| China’s leaders are famous for taking the long-term view. This can be overstated. When Mao’s deputy Zhou Enlai famously said in 1972 that it was “too soon to tell” about the effects of the French Revolution, it turns out that he was answering a question about the student protests that had happened four years before, not the far greater insurrection of 1789. So points out former colleague Richard McGregor. But the point still stands. Another former colleague, Ed Crooks of Wood McKenzie, draws attention to this comment from Deng Xiaoping in 1992: The Middle East has its oil, China has rare earths… it is of extremely important strategic significance.

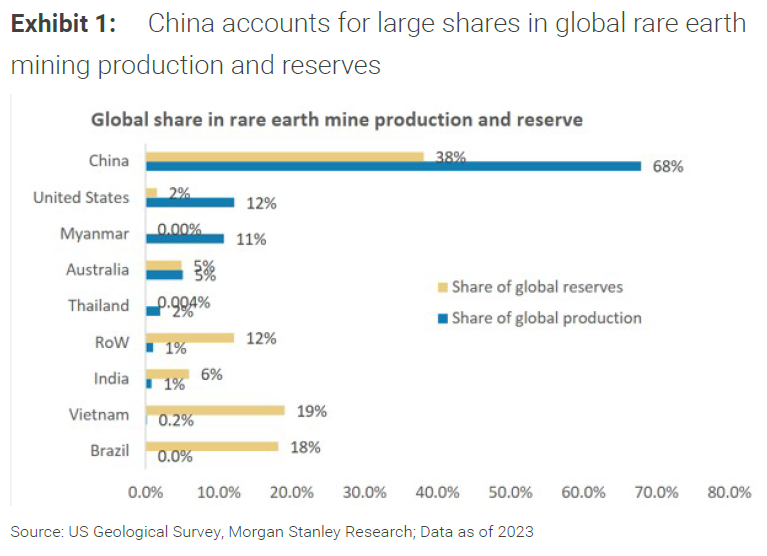

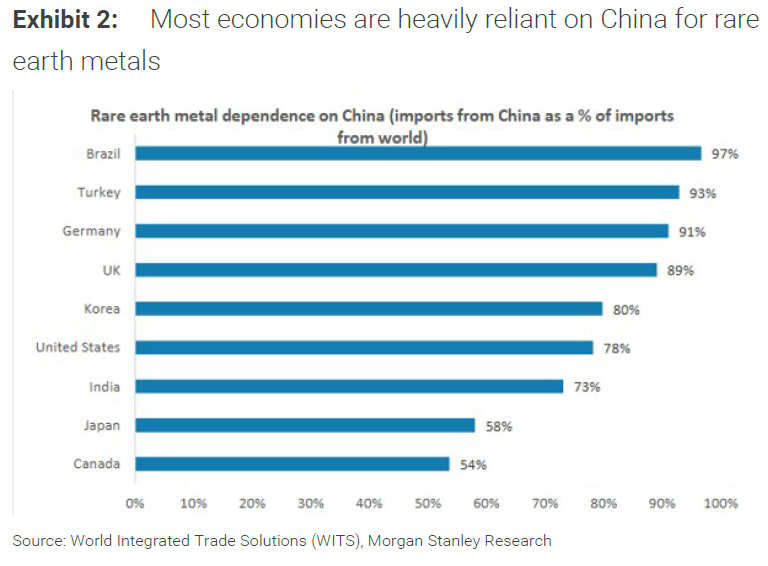

On a 33-year view, he is being proven correct. The extent of that significance is now being tested as never before as the US-China trade conflict reaches a new phase. It’s tasteless and in many ways trivializing to analyze the trade struggle as a game. Livelihoods are at stake, if not the balance of global power. But it’s still handy to look at it in terms of the cards that the two sides have to play. For the US, bonds currently offer a strong card (they didn’t six months ago); but its key point of strategic weakness might be Bitcoin. Rare earths, vital to many growing technologies, are probably China’s strongest card. But they have others, which they’re also playing — such as soybeans. And there is concern that they’re bluffing, using those cards to hide significant weaknesses emerging in their growth model. The legacy of Deng’s long-term thinking is shown in these two charts from Morgan Stanley. First, China has a huge share of the world’s reserves of rare earths, and an even more dominant position in production:  Source: Morgan Stanley That’s left the world’s biggest economies dangerously over-dependent on China for rare earths, which remain vital for products from batteries, through our smartphones to wind turbines:  Source: Morgan Stanley This begins to look like a strategic mistake to rank with Germany’s decision to rely on energy supplied by Russia. Meanwhile, the financial establishment had persuaded itself that this wouldn’t matter much. Bank of America’s latest monthly survey of global fund managers, conducted just before the latest spat broke out, found that concern about a trade war as a tail risk had almost evaporated. That’s what allowed this news to have such a big impact — it hit markets when they were off their guard: So China’s moves to tighten curbs on rare earths last week, and then early Tuesday to add controls over companies involved in shipping them, punctuated with President Donald Trump’s menacing higher tariffs, came as an ugly surprise. Is this a reminder from China of strength, or a desperate attempt to play its best card when its position is weakening? There is support for both interpretations. Robin Brooks of the Brookings Institution argues that China is dealing from weakness. It’s managed to replace exports lost to the US by increasing the products it sells to everyone else, but can only have done this by price-cutting, or “dumping.” He said: Margins are getting hit, which means there’s a big negative shock lurking beneath the surface of these data... China is an export-dependent economy that’s on borrowed time. It’s hardball tactics on rare earths stems from weakness, not strength.

These export tactics risk a coordinated response from China’s trading partners. Speaking in Washington, former EU Trade Commissioner Cecilia Malmstrom warned that anti-dumping measures against China would increase further, “as China is trying to dump its goods on markets and diversify.” An alternative take comes from Peter Tchir of Academy Securities, who notes that this episode of the trade war, unlike its predecessors under Trump, was initiated by Beijing. He argues that China believes that its rare-earths dominance will never be greater, and that it might be well served by reducing its own dependence on US chips (arguably the single greatest US point of leverage, which Trump has threatened to deploy): China’s bargaining chip is declining in value and they think they can actually benefit from restricted access to chips. That would support an argument that China has analyzed the situation and is prepared for a full-on trade war.

This argument is possibly strengthened if China believes, as Brooks contends, that its position is weak. Developments over the last few days, with the US making threats, backpedalling somewhat, and then watching as China ups the ante by restricting shipping, tends to support this interpretation. In any event, looking for assets that can withstand a long trade war, such as those that benefit from boosting economic and military security, looks like a good idea. If there is any asset that’s shown the impact of this trade conflagration, it’s Bitcoin. The links between cryptocurrency and the trade in rare earths may not be obvious, but the news on trade has had an obvious impact. It took a pounding on the escalation, and staged a noticeable recovery as the Trump administration tried to cool things down: While Bitcoin is regarded as some form of digital gold, a hedge against monetary debasement, its behavior during times of trade stress is totally different. During this year’s two biggest flare-ups over rare earths, in April and again in the last few days, gold has held steady or even rallied, while Bitcoin has tumbled: This might be the new American Achilles’ heel. During Trump 1.0, there was a sense of a Trump Put — the administration had minimal tolerance for any significant fall in the S&P 500. Viktor Shvets, macro strategist at Macquarie, suggests that the “old rules of S&P 500 volatility now apply to digital assets.” The interlinkages between the different assets that are now most important both to the US economy and the current administration have, he believes, created a point of critical weakness. Whether via vendor or supplier finance or by direct investment, he suggests that the fates of AI groups like OpenAI and Anthropic, the huge tech platforms like Microsoft, Alphabet, Nvidia and Oracle, and crypto concerns like Tether and Coinbase are closely intertwined. His concern is of “collapsing values cascading through cross-shareholdings, aggravated by an increasing reliance on leverage and laissez-faire regulations.” All stand to be hurt by an embargo on rare earths, particularly if amplified by a fall in crypto prices. Deng and Zhou have already had their say in this newsletter, but Shvets provocatively cites two more communist revolutionaries to make his point: Marx and Lenin had closed but brilliant minds, and for both, intertwined

oligarchic relations between governments and businesses were precursors of a social collapse. For two centuries, capitalism confounded them by self-correcting (e.g. antitrust) but, occasionally, alienation came close to Marxist theory. We are now in such a world, with profits privatized while losses are socialized (justified by macro impacts), further polarizing societies (i.e. 0.1% and peasants).

Even those of us with no sympathy for communism’s godfathers should concede that Shvets has a point. He suggests that investors should watch the values of OpenAI, Nvidia, Bitcoin and World Liberty Financial, “as these will have far greater impact than almost anything China does.” Far from Bitcoin, another key source of Chinese leverage is soybeans. A critical crop for farmers across the American Midwest, China has relied on them for animal feed as it has enjoyed the last few decades of great growth. But soybean prices are in the doldrums, and trailing other agricultural commodities: This is a serious problem for US farmers and for politicians who want to win the battleground states where soybeans are grown. Chinese imports have dropped of late (as trade is highly seasonal, the chart shows 52-week moving averages for clarity): If this isn’t the result of a direct decision to swap its prime supplier from the US to Brazil (these days China’s fellow BRIC), it certainly looks like it: Trump helped the stock market fall into Tuesday’s close by posting this on Truth Social: I believe that China purposefully not buying our Soybeans, and causing difficulty for our Soybean Farmers, is an Economically Hostile Act. We are considering terminating business with China having to do with Cooking Oil, and other elements of Trade, as retribution.

This has followed increasing coverage of the plight of soybean farmers in the American press. Louis-Vincent Gave of Gavekal Research sees a possible attempt to set a “low bar” for the Trump-Xi meeting later this month. “When it comes to delivering concrete ‘wins,’ is there anything easier for Xi to give to Trump than the promise of more soybean purchases?” Gave suggested that a large soybean order would allow Trump to declare victory in the trade war. And meanwhile, China could maintain other sources of leverage. |