|

Tomorrow the Compounding Dividend High Yield Portfolio with launch.

Our first stock has a net cash balance sheet, strong management, and a leading market position with room to grow.

Today I want to tell you about the portfolio and how it will work.

The High Yield Portfolio

Even though this portfolio will be focused on High Yield Companies, we’re still looking for good businesses.

Sustainable competitive advantages

Quality management

Healthy balance sheets

Attractive histories of growth

“The prime purpose of a business corporation is to pay dividends regularly and, presumably, to increase the rate as time goes on.”

- Benjamin Graham

Why High Yield Companies Are Interesting

Over time, the High Yield Portfolio should provide attractive returns.

Here’s 3 reasons why:

1️⃣ High-Yield Companies Perform Well

Wellington Management found that companies in the top 40% of dividend yields outperform the S&P most often:

2️⃣ High-Yield Doesn’t Mean High Payout Ratio

Investors think that a high yield automatically means the business is risky, or that it doesn’t reinvest enough capital to grow.

The same study found this isn’t always true.

3️⃣ Reinvestment

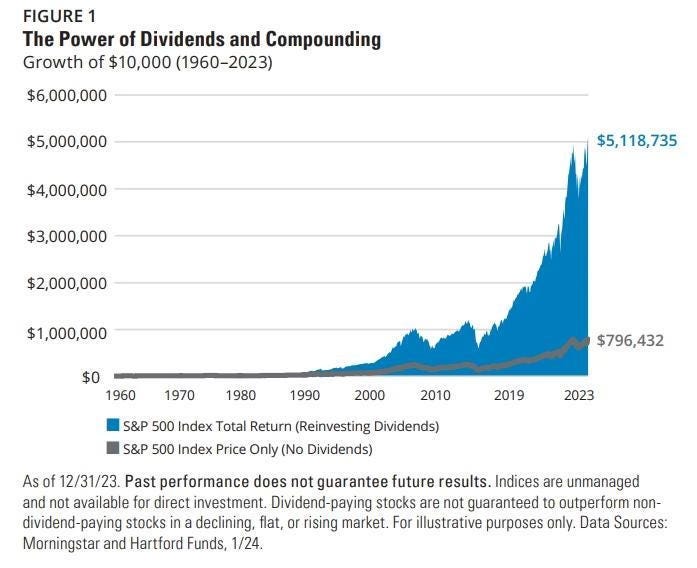

The beautiful thing about High Yield Companies is that they’ll reliably provide you income.

This allows you to retire comfortably.

But until you retire, you can reinvest your dividends.

This fuels compounding over time.

Portfolio Rules

Good agreements make good friends.

Because we are Partners, I will treat you the same way I would like to be treated.

“We have an attitude of partnership. Charlie Munger and I think of our shareholders as Owner-Operators.” – Warren Buffett

Here are the Portfolio Rules:

You can follow the Portfolio 24/7 with 100% transparency

Every month we’ll invest a fictional amount of $5,000

This could be in an existing holding, or a new one

No front-running