| Read in browser | ||||||||||||

Good morning, it’s Angus here in Sydney. Here’s what you need to know on this Tuesday morning, after Australia struck a deal to supply the US with rare earths. But first... Today’s must-reads:

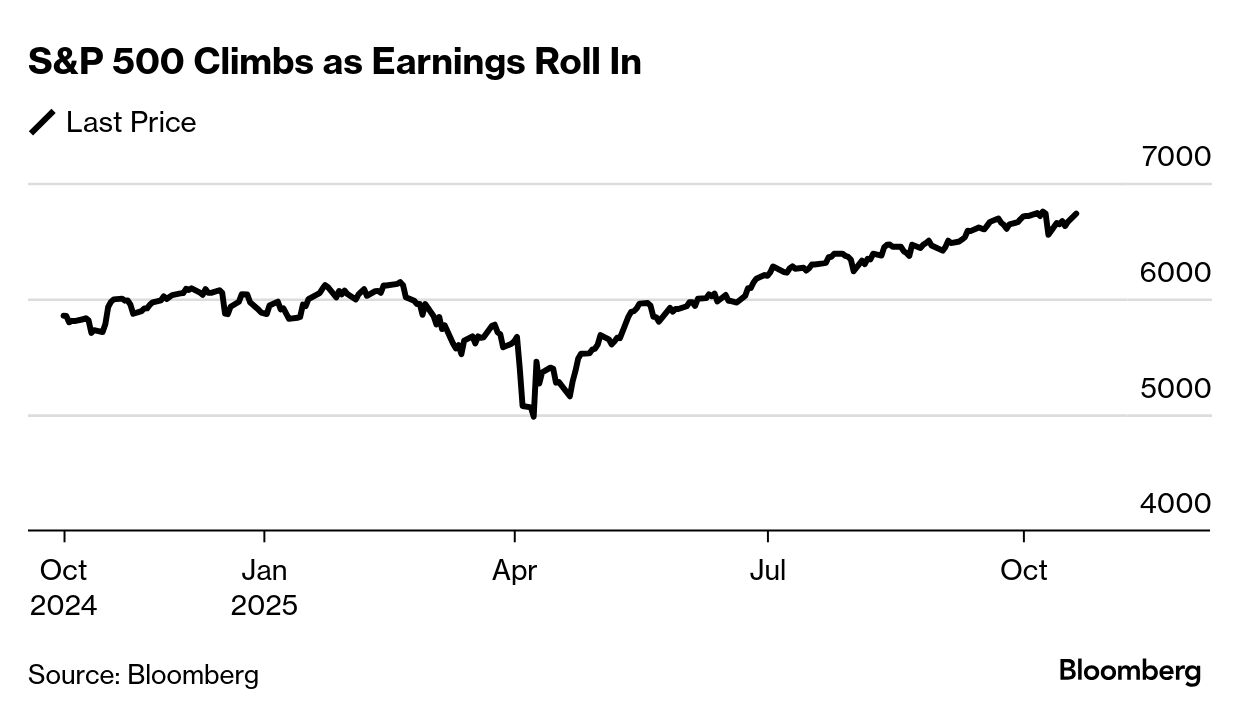

What’s happening nowUS President Donald Trump signed an $8.5 billion agreement with Australian Prime Minister Anthony Albanese at the White House to boost access to critical minerals and rare earths as the US looks to reduce reliance on Chinese supply chains. President Trump says the AUKUS pact between the US, Australia and the UK is “moving along very rapidly,” signaling he’ll allow the Biden-era partnership to go ahead even as his administration reviews the agreement.. DroneShield Ltd., the Sydney-listed counter-drone company whose shares have soared almost 500% this year, said demand is growing among civilian industries as governments bolster air defense capabilities. Airports and data centers are poised to become “significant” sources of business for the Sydney-based company, CEO Oleg Vornik said in a Bloomberg Television interview. AustralianSuper, the country’s largest pension fund, has committed an initial £500 million ($672 million) to launch an investment platform for UK housing, part of a drive to expand its portfolio of British assets. Australia’s fast-growing pension funds are ramping up offshore investments as they struggle to find enough large-scale opportunities at home.  Australian tycoon Raphael Geminder, the brother-in-law of Australia’s fourth-wealthiest person Anthony Pratt, is considering selling the Asian operations of his packaging companies, according to people with knowledge of the matter. Dynapack Asia and Pact Group Holdings Ltd. have reached out to potential investors, the people said. Geminder owns 50% of Dynapack Asia. What happened overnightHere’s what my colleague, market strategist Mike “Willo” Wilson says happened while we were sleeping… The S&P 500 Index rose strongly with about 85% of companies that have reported results this earnings season beating profit estimates. The US-Australia critical minerals deal will be good for stocks in that sector. Currencies were quiet with Aussie and kiwi edging higher. Gold bounced back and posted a new high ahead of China-US trade talks. Today, New Zealand has trade data for brunch, while later, an RBA official joins in on a discussion. Neither should shift markets. Not surprisingly, ASX futures point to a strong opening for local stocks.  President Donald Trump said Monday that the US would destroy Hamas if the militant group didn’t continue to honor the ceasefire with Israel, with a fragile truce resuming after a weekend of heavy fighting in the Gaza Strip. Japan’s ruling Liberal Democratic Party sealed a new coalition deal that sets up Sanae Takaichi to become the country’s first female prime minister. LDP President Takaichi and Hirofumi Yoshimura, co-leader of the Japan Innovation Party, also known as Ishin, signed the coalition agreement on Monday evening. China’s factories kept the country on track to reach this year’s growth target, powered by an export boom that’s papering over deeper vulnerabilities as leaders meet to chart the nation’s next half-decade. The world’s second-largest economy grew 4.8% in the third quarter compared with a year earlier, slightly above estimates.  Amazon Web Services, the world’s largest cloud provider, said issues continued to plague its operations after a widespread outage degraded services for a range of customers including government agencies, AI companies and financial platforms. Amazon.com Inc.’s service underpins a large chunk of the internet, accounting for about a third of the cloud market. What to watch• Reserve Bank of Australia Assistant Governor Brad Jones, who oversees the financial system, participates in a panel at the ISDA/AFMA Derivatives Trading Forum 2025 at 10:45 a.m.in Sydney. One more thing...It took just seven minutes for robbers armed with disc grinders to get in and out of the world-famous Louvre museum in Paris with a stash of royal necklaces, tiaras and earrings. Read the full account of the brazen crime here. We’re improving your newsletter experience and we’d love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg’s Australia Briefing newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|