Howdy Partner 👋

I have a confession to make…

Something had been torturing me in the past few months.

I’m only talking about torture in an intellectual sense.

But this issue cuts deep into the heart of my investment philosophy.

What if you are someone like my dad?

He already has some capital and is just looking to generate extra income from his investments.

Compounding Quality isn’t here, I’m afraid.

Should he invest in risk-free bonds?

That would be terrible. My dad’s buying power would decline year after year.

And because my dad isn’t the only one in this situation…

I’ve decided it’s time to introduce a better strategy to generate income AND protect your buying power AT THE SAME TIME.

This 120% gain is a problem

“Capital allocation is the most important task of the CEO.” – Compounding Quality

Since I began investing, my core philosophy has always been to buy companies that have already won and are on track to keep winning.

A major factor to keep winning is great capital allocation.

My preferred capital allocation choice is reinvesting in the business.

Take Kelly Partners Group.

This company is a serial acquirer of chartered accounting businesses.

That’s why the best use of Kelly Partners Group’s cash is to keep growing via M&A.

The strategy is clearly working.

The stock climbed over 120% since we added it to our portfolio. 📈

But that kind of gain would’ve really bugged me at the start of my investing journey.

Don’t get me wrong.

I would’ve been more than happy with a position that more than doubled my money in less than a year (and yours hopefully too).

But when you compare Kelly Partners with a company like Coca-Cola, you’re wondering what’s going on.

Got $8 billion burning a hole in your pocket? 🔥

Coca-Cola is giving a fortune away instead of reinvesting it. 💸

In fact, Warren Buffett pockets almost $25 every second just from owning Coca-Cola stocks in dividends.

That’s $776 million every year.

This got me thinking…

… Capital allocation is key to Warren Buffett’s investment success.

Yet, he’s ok with Coca-Cola distributing all this money to its shareholders?

Why does he not convince Coca-Cola’s CFO to invest this money back into the business?

He could try. Buffett is Coca-Cola’s largest shareholder.

But Coca-Cola is different to most companies on the stock market.

Some stocks are like your favorite coffee shop

Here’s a simple rule…

“When you look at a public company, look at it exactly the same way that you would look at buying a business down the road, like a car wash or a coffee shop.”

Car washes and coffee shops don’t reinvest all their cash after they’ve established themselves.

If the product is perfect and customers are happy, there’s no need to keep innovating year after year.

Their owners just collect the cash the business makes.

It’s the same with Coca-Cola…

Coca-Cola has beaten the game

It has the perfect product…

Coke is the most popular soft drink in the world.

Its basic formula hasn’t changed substantially since 1925.

Coca-Cola owns a flawless supply chain that it began building in the early 1900s.

Today, there are just two countries in the world where you can’t get a Coke:

Cuba and North Korea.

In other words, Coca-Cola is so far along in its journey as a business…

… It doesn’t need to reinvest a lot of cash.

Instead, it can give away more than $8 billion to its shareholders in the form of dividends.

And Coca-Cola is just one example, of course:

McDonald’s pays more than $5 billion in dividends every year

Bank of America almost $8 billion

And Chevron more than $11 billion

These businesses are essentially money-printing machines.

They sell the perfect (or near-perfect) product that doesn’t require a lot of reinvesting.

Stocks like this are “boring”

It’s easy to overlook this simple reality…

… The media bombards us with disruptions like AI, crypto, or space-flying rockets all the time.

Countless companies with a great but “boring” product get lost in the noise.

Some of the Compounding Quality Partners have been interested in dividend stocks for quite some time.

Take Josh. He is better known as TJ Terwilliger in Our Community.

Maybe you’ve seen his invaluable insights yourself.

The more I talked with him, the more I realized that there’s a massive thirst in our Community to learn more about dividends.

That’s why I decided to kick-off Compounding Dividends…

… Because history tells us neglecting dividend payers is a big mistake.

Ignoring dividends would’ve cost you 700%

You’ll miss out on almost half of the potential gains in the markets that way.

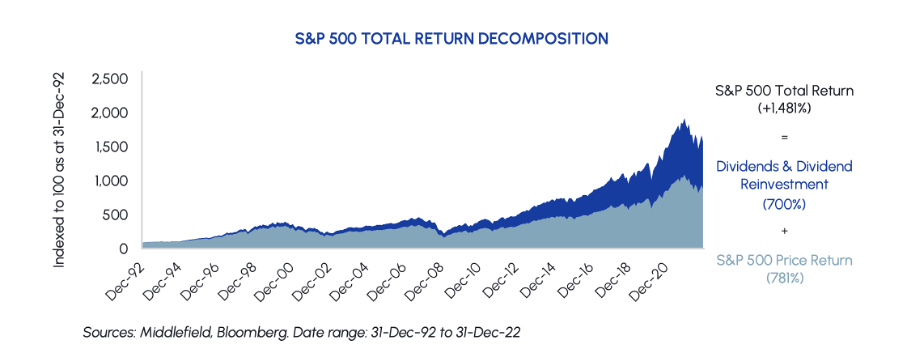

Just look at this chart:

It breaks down the total return of the S&P 500 between 1993 and 2022:

The aggregate total return was +1,481%

+700% came from dividends & dividend reinvestment

Only the remaining +781% are attributable to price appreciation

Almost half of all the gains were the result of dividends.

Can you afford to miss out on that amount of money?

And we’re just scratching the surface…

Because companies across the S&P 500 aren’t necessarily the best dividend stocks.

The S&P 500 is a selection made by a committee according to factors such as:

Market cap

Trading volume

Earnings

That’s why…

If you hand-select the best dividend stocks, your profit potential is even bigger 🔎

However, that’s where a lot of dividend investors make their biggest mistake.

Because they only pay attention to the dividend payout.

In the long run, this approach will NOT maximize your returns.

In fact, if you don’t know what you’re doing, the results can be catastrophic.

Take Boeing.

Boeing grew their dividend from 2014 to 2019 at a rate of more than 23% a year: