| | US regulators approve a pill form of Wegovy, Trump threatens Greenland again, and corporate debt iss͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Flagship |  |

| |

|

The World Today |  - US approves Wegovy pill

- Trump’s Greenland threat

- Drug drones in Colombia

- Beijing-Brussels tensions

- China slows robocar rollout

- Ellison’s WBD intervention

- Corporate debt near record

- Standardizing EU ships

- Botswana’s diamond woes

- Santa’s busy evening

Semafor’s editor-at-large recommends a book about AI’s energy footprint. |

|

US approves weight-loss pill |

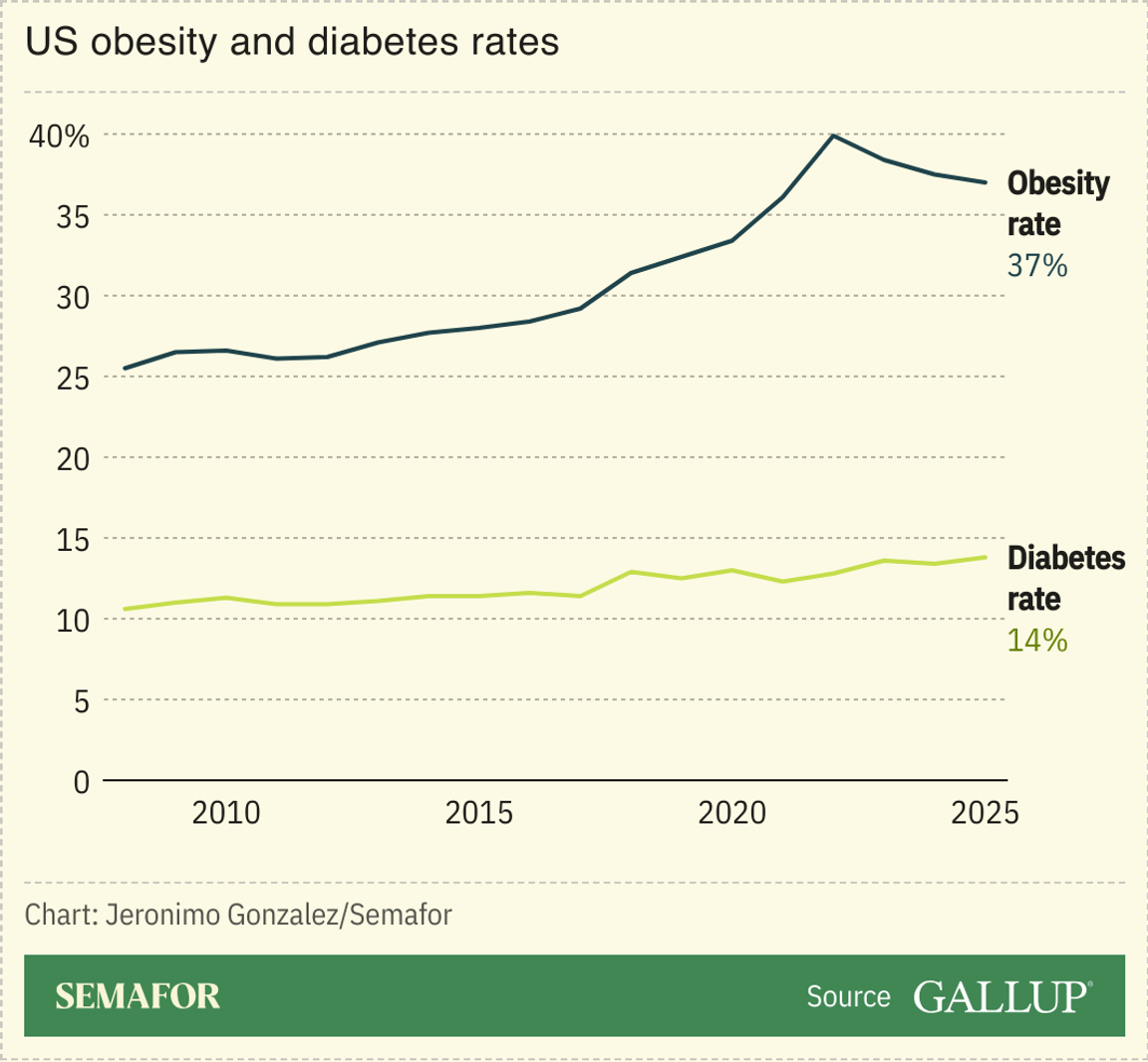

US regulators approved a pill form of the obesity drug Wegovy. The injectable forms have revolutionized weight loss treatment since 2021: Patients lose on average over 15% of their body mass, compared to 2% for prescribed diet and exercise. The rise of GLP-1 drugs is credited with ending the hitherto relentless rise of US obesity rates. It also, for a time, made manufacturer Novo Nordisk Europe’s biggest company by market cap. But rivals such as Eli Lilly released competitor drugs, and Novo’s value is down 67% from its 2024 peak. The company hopes that the oral form — which is almost as effective as the injectable type, unlike the only currently approved GLP-1 pill — will revive its flagging fortunes. |

|

Trump issues new Greenland threat |

Louisiana Governor Jeff Landry. Kathleen Flynn/File Photo/Reuters. Louisiana Governor Jeff Landry. Kathleen Flynn/File Photo/Reuters.US President Donald Trump reiterated his intention to annex Greenland, and appointed a special envoy who echoed the plan. Louisiana Governor Jeff Landry said it was an “honor” to be asked “to make Greenland a part of the US.” The Danish-controlled territory is strategically important as a site for ballistic missile launchers and as a source of key minerals, and Trump has repeatedly said he wants the US to take control of it. The prime ministers of both Greenland and Denmark denounced the plan. Denmark has sought to appease Trump by promising additional defense spending, but Washington seems unmoved, and has piled pressure on Copenhagen by canceling major wind-power projects developed by Danish state-run firm Ørsted. |

|

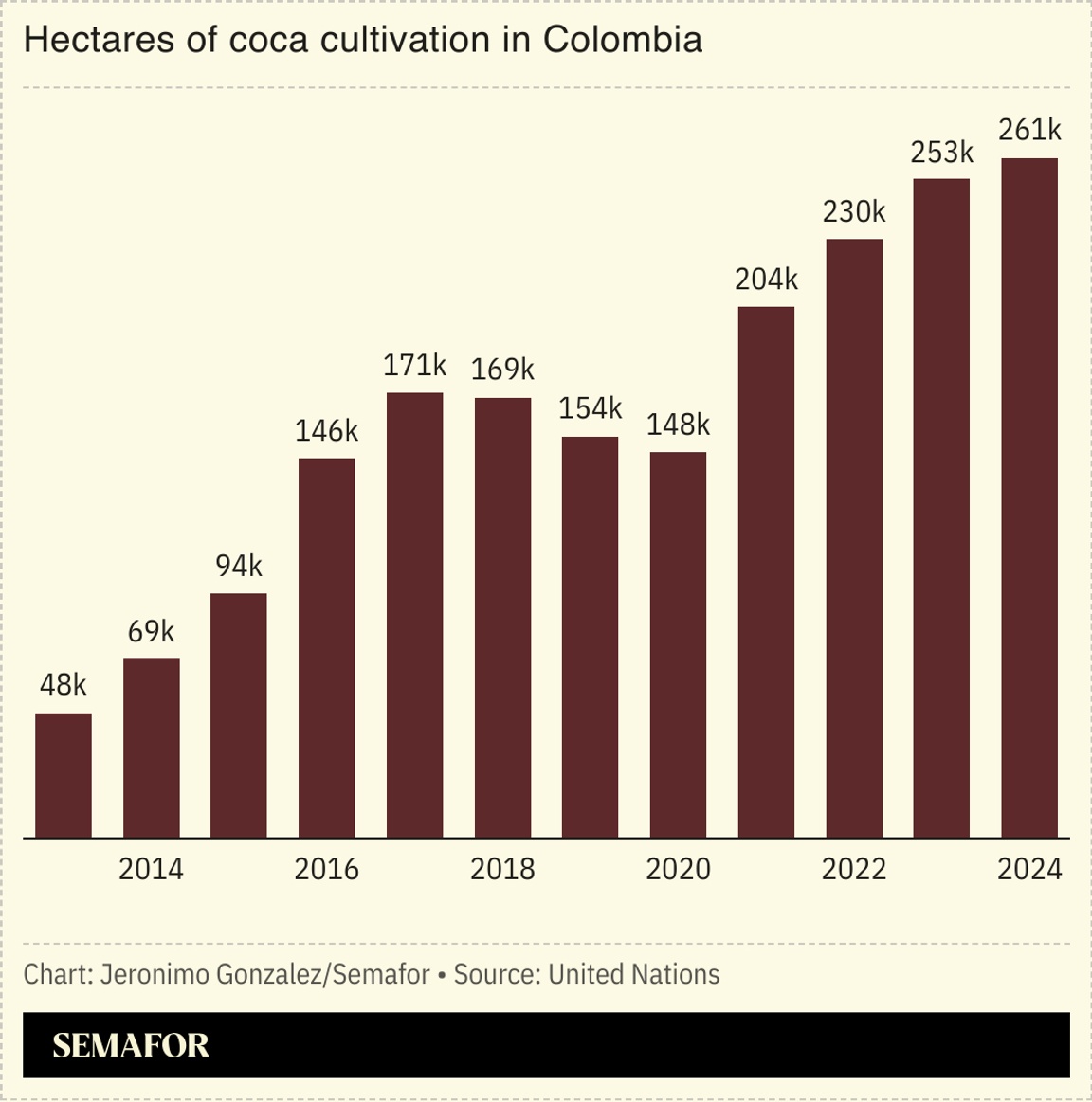

Colombia’s anti-drug drone plan |

Colombia will begin deploying drones to destroy coca crops, as the country grapples with record cocaine production that has fueled violence across South America and built tension with the Trump administration. Coca production has ballooned under Colombian President Gustavo Petro, who has taken a light approach to drug interdictions, with the number of hectares planted almost doubling between 2016 and 2024. US President Donald Trump said Monday that Petro had to “watch his ass” over the cocaine his country exports to the US, Axios reported. Meanwhile, cartels’ fight for control over trafficking routes has set off an unprecedented wave of violence across South America, with the murder rate in Colombia’s neighbor Ecuador increasing fivefold since 2020. |

|

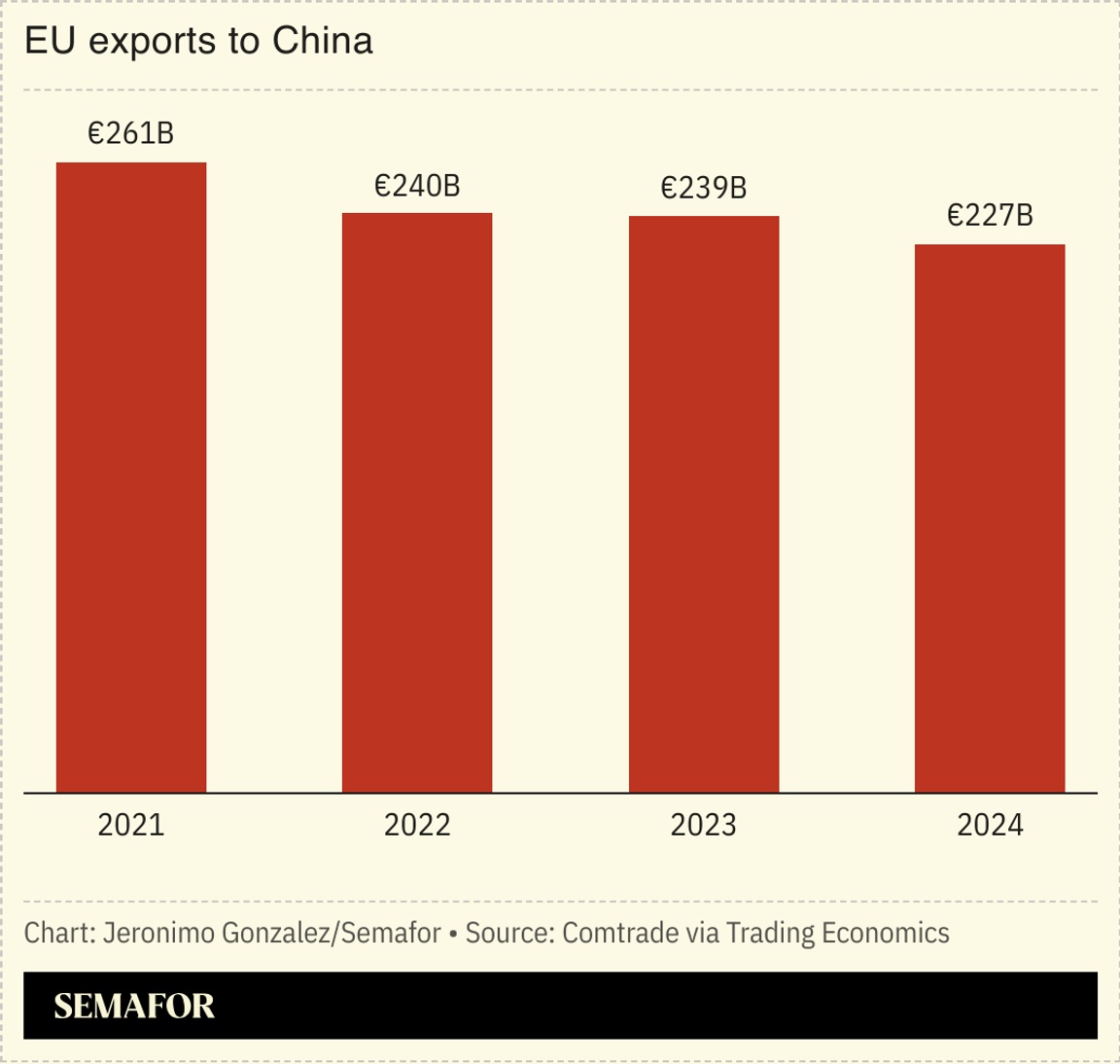

Beijing-Brussels tensions ratchet up |

Trade tensions between China and the European Union rose after both unveiled restrictions on key imports. Beijing said it would impose a 43% import tariff on European dairy products, a move that comes in response to Brussels launching an investigation into Chinese subsidies for its EV industry. Meanwhile the bloc announced increased checks on plastics, as imports from China have cooled domestic demand. The decisions cap a year of growing friction between the economic powerhouses, with some fearing China is moving quickly to reduce its dependency on Europe: EU car exports to China have declined rapidly in recent years, while Chinese firms now make luxury products including caviar and foie gras which were previously mostly imported from the bloc. |

|

China dials back robocar ambitions |

Sarah Wu/Reuters Sarah Wu/ReutersA fatal accident led China to slow its plans for self-driving cars. News of the high-speed crash in March, unlike previous incidents, evaded Beijing’s censors and spread widely. Automakers had been expecting widespread approvals of “level 3” self-driving, in which drivers can take their eyes off the road — some even started mass-producing cars — but the crash, and testing revealing only US-made Teslas met safety requirements, made regulators cautious. Approvals were limited to two companies, in restricted areas, and the less demanding “level 2″ autonomy. China had set an objective of widespread sales of level 3 to the general public by this year, but the scaling back represents a recognition that the plans were too ambitious, The New York Times reported. |

|

Larry Ellison backs WBD takeover |

Larry Ellison. Carlos Barria/Reuters. Larry Ellison. Carlos Barria/Reuters.Paramount said billionaire Larry Ellison, father of the company’s CEO, would personally guarantee $40 billion to support the firm’s bid to buy Warner Bros. Discovery. Ellison’s intervention comes as competition heats up between Paramount and streaming giant Netflix, which is looking to secure WBD’s prized Hollywood assets. WBD’s board had reportedly expressed doubts about the Ellison-backed firm’s financing, instead recommending shareholders accept Netflix’s bid. Paramount’s bid is expected to be backed by as much as $24 billion from Middle Eastern sovereign wealth funds, drawing criticism from analysts. However the decision may ultimately lie elsewhere: US President Donald Trump has said he plans to play a role in a decision about any WBD arrangement, The New York Times reported. |

|

Debt issuance nears record |

An OpenAI data center under construction in the US. Shelby Tauber/Pool/Reuters. An OpenAI data center under construction in the US. Shelby Tauber/Pool/Reuters.Global corporate debt sales neared record levels in 2025, driven by low rates and the race to fund AI infrastructure. The $1.7 trillion in bond issuances fell short only of 2020’s pandemic-fueled rush, with 30% of it related to AI, as Big Tech companies took on debt to fund data center and energy manufacturing. Relatively cheap borrowing, as trade tensions ease and the worst of the post-COVID-19 inflation cools, is also a factor, the Financial Times reported. Despite fears of an AI bubble, issuance is expected to increase further next year to beyond the pandemic record, a Goldman Sachs report forecast. |

|

On Tuesday, January 20, Bank of America CEO Brian Moynihan will join Semafor for The CEO Signal Exchange: Achieving the AI Advantage in Davos. As AI continues to shape the modern enterprise, business leaders are facing new challenges in translating innovation into measurable impact. In conversation with Semafor editors, senior executives, including Bridgewater Associates Founder Ray Dalio, will examine how companies are integrating AI to drive growth, build advantage, and remain competitive in an evolving global business landscape. Jan. 20 | Davos | Request invitation |

|

Call to standardize Europe defense |

Alessandro Bianchi/Reuters Alessandro Bianchi/ReutersEurope’s largest shipbuilder called for the continent to standardize its specifications to boost defense manufacturing. The Italian state-owned firm Fincantieri told the Financial Times that every European country has different requirements for its military vessels, and that streamlining them would allow economies of scale for manufacturers. Europe is racing to rearm in the face of Russian aggression and US isolationism, with 2025 spending expected to be higher than 2024’s already record figures, but as well as stepping up investment there are organizational hurdles to creating a united defense industry in a fragmented bloc. The Future Combat Air System, a €100 billion ($118 billion) joint Franco-German fighter-jet project, is on the brink of collapse after relations between manufacturers broke down. |

|

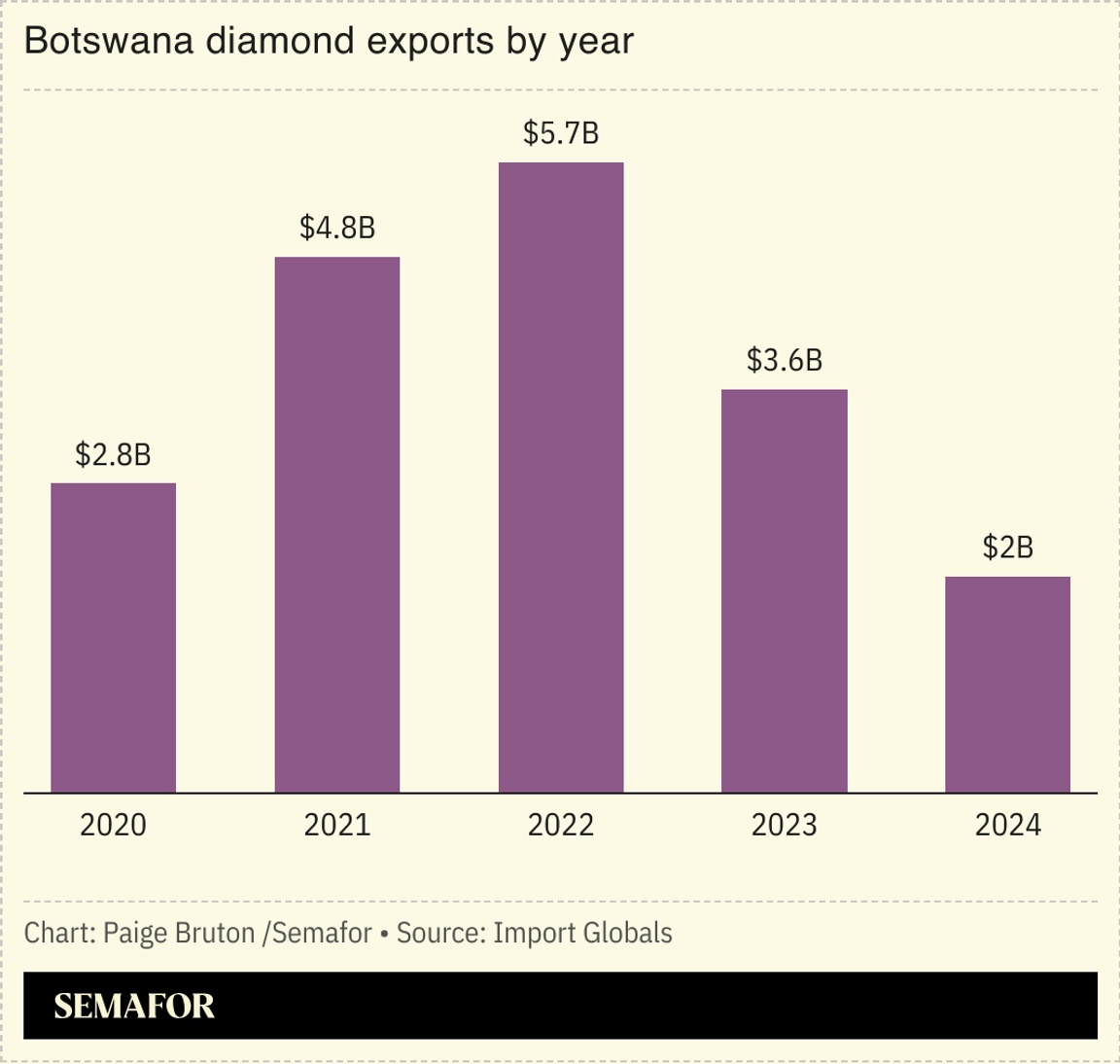

Diamond slump hits Botswana economy |

Botswana’s finance minister said his country’s economy would shrink by almost 1% this year amid a downturn in the diamond market. Natural diamond prices have plummeted in recent years as their lab-grown alternatives — which are significantly cheaper on a per-carat basis — soar in popularity. The move away from natural diamonds has taken a significant toll on Botswana’s economy, which relies on diamonds for around a third of its GDP. In response, President Duma Boko has promised to diversify the economy away from the gems, but progress has been slow: Botswana is in talks to acquire a majority stake in diamond giant De Beers despite the IMF warning that such a purchase would be perilous. |

|

|