|

|

Looking for serious investors

Do you want to become a better investor in 2026? We are looking for a few investors who want to step up their game. Sounds like something for you? Apply here.The Psychology of Money is one of my favorite books on personal finance ever.

Most books explain how to make money, this one teaches you how to think about money.

Let’s dive into its most important lessons today.

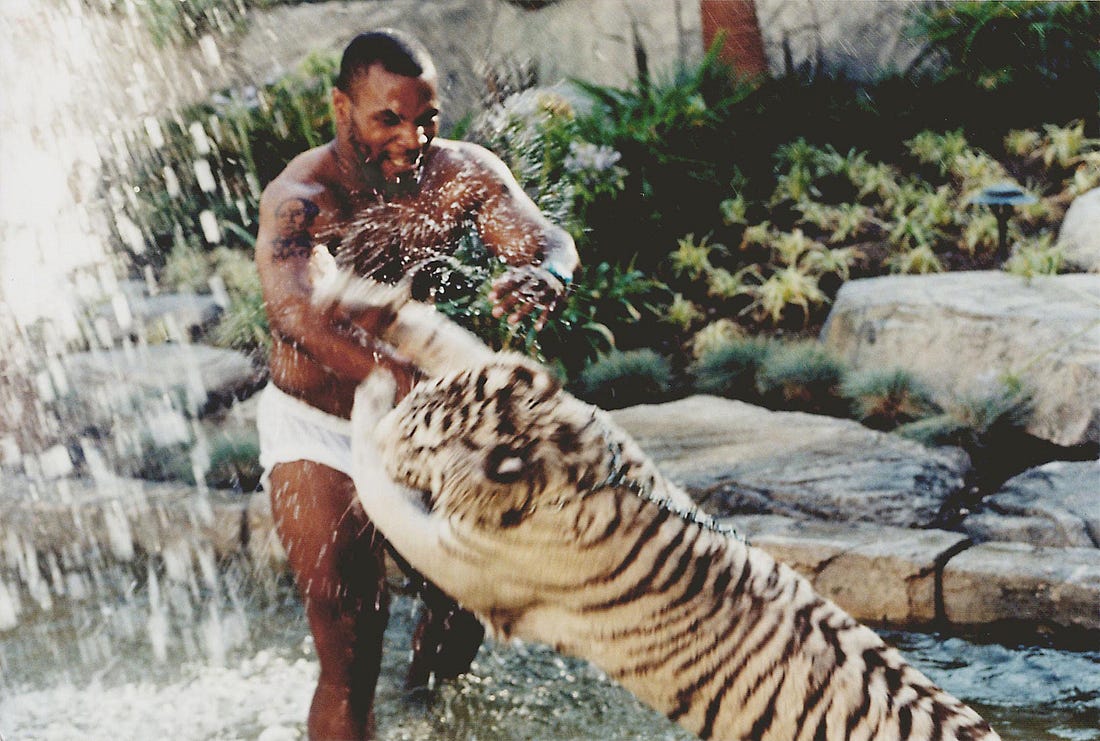

Mike Tyson earned more than $300 million during his boxing career.

He bought huge houses, cars, and threw crazy parties.

He even had three Bengal tigers that cost about $200,000 per year to feed and care for.

He seemed on top of the world, but in the end, he went bankrupt.

Tyson later said that the real fight wasn’t in the ring, it was in his head.

The money wasn’t the problem. His behavior was.

The Psychology of Money is all about how you think and act with money.

These 5 lessons from the book will help you to avoid ending up like Mike Tyson.

1. No one’s crazy

"Everyone forms money beliefs based on their own life experiences, not objective truth."People make financial decisions based on their own unique history.

We all make money choices based on where we grew up, how the economy felt, what our parents did, and even what inflation was like when we were kids.

So something that looks “crazy” to you may be totally logical to someone else.

An example?

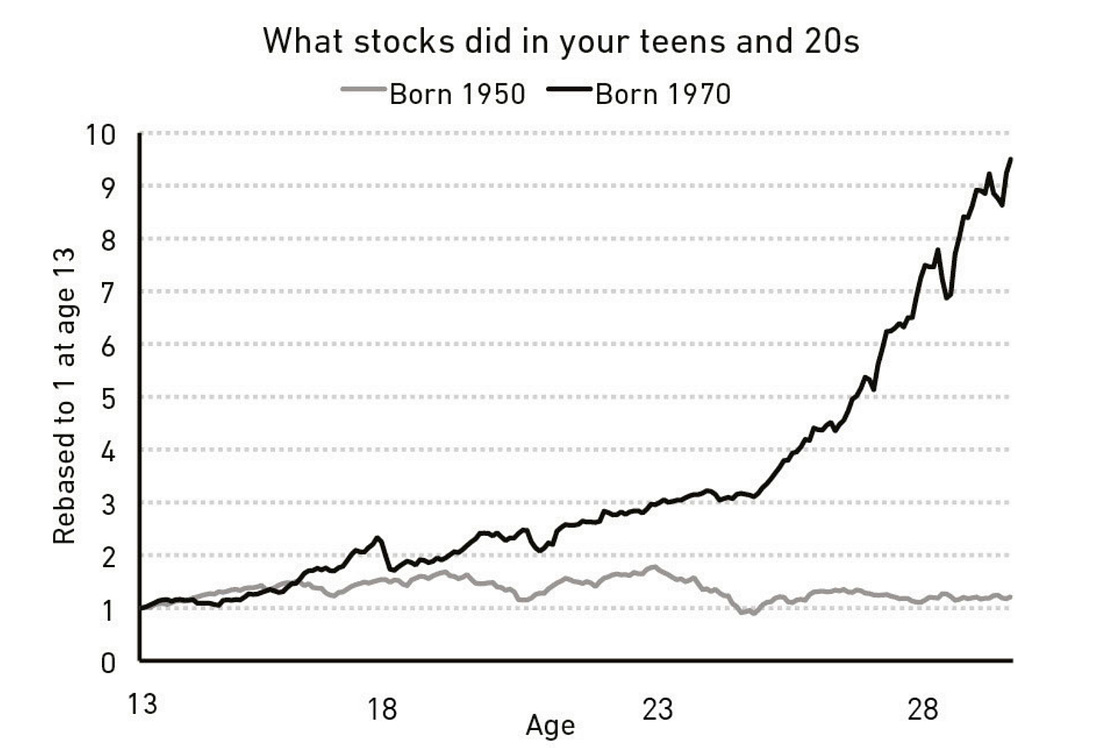

How the market performed during your teens and 20s.

If you were born in 1970, the S&P 500 increased almost 10-fold

If you were born in 1950, the market went nowhere

Same country, same market…

… but two completely different experiences.

The result?

The investor born in 1970 will naturally believe “the stock market always works, invest and you’ll get rich.”

The investor born in 1950 will easily believe that “stocks are risky and unreliable, you can’t count on them.”

Neither investor is crazy.

2. When is enough enough?

"If you don’t know what “enough” is, you’ll make decisions that destroy everything."Chasing more money, more status, or more returns, can push you into terrible choices.

No amount of money can satisfy someone who doesn’t know what “enough” is.

Rajat Gupta grew up poor, but became CEO of McKinsey and a top businessman.