|

|

|

Bond traders are preparing for a wave of delayed economic releases that will shape expectations for the Federal Reserve's next rate move, with the September jobs report due Thursday. JPMorgan's Priya Misra warned that stronger-than-expected labor figures could reduce the odds of a December rate cut and fuel volatility, while managers broadly expect the Fed to maintain an easing bias even if it pauses next month, as officials express uncertainty around the rate outlook.

|

|

|

|

As Q4 guidance reshapes 2026 forecasts, learn how S&P Capital IQ Estimates and Visible Alpha together reveal what's driving revisions and sentiment shifts. Join experts to explore a clearer, data-driven view of market expectations.

|

|

|

| ADVERTISEMENT |  |

|

|

The Bloomberg US Aggregate Bond Index is on track for its best performance since 2020, potentially fueled by Federal Reserve interest-rate cuts and other factors. The index has returned about 6.7% this year, outpacing short-term Treasury bills. However, potential threats remain, including uncertainty over future rate cuts.

|

|

|

Bitcoin fell to a six-month low of about $93,000 over the weekend amid tight liquidity, but analysts are optimistic about a potential rebound as the US government resumes normal operations. "The bottom line is this pullback reflects tight funding conditions and shifting rate expectations, not a break in crypto fundamentals," says Edward Carroll, head of markets at MHC Digital Group.

|

|

|

A potential rare earths agreement between the US and China could be finalized by Thanksgiving, according to US Treasury Secretary Scott Bessent. "I am confident that post our meeting in Korea between the two leaders, President Trump, President Xi, that China will honour their agreements," Bessent said.

|

|

|

Wall Street is pouring unprecedented capital into AI infrastructure, backing multibillion-dollar data center projects for tech giants like Meta, Oracle, and Amazon. Major fund managers, private equity firms, and banks are arranging massive debt and private deals to meet the surging demand for computing power, with some single deals reaching $30 billion or more.

|

|

|

|

|

Access the market's most comprehensive estimates with S&P Capital IQ and Visible Alpha now combined under S&P Global Market Intelligence. Gain unmatched breadth, depth, and insight for sharper benchmarking, forecasting, and investment decision-making. Get Started > |

|

|

|

| ADVERTISEMENT |  |

|

|

The Leapfrog Group's recent safety report awarded "A" grades to 33 of the 143 hospitals ranked statewide, including several New York City-area hospitals managed by New York-Presbyterian, Northwell Health and NYU Langone Health. The rankings are based on adequate staffing, fall prevention and infection control, among other metrics. New York ranks 30th in the US for hospitals with top safety grades.

|

|

|

New York City is experiencing a surge in residential buildings with exactly 99 units, driven by the new tax abatement program that requires higher wages for buildings with 100 or more units. Developers filed 21 applications for 99-unit buildings in Q3, compared with just 13 from 2008 to 2023, according to the Real Estate Board of New York.

|

|

|

|

|

AI isn't hype anymore—it's here. Join EPAM, Stripe, and commercetools to learn how to harness AI—responsibly and effectively. See how AI is reshaping the shopper journey, and learn why composability is key to doing it right. The brands moving first are already winning. Register now! |

|

|

|

|

|

| |

|

| (ariya j/Getty Images) |

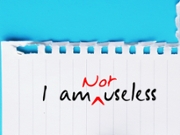

We all have an inner critic just waiting to tear us down, but we also have an inner "maverick," the voice "telling us that we can do what we set out to achieve," writes John Baldoni, who outlines how a new book, "Headamentals," can help us activate that maverick to slay our inner monsters. Use a three-step strategy to recognize what triggers the critic, reframe setbacks as learning opportunities and remind yourself of how you've overcome challenges in the past, Baldoni writes.

| | | | | |