|

|

Investing is one of the most wonderful things in the world.

But there’s not just one ‘right’ way to do it. Multiple roads lead to heaven.

Today, I’m sharing three different types of investment portfolios with you.

Loyal readers know there are three main investment strategies you can use:

Living Rich: Great companies that are paying an attractive dividend

Staying Rich: Established quality stocks that are still growing attractively

Getting Rich: Small quality companies that are growing very quickly

Let’s dive into each strategy and share a Portfolio of 25 companies for each one.

1. Living Rich (Compounding Dividends)

Compounding Dividends focuses on growing your wealth while receiving an attractive dividend so you can retire comfortably.

The goal is to build a Dividend Growth Portfolio that generates more dividend income than your monthly expenses.

Compounding Dividends is all about ‘Living Rich’.

How to find Living Rich stocks?

We use these criteria:

💸 Dividend yield > 2%

💰 Payout ratio < 80%

📈 Dividend growth > 10% per year (last 5 years)

📊 Profit margin > 5%

🏆 ROIC > 10%

⚖️ Net Debt / Free Cash Flow < 4x

Let’s highlight two companies that match these criteria.

🍔 McDonald’s ($MCD)

Let’s start with McDonald’s.

You already know the brand. It has over 43,000 restaurants in 115 countries.

About 60% of its money is generated via franchising.

It means other people run the restaurants, and McDonald’s earns a fee.

It’s a simple and very profitable model that gives McDonald’s steady income, high margins, and low costs.

McDonald’s has three big advantages:

A world-class brand

Huge economies of scale

Strong focus on efficiency

McDonald’s is also investing a lot in digital tools.

Today, 40% of its sales come from digital channels, and its loyalty program already has 175 million members (!).

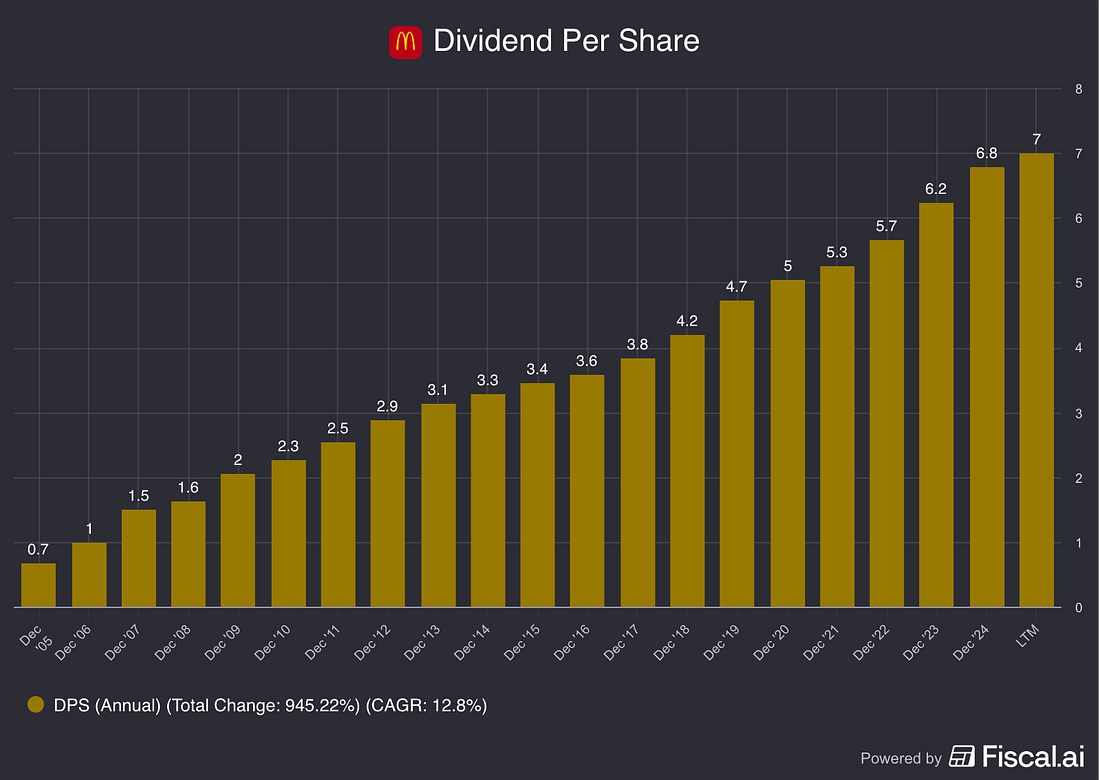

McDonald’s has raised its dividend every single year since 1976.

Right now, the dividend is about $7 per year, which is a 2.2% yield at today’s price.

We expect McDonald’s to keep growing its dividend for many years to come.

|

🏪 Realty Income ($O)

Another great example is Realty Income.

They call themselves “The Monthly Dividend Company”, and for a good reason.

Realty Income is one of the largest real estate investment trusts (REITs) in the US, owning more than 15,600 properties.

Most of these buildings are rented to big, stable tenants like supermarkets, pharmacies, and fast-food chains.