Do you know how Compounding Quality started?

On a Friday night, I was staying at my childhood home because the day after one of my best friends had his bachelor party.

I was bored and didn’t know what to do on that particular evening.

Why not create an anonymous account on Twitter?

I thought it would be cool to say whatever I wanted about the stock market at any given time (at the time I was still working in the Asset Management industry meaning that you aren’t allowed to speak openly about investment-related topics).

So it happened and I created an account on Twitter.

Now I needed to find a name. I thought for 30 seconds and named the account Compounding Quality. It beautifully sums up the strategy:

Let the magic of Compounding do the work for you by investing in Quality Stocks.

Today, Compounding Quality has more than 1.5 million followers on social media and more than 500,000 readers on its website.

When did you start investing?

When I was 13 years old, on a nice summer evening, someone told me about the stock market.

You could make money without having to work for it?

This was one of the most beautiful things I had ever heard.

I remember the conversation as yesterday as it sparked a light in me. My passion for investing was born on that summer evening.

The day after the conversation, I set up a brokerage account (via my parents as you aren’t allowed to invest in stocks under age 18).

After a few days, the account was set up and I transferred the hard-earned money I earned that summer to my investment account.

But there was only one small problem…

… In which stock should I invest? I didn’t know anything about stocks.

‘Luckily’ the broker I used had a top pick list and they recently added a new company to this list. It was a local company active in the production, storage, supply, and transportation of oil and gas.

The people who managed the top pick list were so-called experts.

They should know what they were doing right?

So I blindly followed them and bought that specific company with all the money I earned that summer.

After 1 year I sold the stock…

… with a loss of 60%.

And you know what? It’s the best investment I’ve ever made.

My worst investment ever has become my best investment ever.

After selling my first investment (which was very painful), I could beat myself up.

How could I be so stupid?

When something like this happens to you, you can do two things:

You conclude investing isn’t something for you and you give up

You promise yourself to never make the same mistake again and educate yourself

I decided to choose the latter.

From that point in time, Ibecame completely obsessed with the stock market.

Starting from age 14, I did the following:

Read all financial newspapers every morning

Read at least 1 finance/investing book every week

Listen to everything I could find about investing on YouTube, the radio, … for several hours

My ex-girlfriend once said to me that I loved the stock market and books more than I loved her. She was probably right as we broke up a few months later.

What you can learn from this?

Making many investment mistakes at the beginning of your investment journey is probably the best thing that can happen to you.

It’s way better to make a mistake with $1,000 than making a mistake with $100,000.

Failures are part of life. If you’ve never failed, you’ve probably never tried anything new.

The life of optimistic investors is beautiful in that sense. If you make a good investment decision, you make money and if you make a bad decision, you’ll learn something new.

As Thomas Edison beautifully said: “I have not failed. I’ve just found 10,000 ways that won’t work.”

In my office, there still is a framed picture of that first investment which I sold at a loss of 60%.

I do this to remind myself that you should always stay humble.

How I got to Dividend Investing

I started by reading the classic investing books:

The Intelligent Investor

One Up on Wall Street

Margin of Safety

Stocks for the Long Run

The Most Important Thing

Value investing made complete sense to me.

So I went off looking for bargains.

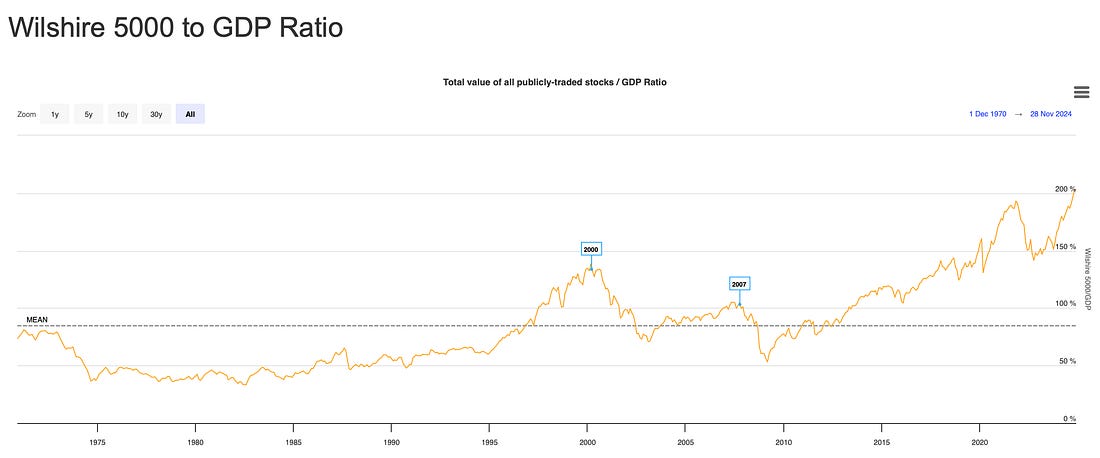

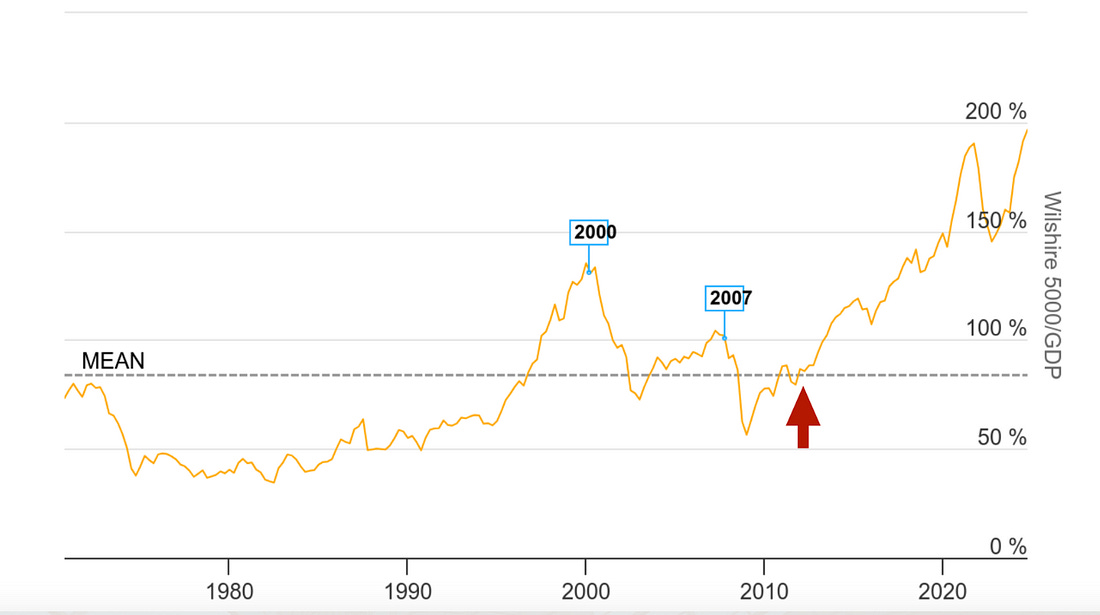

The picture below is the “Buffett Indicator”.

It’s a measure of the overall valuation of the stock market compared to the economy.

It divides the total market capitalization of publicly traded companies by the country’s Gross Domestic Product (GDP).

I started about where the red arrow is:

The stock market has become more expensive since I started investing seriously.

That doesn’t mean there aren’t good deals sometimes. But they’re harder to find.

As the market kept going up, I started trying to understand what was happening.

Some really good investors had also noticed a change in the market.

“Though the stock market is massively larger than it was in our early years, today’s active participants are neither more emotionally stable nor better taught than when I was in school. For whatever reason, markets now exhibit far more casino-like behavior than they did when I was young. The casino now resides in many homes and daily tempts the occupants.” - Warren Buffett

I don’t know what the stock market will do.

I don’t know if passive investing has broken the markets, or if investors have become gamblers.

What I do know is that it makes a lot of sense to me to remove the opinions and emotions of other investors.

And to get paid directly by the companies I own.

What separates Compounding Dividends?

At Compounding Dividends, there are no commercial incentives (except for the subscription fee).

Honesty and integrity are essential and we genuinely want to do the right thing.

And what’s even more important? We are PARTNERS in this.

We’re in this together. Real money is invested in the Compounding Dividends Portfolio.

If you do well, I do well, and the other way around.

Here’s what Charlie Munger said about the power of incentives:

Compounding Dividends 2.0

You told me you were ready to join Compounding Dividends.

As promised, you can secure your spot now…

…1 hour before everyone else.

Consider this a gift. Spots will likely sell out fast.

Why? There are thousands of investors on this waiting list and only 100 spots available.