear to be offset by strong demand for risk assets.  The Gulf in particular doesn’t seem to be buying into the gloom. Companies and governments are finding buyers for their debt, venture capital is booming, luxury property prices keep rising, and optimism is building that the IPO market could revive soon. So while most newscasts — including our own — lead with the risk, investors and businesses appear more optimistic. Or, maybe, in the eternal words of former Citigroup CEO Chuck Prince: “As long as the music is playing, you’ve got to get up and dance.” |

|

Mideast venture deals hit record |

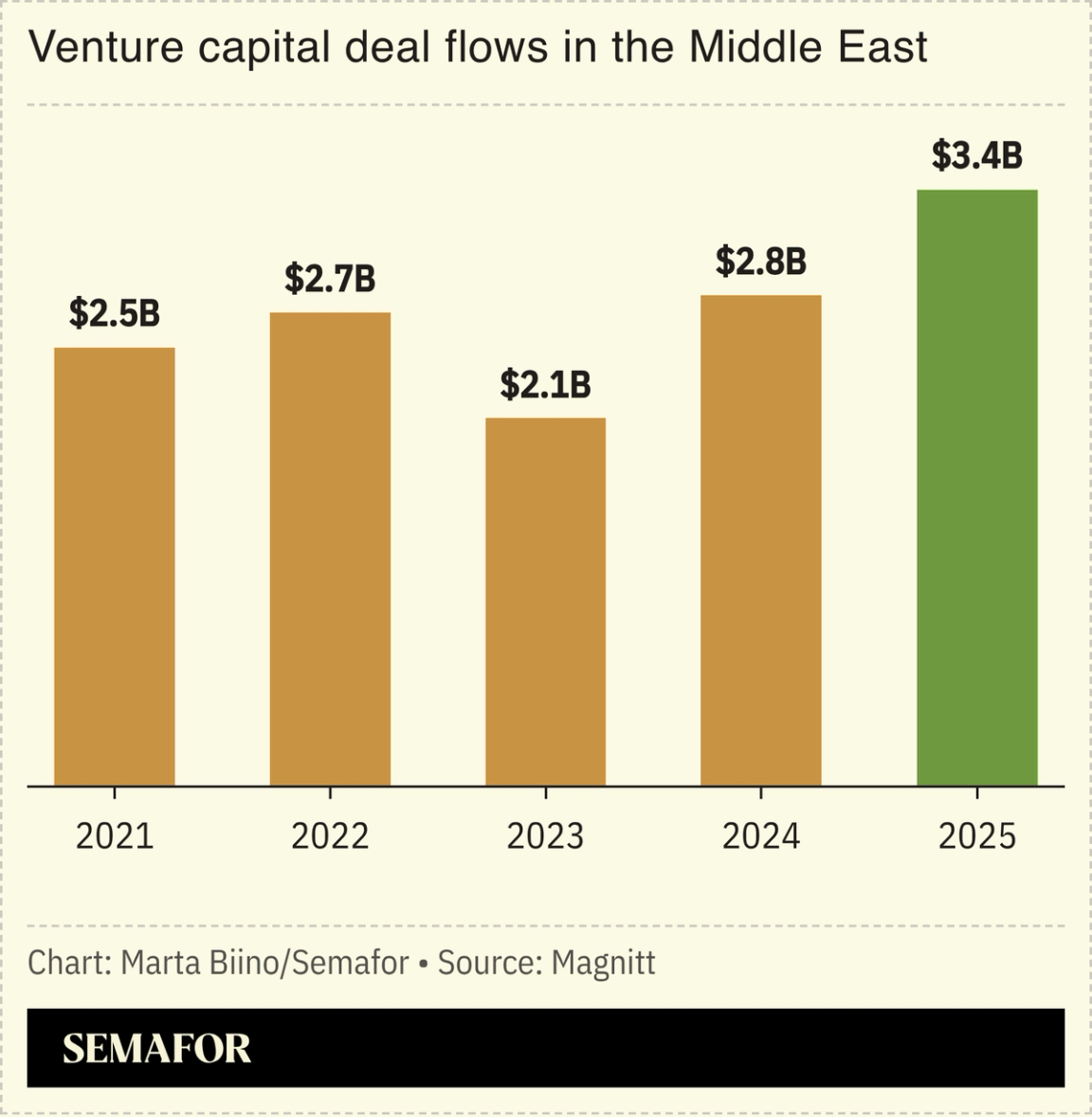

Venture capital deals in the Middle East jumped last year to an all-time high of $3.4 billion as more global funds dove in. The region bucked a wider slowdown in startup funding across other emerging markets, and is now almost the same size as the venture market in South East Asia, according to a report by data provider Magnitt. Saudi Arabia was the biggest market for venture deals in the Middle East, with $1.7 billion of new funding rounds, followed by the UAE. The figures are a reflection of increased government focus on promoting entrepreneurship as a way of creating jobs, as well as regional success in attracting international funds: Almost half of venture capital investments in the region last year came from global fund managers, a new record, with investors including Blackstone, General Atlantic, and Permira building up their investment activities in the Middle East. That’s a shift for the Gulf, which had in previous years been driven by local, often government-backed, funds. This year will likely see more startups merging or acquiring rivals as a way of creating exit opportunities for investors, or looking to sell shares through initial public offerings, according to Magnitt. — Matthew Martin |

|

Bonds of a different color |

Satish Kumar/Reuters Satish Kumar/ReutersA spate of bond issuances ushered in 2026, as the Gulf joined a global rush into debt markets. The UAE, in particular, is getting more creative: In a vote of confidence for ESG investments, Emirates NBD issued a dual-tranche blue and green sustainable bond — billed as the Gulf’s largest-ever blue bond. (A blue bond is tied to ocean and water-related investments; green ones are more related to climate.) Both the $300 million blue tranche and the $700 million green issuance saw tighter-than-expected spreads, pointing to investor appetite for water and energy projects in the region, Enterprise reported. Meanwhile, Aldar, Abu Dhabi’s largest property developer, priced a $1 billion hybrid note issuance that was oversubscribed. This year is expected to be another busy one for borrowing as several Gulf nations forge ahead on ambitious diversification drives. Although activity may lose some of the velocity of 2025, a strong issuance pipeline and favorable funding conditions indicate the window for tapping debt is not yet closed, according to Fitch Ratings. — Kelsey Warner |

|

Abu Dhabi’s crown prince chairs L’IMAD |

Courtesy of Abu Dhabi Media Office Courtesy of Abu Dhabi Media OfficeAbu Dhabi’s newest sovereign wealth fund appointed its board and outlined the broad direction of its portfolio, marking its arrival on the global dealmaking scene. L’IMAD Holding Co. recently joined other Gulf investors backing Paramount Skydance’s bid for Warner Bros. Discovery, its most prominent move after disclosing its first public transaction (and existence) in October. Bankers will be familiar with the leadership of the fund, which joins an expanding alphabet soup that includes ADIA, ADQ, and Mubadala — together controlling roughly $2 trillion in assets. L’IMAD will be chaired by Abu Dhabi Crown Prince Sheikh Khaled bin Mohamed bin Zayed Al Nahyan, with Mubadala’s Khaldoon Al Mubarak on the board. CEO Jassem Al Zaabi also serves as vice chairman of the UAE Central Bank. L’IMAD plans to invest in the UAE and internationally, targeting most sectors of the economy, including infrastructure and real estate, financial services and asset management, advanced industries and technologies, urban mobility, and smart cities. — Mohammed Sergie |

|

Meta hires Powell McCormick for AI buildout |

Courtesy of Future Investment Initiative Courtesy of Future Investment InitiativeMeta is signaling a deeper push into the Gulf’s AI race with a high-profile hire with close ties to the region. The company tapped former Trump adviser Dina Powell McCormick as president and vice chair, responsible for overseeing a planned $600 billion infrastructure buildout over the next decade. The move suggests Meta could follow peers such as Google, Nvidia, and OpenAI in striking AI partnerships and investments across the Gulf. Saudi Arabia, Qatar, and the UAE are investing heavily in AI infrastructure and applications, with Abu Dhabi pouring more than $148 billion into the technology since the beginning of 2024. Born in Cairo and a veteran of the Bush administration and Goldman Sachs, Powell McCormick is well known to the rulers and top wealth managers in the region. She’s a frequent speaker on the conference circuit, maintaining relations without showing favor during various Gulf spats. Meta’s CEO Mark Zuckerberg said Powell McCormick will have a particular focus on “partnering with governments and sovereigns to build, deploy, invest in, and finance Meta’s AI and infrastructure.” — Mohammed Sergie |

|

The foundations of global finance are shifting. AI is reshaping everything, from risk modeling to asset allocation, while massive investments in digital infrastructure are redefining where value is created and how it scales. Join Semafor editors on Jan. 21 in Davos as we sit down with global executives including Crusoe Co-founder and CEO, Chase Lochmiller, to unpack how data centers, compute capacity, and AI applications are representing a new frontier of strategic investment. Jan. 21 | Davos | Request Invitation |

|

Every week, we ask a different expert what they’re focused on. Today, we’re talking to Philip Bahoshy, CEO of Magnitt, a Dubai-based data analytics firm focused on venture capital in emerging markets.  |

|

Courtesy of Dacha Real Estate Courtesy of Dacha Real EstateThere seems to be no peak to the top tier of Dubai’s luxury property market. The city recorded 500 sales worth more than $10 million in 2025, according to property consultancy Knight Frank, the most globally. The figure included close to 70 properties worth at least $25 million. Popular neighborhoods included La Mer, Palm Jumeirah, and Tilal Al Ghaf. But the highest price was reached in Business Bay, where a six-bedroom penthouse changed hands for almost $150 million. With more than $9 billion of prime sales last year, and the ultra-rich increasingly buying homes rather than just investment properties, Knight Frank reckons Dubai’s property market may now be less vulnerable to speculative booms and busts. There are still bubbles though, it’s just that now they’re ones of privilege and security: The city’s key attractions include waterfront living, low crime rates, and world-class amenities, all packaged up in pricey, self-contained ecosystems. — Dominic Dudley |

|

| |  | | | You’re receiving this email because you signed up for briefings from Semafor. |

|