|

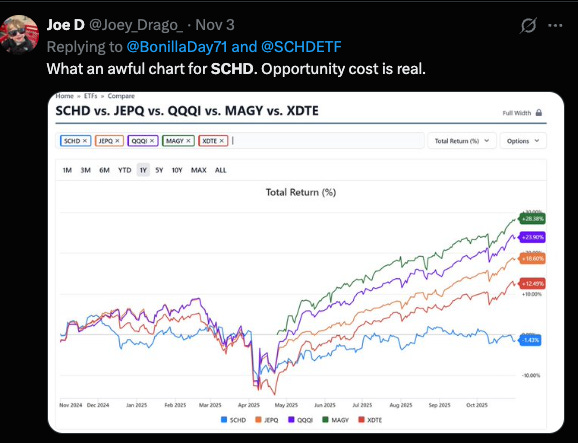

If you’ve been looking at SCHD lately and feeling disappointed that it hasn’t kept up with the S&P 500, you’re not alone.

Social media is full of posts like this - charts comparing price performance, hot takes about “underperformance,” and calls to dump SCHD for an S&P index fund.

But here’s the truth:

If you’re comparing SCHD’s price chart to the S&P 500’s, you’re asking the wrong question.

Different Goals, Different Metrics

The S&P 500 (and the funds that track it — SPY, VOO, etc.) exist for one main purpose:

Capital appreciation.

Their goal is to match the total return of the U.S. stock market.

So naturally, when you analyze them, you look at metrics like:

Earnings growth - what’s driving long-term returns

Valuation (P/E ratio) - how much investors are willing to pay for those earnings

Total return - price appreciation + dividends

But SCHD’s mission is entirely different.

Its goal isn’t price growth. It’s reliable, growing income.

So when you measure SCHD’s success, you need to use a different scorecard:

Dividend yield - how much income your money earns now

Dividend growth rate - how fast that income grows over time

Payout consistency - whether it keeps rising through good and bad markets

A Tale of Two Markets

Let’s look at how different these funds really are.

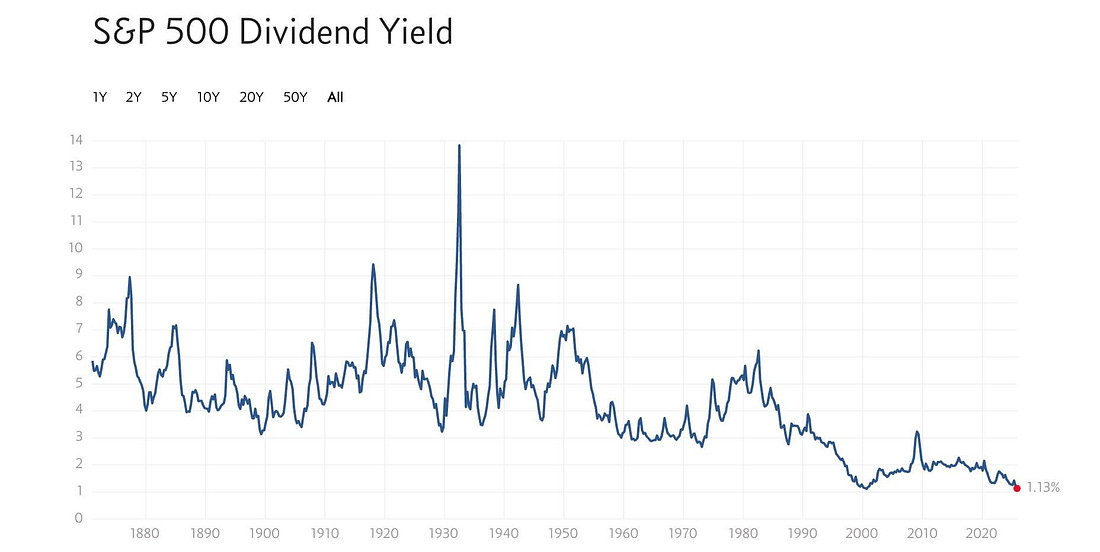

The S&P 500’s dividend yield has been shrinking for decades - down to around 1.1%, one of its lowest levels ever.

SCHD, on the other hand, typically yields between 3% and 4% - roughly 3x more income per dollar invested.

So if you’re an income-focused investor, SCHD plays the same game you do.

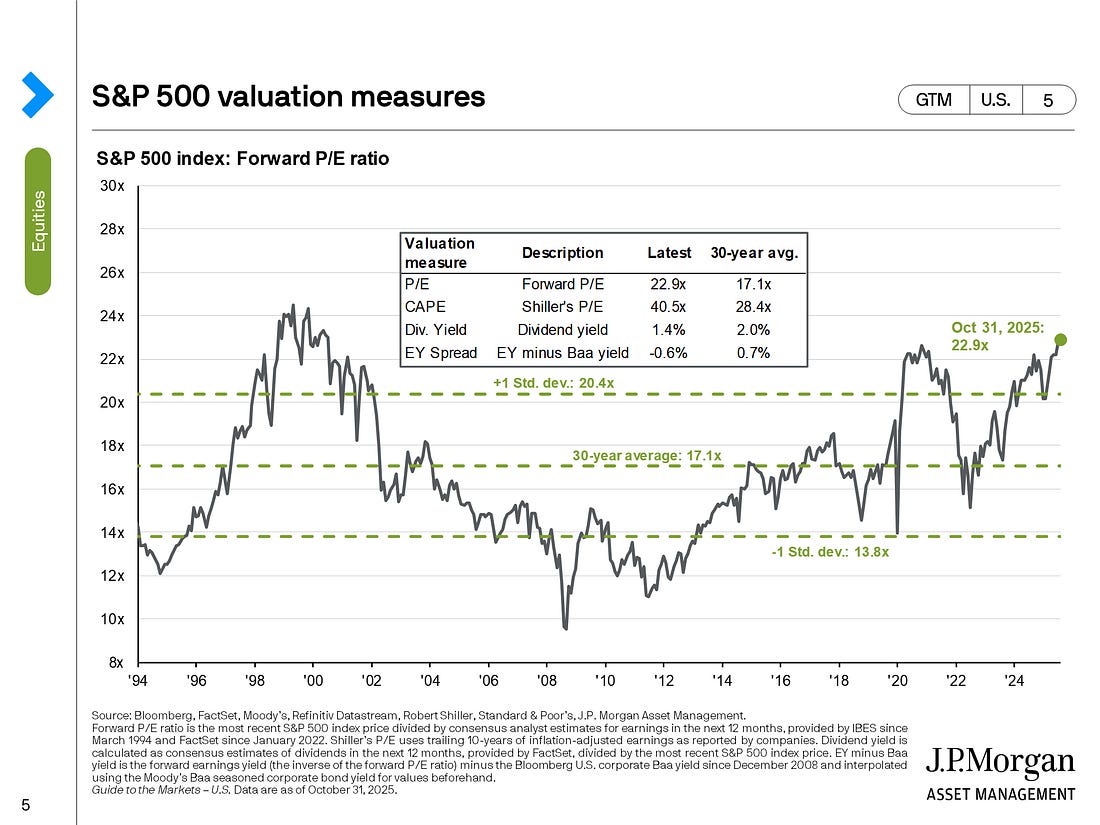

It’s also worth noting how differently the two are priced.

The S&P 500’s forward P/E ratio is sitting above its long-term average, meaning investors are paying a premium for every dollar of earnings.

SCHD’s holdings, by contrast, are much cheaper.