| | In this edition, this year’s M&A deals are more defensive than searching for growth. And Paramount’s͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- Defense primes get Trumped

- Palantir’s frontman

- The doomer trade

- An Ellison family Christmas

- Eye on the Target

US GDP print delights … |

|

As we close the books on 2025, here are two data points to consider: Gold hit a record high and corporate mergers came very close to one, with a few days left to go. Gold is a classic doomsday asset. M&A tends to rise when executives feel good about the world. They shouldn’t travel together — and certainly not when interest rates are still relatively high, which makes dealmaking more expensive and non-yielding assets like precious metals less attractive. My best attempt to square these milestones will — I’m sorry, I know it’s Christmas Eve Eve — be a bit of a bummer. M&A may be less of a purely bullish indicator than we think, particularly the mergers we’re seeing now, which are largely aimed at defending moats rather than building for the future. It’s “endgame consolidating,” Goldman Sachs President John Waldron told me this spring, with the goal of each industry having “a few large players.” He blames (or credits, as Wall Street rakes in M&A fees) AI: “If you’re going to create a generative-AI rewiring of your business and take a lot of cost out, you’d rather do it on a broader canvas. So if there is a deal that you want to do, go do that and then put the AI on top.” Two of the biggest railroads announced a merger. Dying cable networks are being spun off or sold. Oil companies consolidated. The world’s biggest advertising agency, Omnicom, bought its rival, IPG, as AI rocks the industry that basically invented it. Looking ahead, I think we’ll get a big attempted airline merger next year — a final plug for our 2026 bingo card, coming to you next week before we take a few days off. AI may be a revolutionary and exciting technology, but its immediate effect has been to put companies in a defensive crouch. This round of consolidation looks more like a clearing of the decks before AI scrambles everything. |

|

Defense industry gets Trump treatment |

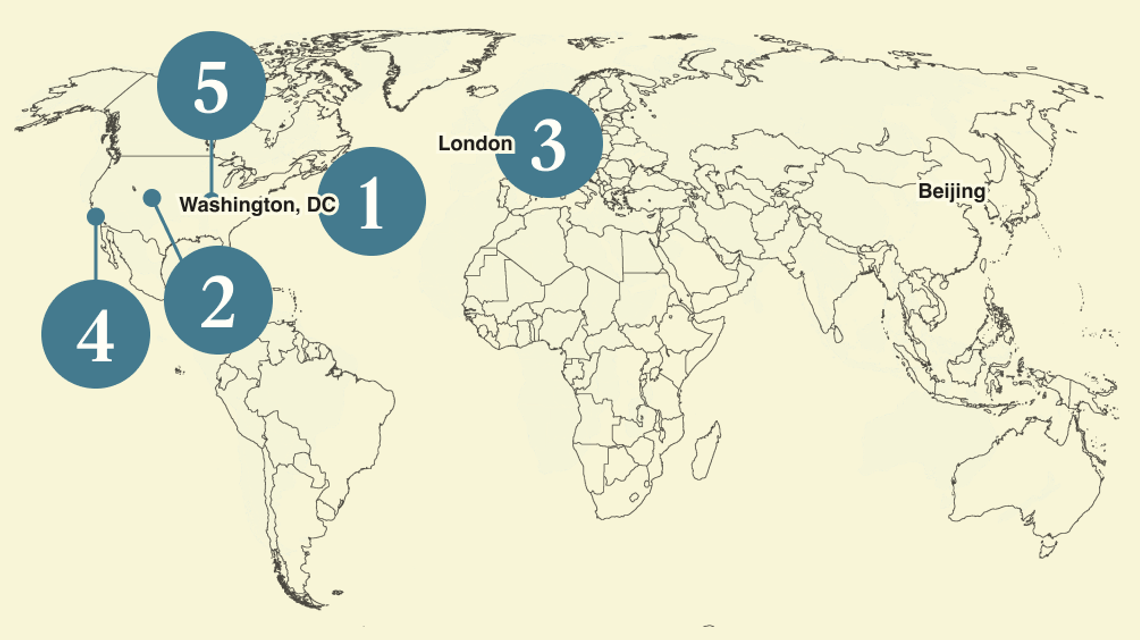

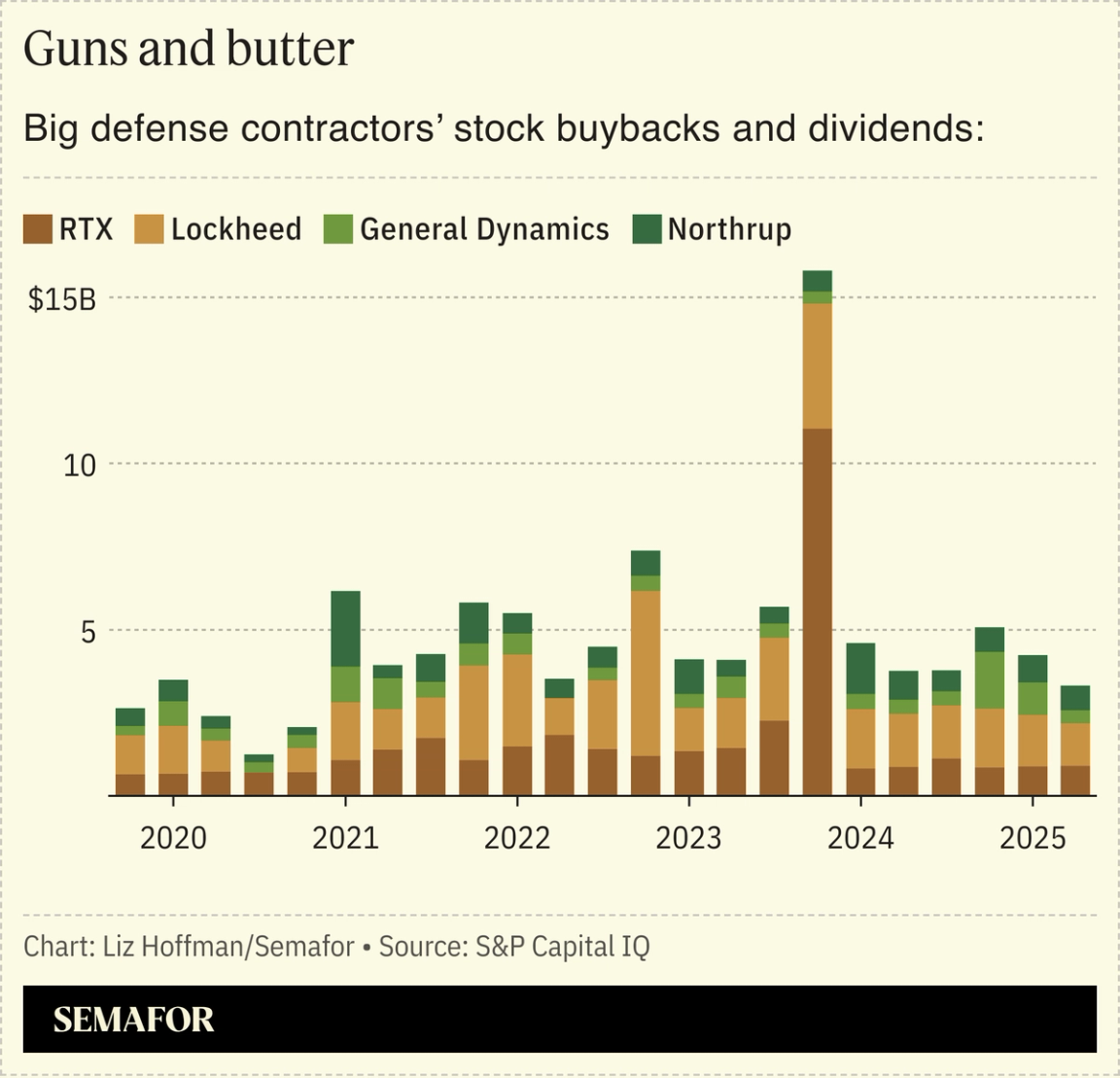

Scott Bessent and Howard Lutnick are reshaping the business landscape. Their next target is the defense industry.  President Donald Trump said Monday that he will meet next week with executives from the largest defense contractors, as he pushes them to rein in costs and invest in manufacturing instead of stock buybacks, and commissioned a new class of warships named after himself. These are old-fashioned manned ships at a moment when the future is clearly unmanned and autonomous, though Defense Department brass is skeptical of the speed of that transformation. |

|

A revealing interview with Alex Karp |

Brendan McDermid/Reuters Brendan McDermid/ReutersElsewhere in the defense-industrial complex, Semafor’s Reed Albergotti sat down with Palantir CEO Alex Karp, who is in the middle of a big news cycle. The company, long despised by the left because of its work with the Israeli government and US immigration authorities, has picked up critics on a fast-splintering right, too. A new biography of Karp has brought fresh scrutiny, as did his fidgety appearance at the DealBook Summit earlier this month and subsequent launch of a fellowship for people who can’t sit still (a pre-interview Mexican Coke was to blame, Reed uncovered). The company also started recruiting straight from high schools, a rebuke of a US higher-education system that many on the right believe has lost its way. While many CEOs have cozied up to Trump, they’ve done so safely, finding a balance between appeasing the president and avoiding blowback from left-leaning employees or future administrations. Karp has done the opposite, freely expressing opinions that have caused some employees to leave the company and invited retribution. Reed talked to Karp about much of that: concerns about the US sliding into authoritarianism (“absurd,” Karp said), how his work plays at his parents’ synagogue, and why he chose Michael Steinberger, a longtime wine columnist, to write a biography that Karp says he still hasn’t read. “A very ornery grape,” Steinberger said when Reed asked him for Palantir’s corporate tasting notes. |

|

Metals shine in murky times |

Gold and silver hit record highs as investors seek safe havens in a world with few of them. Bullion neared $4,500 an ounce Tuesday, more than double since 2022 — a year when both Russia’s invasion of Ukraine shattered a period of relative geopolitical calm and the onset of inflation eroded investors’ trust in government currencies. “It’s a little bit of a spicy time right now,” Anduril’s CEO told Semafor in a recent interview, and periods of unease are metals’ time to shine.  In addition to retail boosters — you can buy gold bars at Costco, where sales jumped double digits last quarter — central banks have turned to gold as a replacement for US dollars. Russia, India, and China are among the biggest buyers, and globally, central banks now hold more gold than US Treasury bonds. The prospect of lower interest rates also helps by reducing the opportunity costs of holding non-yielding assets like bullion. |

|

Semafor will be on the ground in Davos next month for the World Economic Forum, the annual gathering where the world’s most powerful come together to strike deals, tout their good deeds, and navigate the snow — sometimes getting stuck long enough to share a scoop or two with us. We’ll deliver exclusives on the high-stakes conversations shaping the world. Expect original reporting, scoops, and insights on all the dealmaking, gossip, and lofty ambitions — with a touch of the pretentious grandeur Davos is famous for. Get the big ideas and small talk from the global village — subscribe to Semafor Davos. |

|

Paramount firms up Ellison’s cash |

Elizabeth Frantz/Reuters Elizabeth Frantz/ReutersParamount is trying to derisk its bid for Warner Bros. Discovery in a more old-fashioned way: calling Dad. The company said Larry Ellison, billionaire founder of Oracle and father of Paramount CEO David Ellison, would personally guarantee its bid for Warner Bros. Discovery, hoping to overcome skepticism that pushed the company into a deal with Netflix. Warner’s board had raised concerns about the Ellison family trust and the reliability of three Middle Eastern sovereign funds supporting Paramount’s bid. But Paramount hopes a $40 billion commitment from the elder Ellison will change its mind. The maneuver comes without a price bump that many shareholders have been banking on, but could force Warner’s board to reconsider its determination that Netflix’s $27.75-a-share bid (for most of the company) is better than Paramount’s $30 (for the entire company). Its decision hinges as much on the certainty of Paramount’s money — and David Zaslav’s evident desire to sell to anyone other than Ellison — as on the value of Warner’s fading but still profitable cable networks, which Netflix would leave behind. Warner has said they are worth about $1 per share, though industry analysts have pegged it between $3 and $5 — a gap large enough to swing the deal calculus. Paramount has also taken steps to mollify a new critic, Trump: The evening before the financing guarantee was announced, Bari Weiss ordered 60 Minutes to yank a fully reported, edited, and lawyered segment on conditions inside an El Salvador prison where the Trump administration has deported hundreds of migrants. You can read her thinking here. |

|

Target’s insider goes back to basics |

Courtesy of Target/Joey Pfifer/Semafor Courtesy of Target/Joey Pfifer/SemaforTarget, high-flying during the pandemic, has lost its way. Its incoming CEO is betting that a return to an “elevated experience” (remember Tar-zhay?) will help win back customers. Whether Michael Fiddelke, who has been with the company for 23 years, can win back investors is another question. “You don’t just get to get out of bed and grow. You’ve got to make bets, and you’ve got to take risks,” he told Semafor’s Andrew Edgecliffe-Johnson. Target shares surged during the pandemic, when stimulus-flush consumers flocked to buy TVs and outfit home offices. The broader economic slowdown hit Target hard — shares are down about 60% since 2021 — and Fiddelke acknowledged the company took its eye off the ball as it focused on building an e-commerce and membership business to compete with Amazon Prime and Walmart+. “The growth of the digital business added a lot of complexity, so now we need to remove some of that complexity,” he said. “And we need to make sure we’re making the right investments in the store experience, so that we can do both things well.” Fiddelke will take over the top job at the same time John Furner takes over at Walmart. But Target’s CEO-in-waiting isn’t worried about competition: “We have to play our game, and that’s going to look different than other retailers’ playbooks.” Notable: Wall Street’s skepticism may be misplaced: Insiders promoted to the CEO role consistently outperform outside hires, according to a recent study by the Yale School of Management. |

|

➚ BUY: Reindeer. Trump appointed Louisiana Gov. Jeff Landry to serve as special envoy to Greenland, renewing talk of a takeover of the mineral-rich Danish territory. ➘ SELL: Coal. Global demand has likely plateaued and will start declining by 2030, when renewable energy is expected to overtake coal use in China, according to a new report from the International Energy Agency. |

|

What is Instagram in 2025? That was the first question on Ben Smith and Max Tani’s mind when they sat down with Adam Mosseri for this week’s Mixed Signals. The conversation covers the platform’s new move onto TV screens, the dominance of Reels and DMs, and whether “everything is becoming television.” Mosseri also explains how the company is competing with TikTok and YouTube, and whether “AI slop” is a legitimate concern for social media feeds. Listen to the latest episode of Mixed Signals now.

|

|

Companies & Deals- Welcome back, Citi: The banking giant’s shares recently crossed a key metric, rising above the value of its loans, securities, and other assets. Trading “below book,” as Citi’s stock has for

|

|

|