| Read in browser | |||||||

Good morning, it’s Paul-Alain Hunt here in Melbourne. The ASX looks set for a sluggish open this morning — but first, here’s some must-reads to get you started... Today’s must-reads:

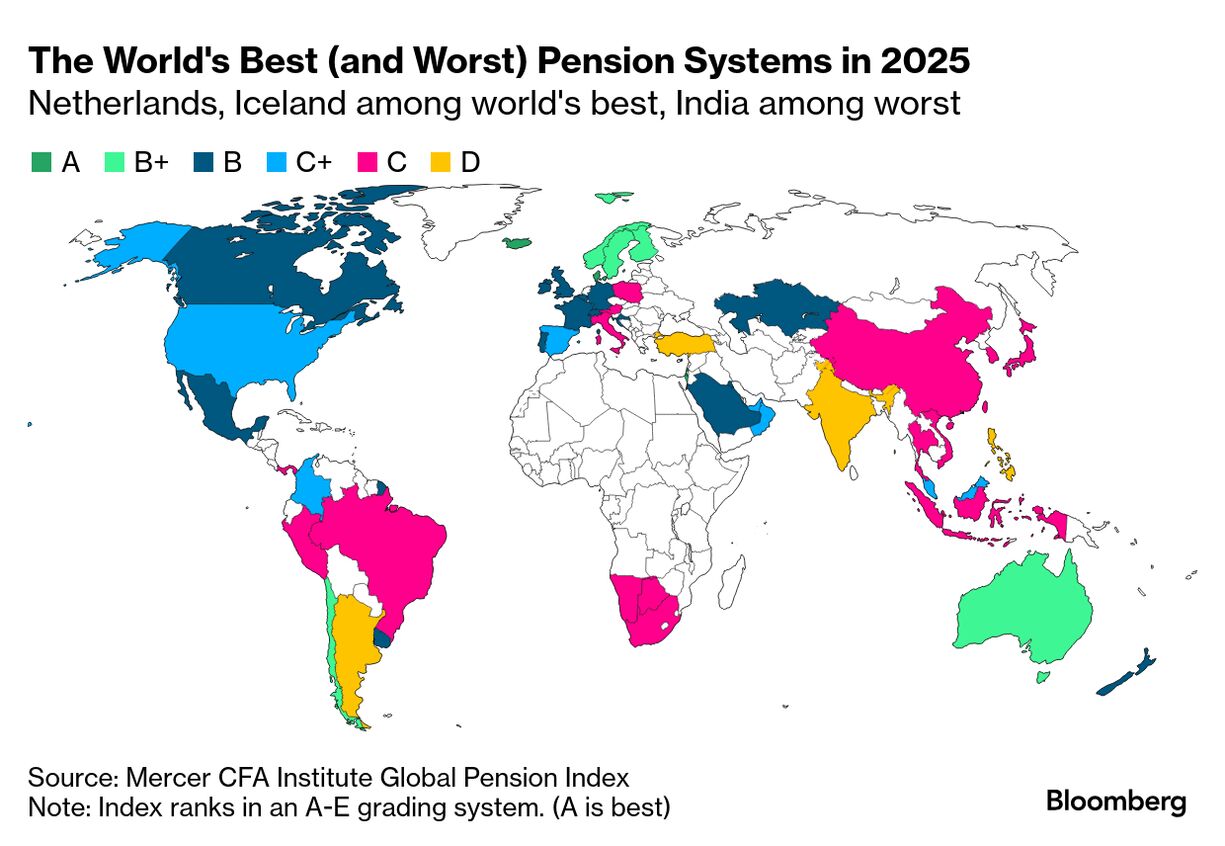

What’s happening nowIt’s an RBA bonanza: Governor Michele Bullock has just been speaking in Washington - read her latest comments on rate decisions here. Meanwhile, Assistant Governor Christopher Kent said this morning that he sees financial conditions easing, after his colleague Sarah Hunter yesterday said inflation in the third quarter is likely to be stronger than the central bank had anticipated. Australia slipped one notch in an annual global pension index to seventh position below Sweden, while the Netherlands held on to the No. 1 spot. Singapore fared better, breaking into the top tier of the ranking for the first time.  In a Bloomberg Australia Podcast special bonus episode, Wellington Bureau Chief Matthew Brockett interviews New Zealand Finance Minister Nicola Willis live on stage in Auckland. Now in its fifth year, the annual Bloomberg Address has become a cornerstone of New Zealand’s policy calendar.  Another warning on our ballooning private credit investments: increased regulatory scrutiny of Australia’s A$200-billion sector is needed to help protect retail and less sophisticated investors, says real estate private credit lender Qualitas Ltd.’s Andrew Schwartz. What happened overnightHere’s what my colleague, market strategist Mike “Willo” Wilson says happened while we were sleeping… Rising US stocks pushed yields higher as solid earnings reports combined with the US softening its posture toward China to improve market sentiment. That said, gold touched a fresh peak as buyers still sought haven from inflation and political risks. This was the opposite to the dollar which eased despite rising Treasury yields. The Aussie and kiwi edged higher in a quiet overnight session. Today sees Australia’s jobs report for September, while New Zealand has some bonds to sell. ASX futures show a pretty flat start for local equities. US Treasury Secretary Scott Bessent proposed a longer pause on high US tariffs on Chinese goods in return for Beijing putting off its recently announced plan to tighten limits on critical rare earths. It comes as finance chiefs from the Group of Seven industrial nations will consider a joint response to discourage China’s planned move to control the global supply of rare earths. Apple Inc. Chief Executive Officer Tim Cook pledged to boost investment in China during a visit to the world’s second largest economy, despite threats from US President Donald Trump to slap tariffs on its foreign-made products. Apple still makes the bulk of iPhones in China, but has been diversifying its supply chain away from China over the past few years. The US Securities and Exchange Commission chairman, Paul Atkins, has announced a proposal to scrap quarterly earnings and require public companies to disclose financials only twice a year. Businesses, as you might imagine, are thrilled, after having decried the regulatory requirement as onerous, expensive and something that hangs over every decision they make. What to watch• Australia jobs data for September released at 11.30 a.m. One more thing...If you want an emblem of a bankrupt energy policy, it’s hard to improve on the sight of Shell stations running out of fuel in the very place that turned the company into an oil giant, writes Bloomberg columnist David Fickling. That’s what’s happening in Indonesia, where roughly 200 Shell retailers have sold out of gasoline amid disruptions prompted by PT Pertamina’s control of dwindling domestic supplies, and an anti-corruption probe of the state-owned giant.  Photographer: Dimas Ardian/Bloomberg Follow us You received this message because you are subscribed to Bloomberg’s Australia Briefing newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|