| | In this edition: US ambassadors leave Africa, a UAE-Africa blockchain deal, and a gripping new Niger͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Africa |  |

| |

|

- US ambassadors removed

- Ghana legalizes crypto

- UAE-Africa blockchain deal

- Fintech ecosystems grow

- Stock exchange challenges

- AFCON changes cycle

A gripping Nigerian thriller on Netflix. |

|

We’re taking a break for the holidays. We’ll be back in your inboxes on Dec. 31, with a special edition looking back at 2025. Thanks for your loyal readership, and happy holidays. |

|

Trump withdraws Africa ambassadors |

Jessica Koscielniak/File Photo/Reuters Jessica Koscielniak/File Photo/ReutersThe Trump administration removed dozens of ambassadors and senior diplomats around the world, the bulk of them in Africa. The move, aimed at ensuring embassies are aligned with US President Donald Trump’s “America First” priorities, will leave Washington without top-level representatives in more than half the countries in sub-Saharan Africa, highlighting the White House’s shift away from the continent. Nigeria, Rwanda, and Senegal are among the countries where ambassadors have been withdrawn. Less than a year into his second term, Trump has upended US-Africa relations: His administration’s sudden cuts of aid to the continent have left dozens of countries struggling to get by, while his tariff regime has compounded the economic pressure on many, and he has yet to appoint senior officials with responsibility for Africa-related issues. Nonetheless, the Trump administration has vied to outcompete China on strategic projects in Africa, especially those focused on rare earths — key for the defense and tech industries. A version of this item first appeared in Flagship, Semafor’s daily global affairs briefing. Subscribe here. → |

|

|

Ghana approves bill to legalize crypto |

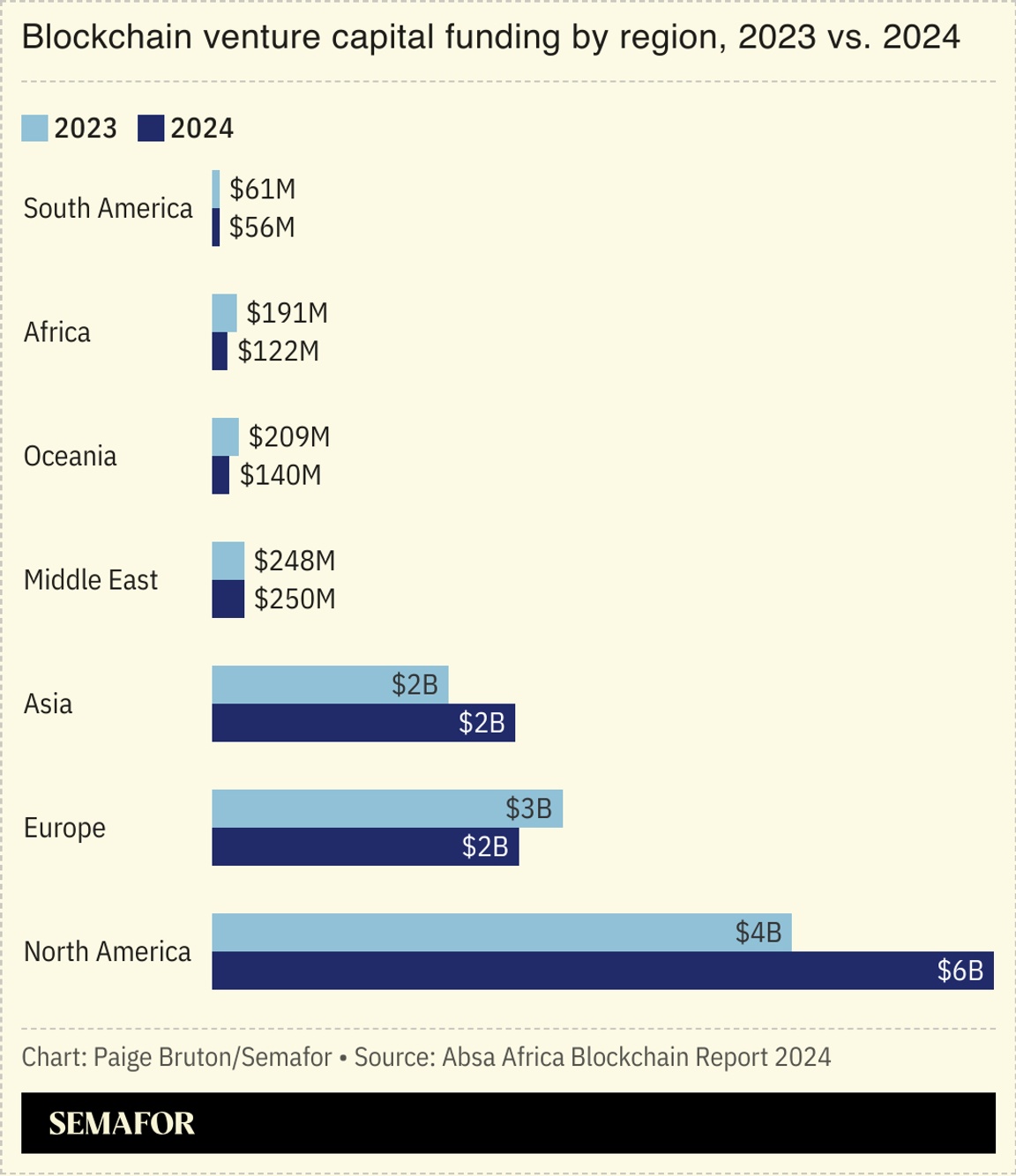

Ghana’s parliament approved a bill to legalize the use of cryptocurrency in the country, marking a milestone as digital currencies gain traction across sub-Saharan Africa. Ghanaian central bank Governor Johnson Asiama said the move would give the country “a framework to manage the risks involved.” Crypto is increasingly popular among digitally savvy consumers and businesses on the continent trying to hedge against currency volatility. Crypto volumes traded in sub-Saharan Africa grew by 52% between July 2024 and June 2025 to more than $205 billion, according to data firm Chainalysis. Nigeria had the highest volume of transactions in the region, while Ghana was in the top five along with Ethiopia, Kenya, and South Africa. The use of digital currencies has outpaced policymaking in some countries, however, creating legal gray areas: Some policymakers warn that crypto is used by criminal gangs for money laundering. In a high-profile dispute, Nigeria this year filed a $81.5 billion lawsuit against Binance, the world’s largest crypto exchange, over economic losses. — Alexander Onukwue |

|

UAE firm inks M-Pesa deal |

| |  | Alexis Akwagyiram |

| |

Seun Sanni/Reuters Seun Sanni/ReutersAn Abu Dhabi-based financial technology initiative plans to extend its blockchain technology to millions of Africans through a partnership with mobile money platform M-Pesa, one of the executives leading the project told Semafor. The ADI Foundation, which is backed by the digital arm of a $240 billion conglomerate chaired by the UAE president’s brother, aims to bring 1 billion people onto its blockchain, ADI Chain, by 2030. Huy Nguyen Trieu, council member on the ADI Foundation’s board of advisers, said he wanted a “large proportion” of ADI Chain users to be in Africa. He said a memorandum of understanding agreed with M-Pesa this month was part of a drive to scale-up ADI Chain access. M-Pesa — used to transfer money and pay for goods — has more than 60 million monthly users across eight African countries. The agreement marks the latest step in Abu Dhabi’s efforts to bolster ties between the Gulf and Africa. The UAE, one of the biggest investors in Africa, recently said its total investments in the continent totaled over $118 billion between 2020 and 2024. Last month, it said it will invest $1 billion to expand AI infrastructure and services across Africa. |

|

From geopolitical shocks to climate volatility and disruptive technologies, today’s business environment is increasingly resistant to prediction. As public trust frays, CEOs are being pushed to lead with clarity under pressure. Semafor CEO Signal Editor Andrew Edgecliffe-Johnson will sit down with global leaders, including GE Vernova CEO Scott Strazik, on Wednesday, Jan. 21, in Davos to examine how executives are resetting priorities, reassessing risk, and redefining resilience. Jan. 21 | Davos | Request Invitation |

|

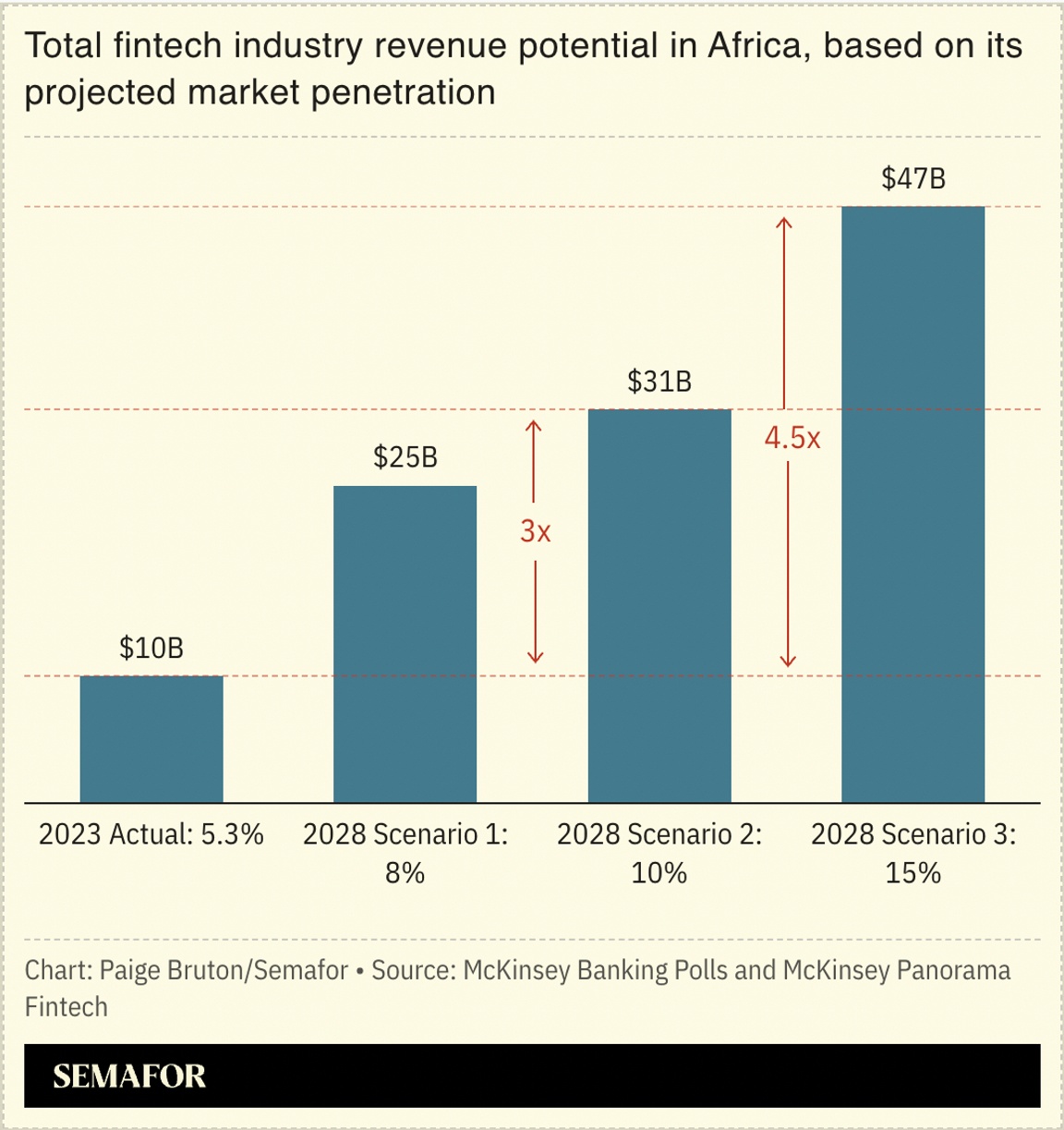

Why fintechs need robust ecosystems |

Africa’s fintechs need robust cross-sector collaboration and supportive ecosystems in order to succeed, a new report argued. “Fintech cannot thrive in isolation; its success hinges on collaboration across an expansive ecosystem,” the authors of the analysis by the consulting firm EY said. Regulators, financial institutions, telecoms companies, and development partners must work together to drive innovation, scale impact, and attract investment, they said. Financial inclusion remains a challenge in sub-Saharan Africa, where around 42% of adults remain unbanked, but the growth in mobile money platforms is widening access to banking services. The report spotlights Nairobi, dubbed “Silicon savannah,” as a successful example, saying companies such as the fintech and carbon credits provider Melanin Kapital have benefited from Kenya’s regulatory innovation and position as one of East Africa’s most mature fintech landscapes. — Preeti Jha |

|

S. Africa leads on stock exchanges |

The number of companies listed on African stock exchanges by the end of 2024, out of 44,000 globally, according to a new report. The firms account for only 5% of all listed companies in emerging markets, with a total market capitalization of $561 billion, the Africa Capital Markets Report by the OECD found. Companies listed in Africa are “notably small” and “illiquid” the report said, with South Africa standing out as the most developed public equity market on the continent, accounting for 60% of the region’s market capitalization. Stock exchanges in Botswana, Ghana, Namibia, Tanzania, Uganda, and Zambia, by contrast, remain very small, with each listing between 12 and 29 companies. Despite “notable progress,” the report said, Africa’s stock markets remain small due to high trading costs compared to other regions, political instability in some countries, and macroeconomic risks including currency volatility. — Preeti |

|

African football shifts to 4-year cycle |

Amr Abdallah Dalsh/Reuters Amr Abdallah Dalsh/ReutersThe African Cup of Nations will switch to a four-year cycle from 2028, aligning it with European sporting calendars after years of complaints from clubs whose players compete in the tournament. Launched in 1957 with just three teams — Egypt, Ethiopia, and Sudan — the tournament is currently held biennially. Patrice Motsepe, the South African billionaire who leads the Confederation of African Football, said the aim was to avoid fixture conflicts between players’ clubs and their national teams. CAF will also introduce the African Nations League, an annual competition between 54 national teams that will see each member association receive $1 million every year — five times members’ current allocation. |

|

Business & Macro |

|

|