|

American consumers face a behavioral contradiction that defines modern e-commerce and reveals a fundamental vulnerability in how technology companies operate. While 95% of Americans worry about data breaches, 78% willingly trade their personal information for shopping perks, with nearly one-in-five accepting discounts as low as 10%. This cognitive dissonance between stated privacy concerns and actual behavior creates what researchers call the “privacy paradox”—and it generates a lucrative but unstable data economy that threatens both consumers and the companies harvesting their information.

Recent survey research by Incogni commissioned from 1,000+ American respondents reveals the depth of this contradiction through concrete behavioral data. Daily online shoppers report being affected by retailer data breaches at nearly double the rate (47%) of monthly shoppers (21%) yet increased shopping frequency correlates with higher data-trading willingness, not increased privacy protection measures.

Millennials emerge as the most vulnerable demographic, with 82% willing to trade data compared to 72% of Baby Boomers, yet Millennials also shop online most frequently, exposing them to maximum breach risk. This pattern illuminates why the data monetization industry reached approximately $434 billion in 2025 value as consumers consistently choose immediate discounts over abstract future protections.

For technology leaders, these survey findings translate into concrete business and engineering implications. The contradiction between consumer anxiety and actual behavior determines market opportunities, regulatory requirements, competitive positioning, and fundamental architecture decisions.

Understanding this paradox separates founders and product managers who build sustainable, defensible products from those accumulating liability through shortsighted data monetization strategies.

The Breach Crisis and Consumer Vulnerability

The foundation of consumer privacy anxiety is empirically justified. The retail cybersecurity landscape deteriorated significantly in 2025, with attacks increasing 34% compared to 2024, and 70-80% of retail businesses reporting cyberattack exposure. Among Americans in the Incogni survey, 26% have already experienced retailer data breaches, meaning their phone numbers, emails, and potentially more sensitive information were exposed to cybercriminals. An additional 16% remain uncertain whether they’ve been affected, suggesting that approximately 42% of Americans face ambiguous breach exposure risk.

The financial consequences for enterprises are staggering. The global average data breach cost reached $3.54 million in 2025, with U.S. retail breaches averaging $10.22 million. That’s nearly three times higher due to regulatory penalties and extensive containment efforts. These costs directly reflect why 53% of breached retailers experienced reputational damage and 33% faced regulatory fines. Remarkably, 97% of the top 100 U.S. retailers suffered third-party data breaches in 2024, meaning security extends far beyond company firewalls into vulnerable partner ecosystems.

Yet despite this clear evidence of systemic breach risk, consumers continue trading data for minor economic incentives. The behavior persists partly because of temporal discounting—a documented cognitive bias where immediate rewards override abstract future threats. A 10% discount provides tangible savings happening now; a potential data breach represents an uncertain event that may never occur for any individual, even though population-level risk is substantial. This individual-level rationality creating population-level irrationality defines both the opportunity and the peril for technology organizations.

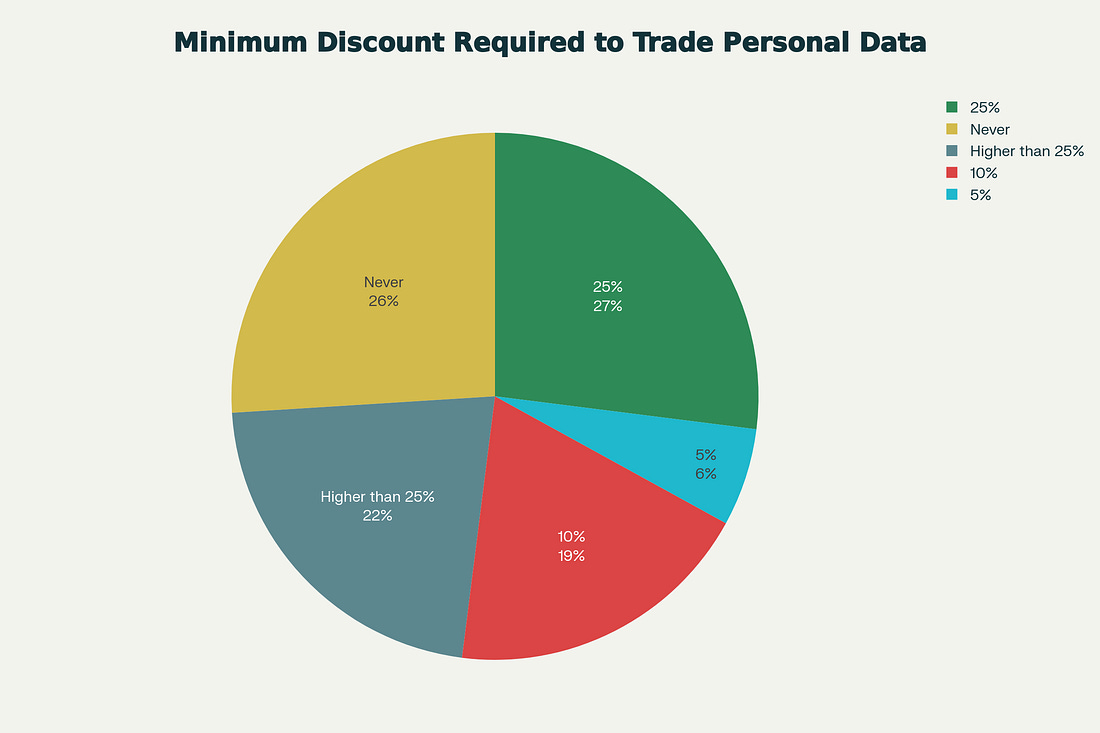

Nearly one in five Americans (19%) would trade personal data for just a 10% discount, while 26% refuse to trade data at any price

The Regulatory Complexity

This consumer behavior occurs within an increasingly complex regulatory environment. The European Union’s GDPR requires explicit opt-in consent before collecting personal data, while California’s CCPA employs an opt-out model where businesses can collect data unless consumers specifically refuse. GDPR violations can incur fines reaching €20 million or 4% of annual global revenue, while CCPA violations carry $2,500-$7,500 per instance penalties plus private lawsuit exposure.

For engineering teams, this regulatory patchwork—now spanning at least 12 U.S. states plus the EU, UK, Canada, Brazil, and others—creates substantial technical complexity. Organizations must implement modular consent management platforms capable of handling both opt-in and opt-out paradigms depending on user geography, maintain region-specific data handling protocols, and generate comprehensive audit documentation for regulatory inquiries.

The Incogni survey shows that only 20% of consumers claim familiarity with retailer data practices, meaning most lack understanding of the technical infrastructure supporting their data collection.

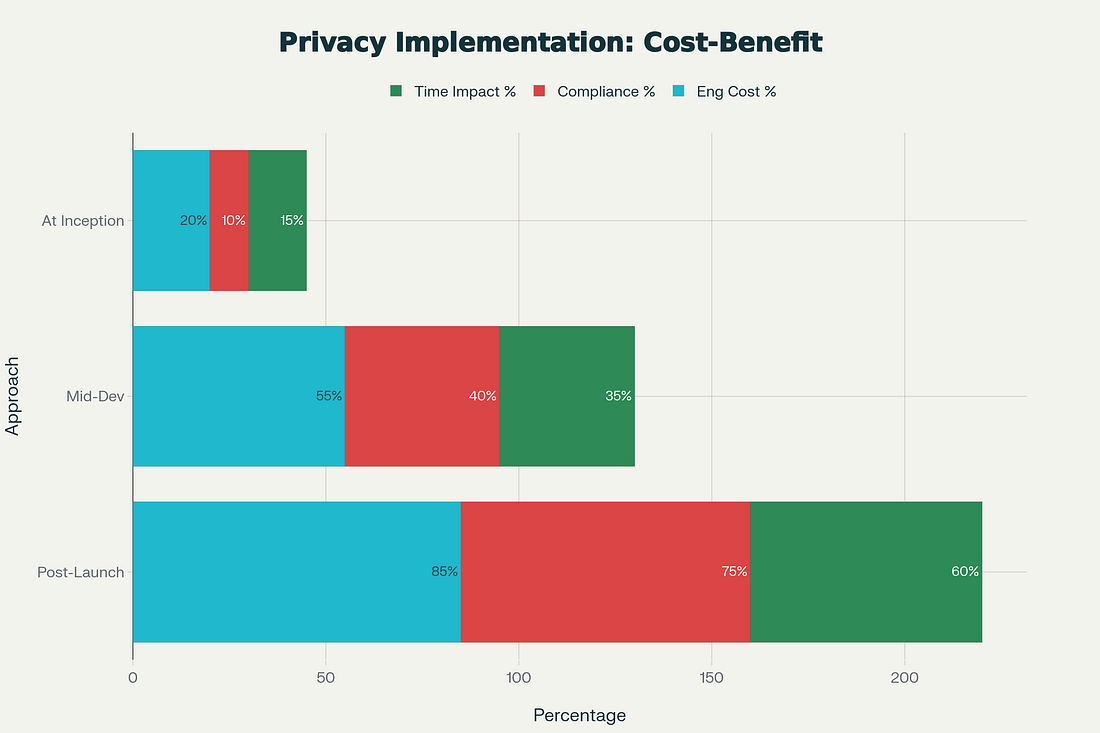

This knowledge gap creates a particular vulnerability for engineering teams. Privacy policies represent formal commitments that engineering must implement—a promise to “delete user data within 30 days” creates mandatory architectural requirements; a claim about “encryption of data in transit” demands specific technical implementations. Teams failing to implement promised privacy protections face regulatory sanctions, regardless of technical feasibility arguments. For startup founders, this means involving privacy specialists during product development, not post-launch, as retrofitting privacy to existing systems costs approximately 75% more than implementing privacy-by-design from inception.

Privacy-by-design implementation from inception costs 75% less in engineering effort, reduces compliance risk by 87%, and limits time-to-market delays compared to reactive post-launch privacy retrofits