| Bloomberg Evening Briefing Americas |

| |

| Part of the plan for a second Trump administration was supposedly to “flood the zone:” inundate the media and the opposition with big speeches, executive orders, social media posts—you name it. Nine months into a frenetic presidential term like no other, the betting markets are backing up what Wall Street realized a while back when it comes to those speeches, orders and posts. Investors filed many of them under TACO, or “Trump Always Chickens Out,” and placed their bets accordingly.

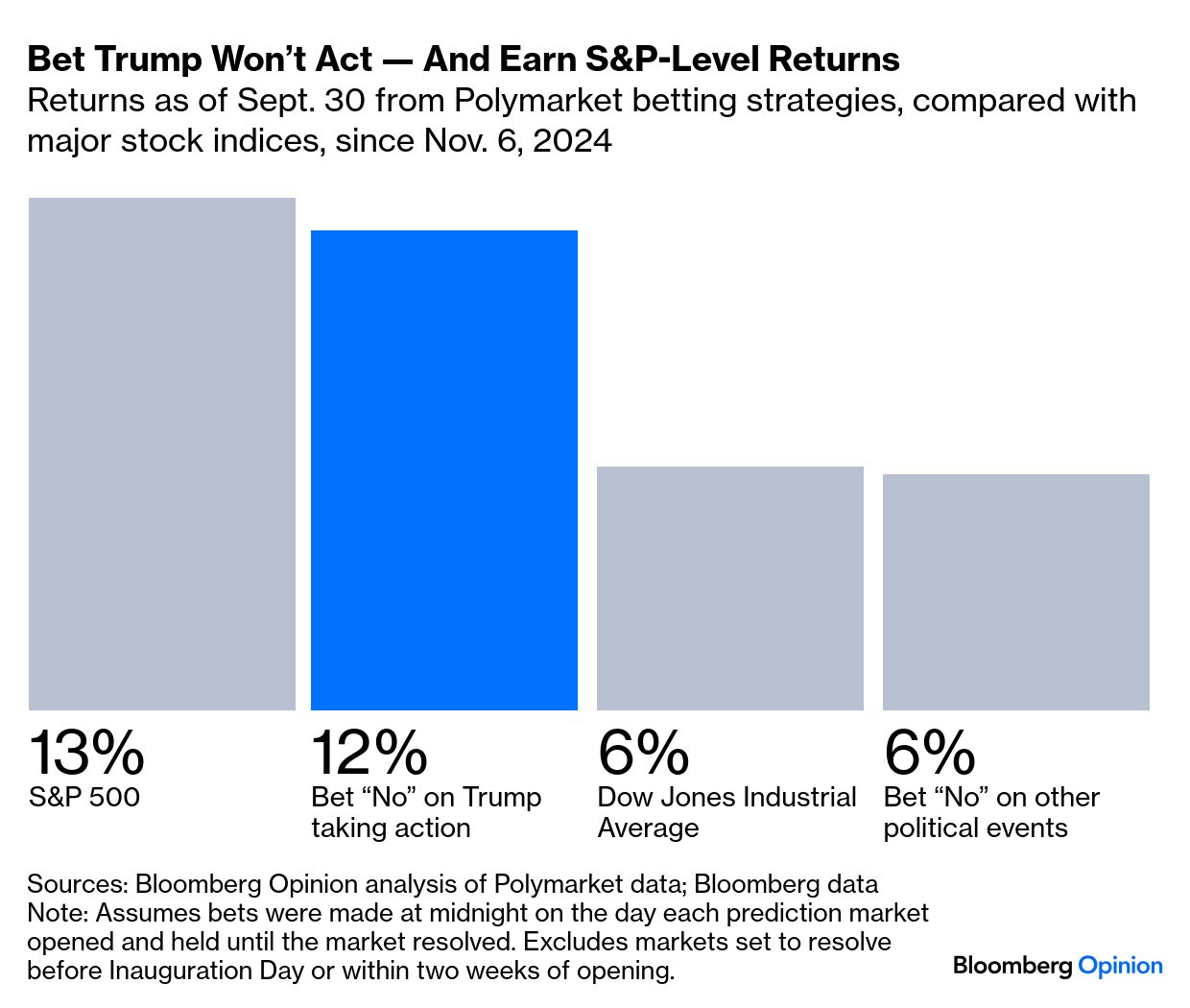

Carolyn Silverman and Timothy L. O’Brien write in Bloomberg Opinion that Trump’s deluge strategy also has left an overwhelmed public with a unique question: What does one do when confronted by the reality that a president is a professional distraction machine and chaos agent?  It’s become clear to anyone watching that Trump often doesn’t follow through on what he promises, pledges or threatens. And the prediction markets bear that out, O’Brien and Silverman write. From tariffs to firing cabinet officials to what executive orders he would sign, bettors assigned an average probability of 34% to those events occurring within a specified timeframe. And in the end, only 28% actually happened.

The smart money seems to be on the 79-year-old Republican doing absolutely nothing, they write: You would have made a $12 net profit for every $100 you spent. See for yourself how the professionals are gaming out this moment in American history. —Natasha Solo-Lyons and David E. Rovella | |

What You Need to Know Today | |

| A different kind of flood took place this weekend as millions of Americans poured into streets across more than 2,000 cities and towns to protest against Trump, in one of the larger mass protests in US history. The “No Kings” demonstrations sought the removal of the twice-impeached president from office, decrying his unprecedented use of federal paramilitary forces in an immigration dragnet and the militarization of Democratic-run cities on the false pretense of rising crime. Organizers said approximately seven million people took part, which would surpass the previous national anti-Trump protest in June attended by an estimated 4 million to 6 million people. Nevertheless, on Monday Trump notched another victory as two Trump-appointees to the US Court of Appeals overruled a lower court judge (also a Trump appointee) to allow him to send soldiers into Portland, Oregon.  Demonstrators during the “No Kings” protest in Boston on Oct. 18. Organizers said seven million Americans took part. Photographer: Joseph Prezioso/AFP Also over the weekend, Vice President James Vance presided over an unusual military display in California where Marines fired live artillery shells over an often busy California freeway. Vance used a speech at the event to attack Democratic politicians in front of an audience of soldiers. One of those Democrats, California Governor Gavin Newsom, accused Vance, a former public affairs officer in the Marines, of staging an “absurd show of force” that would endanger residents of the blue state. As it turned out, shells fired during the display included one that spread shrapnel near the highway, damaging police vehicles. Newsom, however, had closed the highway to traffic for safety reasons—despite criticism by local Republicans for doing so. | |

| |

|

| Amazon Web Services, the world’s largest cloud provider, said issues continued to plague its operations after a widespread outage degraded services for a range of customers including government agencies, artificial intelligence companies and financial platforms. Hours after saying that it had mostly recovered from the database network issue, AWS said on Monday that some users were still struggling to connect. In an update on its health dashboard, the company said multiple AWS services in the East Coast region had experienced network connectivity issues. The troubles continued through the afternoon. | |

| |

|

| Apple shares hit their first record of 2025 on Monday after Loop Capital upgraded the stock to buy from hold, becoming the latest firm to cite positive iPhone demand trends. Shares rose almost 4% to $262.24, taking out an all-time high that had stood since December. Apple had been a high profile underperformer among S&P 500 Index stocks for much of the year, down as much as 31% at its worst point in April. But since then the iPhone maker has soared more than 50%, finally turning positive for the year in late September. | |

|

| Further signs of strain in the credit market risks provoking another broad equities rout as long-only investors, including pension funds, will be compelled to sell, according to strategists at Bank of America. “If private lending hiccups continue, pensions etc. may be forced sellers of index funds to avoid punitive private asset marks and meet ongoing obligations,” said Savita Subramanian, head of US equity and quantitative strategy at BofA Securities. Passive investment “dominates the S&P 500,” so a downturn would push funds that track indexes to sell equities, she wrote in a note Monday. | |

|

| A company whose primary purpose is to hold the cryptocurrency tied to the Ripple payment network, XRP, is set to go public via a blank-check company. Called Evernorth, the new venture joins an explosion of digital asset treasury companies, or DATs, raising funds through a special purpose acquisition company or SPAC. The publicly listed entities draw investors that want to gain exposure to tokens without directly holding them. The deal is expected to raised more than $1 billion in proceeds. | |

|

| Argentina’s central bank and the US Treasury signed a currency swap line for $20 billion, a vote of confidence for President Javier Milei ahead of a crucial midterm election the Trump administration seems t0 want his party to win. But with details still scarce, bonds erased initial gains and the peso weakened. The deal, announced by the Argentine monetary authority on Monday, is a key pillar of a sweeping rescue package Treasury Secretary Scott Bessent put together for Milei in a whatever-it-takes approach to stabilize the volatile South American economy. | |

|

| |

What You’ll Need to Know Tomorrow | |

| |