|

Today is Dividend Day.

The series where I teach you 5 things about dividend investing in less than 5 minutes.

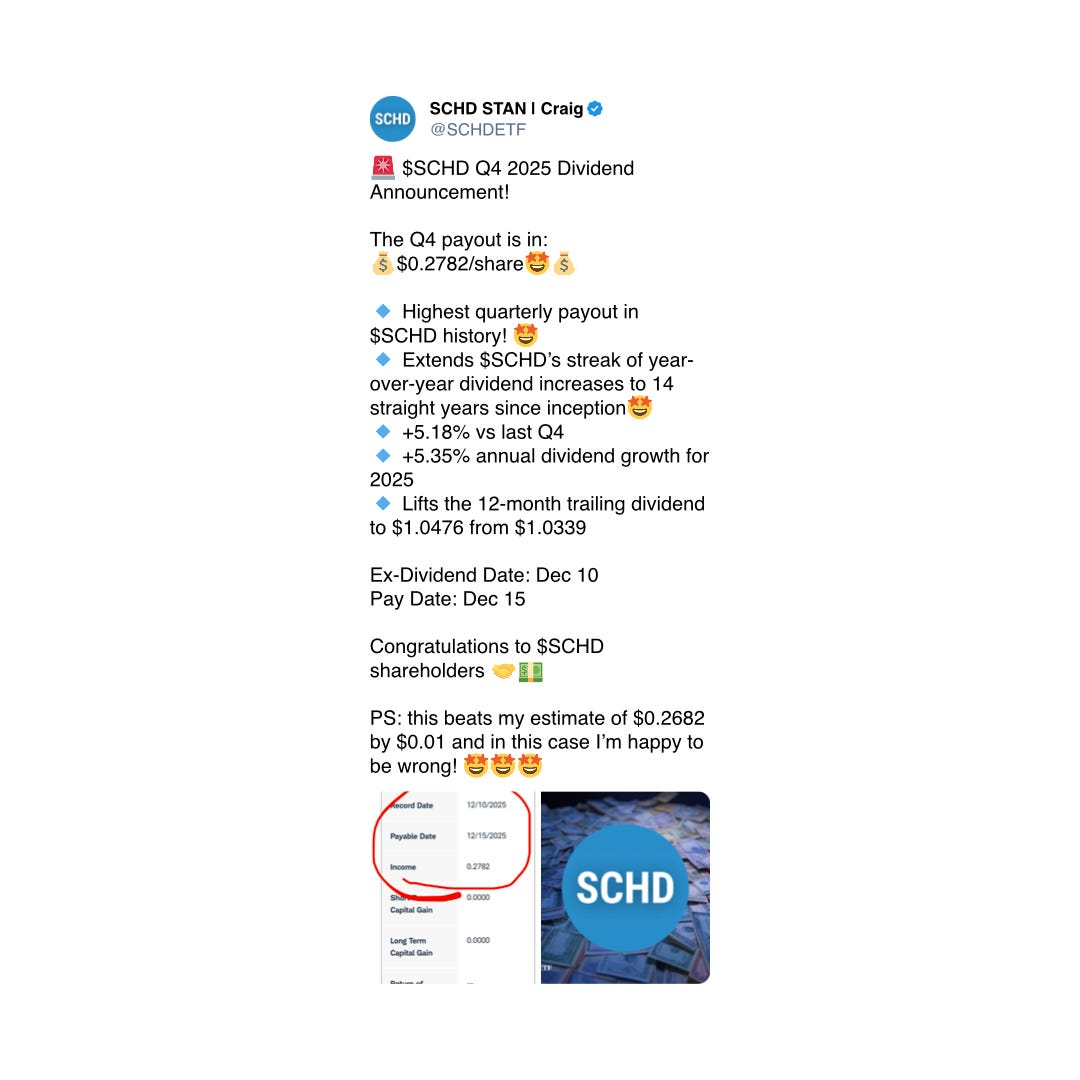

1️⃣ A Record Payout

The popular Schwab US Dividend Equity ETF (SCHD) pays the final dividend payment of 2025 today.

It’s the highest payment in a single quarter in SCHD’s history.

5.18% higher than Q4 last year

5.35% annual dividend growth

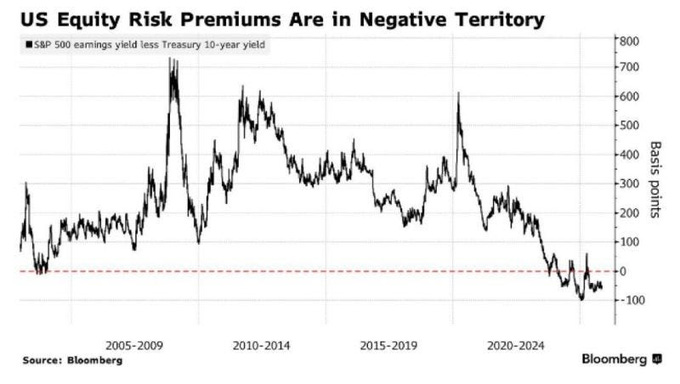

2️⃣ Negative Risk Premiums

The Equity Risk Premium is the “extra” return investors usually get for buying stocks over safe government bonds.

The chart shows this premium is currently negative, meaning safe bonds are actually yielding more than stock earnings right now.

When the risk premium drops this low, the S&P 500 historically returns only 2–3% over the next year, far below its usual 10% average.

While stocks are great for the long run, you may want to lower your expectations for the S&P over the next 12 months.

3️⃣ An Investing Quote

Howard Marks (Oaktree Capital) often asks a simple question: Why would anyone buy a risky stock if a safe bond paid the same amount?

In a rational market, you should get paid extra for taking on uncertainty.

When that premium disappears, as it has recently, it suggests investors have stopped worrying about downsides.

Marks warns that makes the market more risky:

“In order to entice capital, risky assets have to appear to offer higher returns than safe assets. If a risky asset didn’t offer a higher expected return, why would anyone own it? ... [But] when the market is euphoric, investors are willing to accept lower prospective returns for taking risk... The riskiest time in markets is invariably when the common view is that there is no risk.”

— Howard Marks

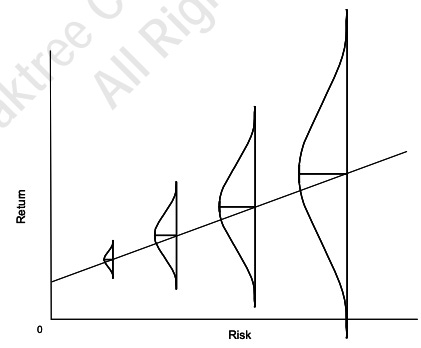

4️⃣ Marks on Risk

Marks wrote an entire memo on risk.

He argues that the relationship between risk and reward isn’t a straight line, but a widening distribution of possible returns.