| Bloomberg Evening Briefing Americas |

| |

| The International Monetary Fund is warning that the global economy is showing signs of strain, and the main reason for it is US policy. Specifically the sweeping tariffs and protectionism emanating from Donald Trump’s global trade war. But there’s a silver lining, apparently. As bad as things are, they’re not as bad as expected—at least not yet, the IMF said. The global economy is expected to grow by 3.2% this year, up from 3% predicted in July. The upgraded forecast is largely due to a burst in activity as companies and households rushed to get goods in anticipation of high tariffs, as well as a weaker dollar that juiced trade. “It’s not as bad as we feared,” IMF Chief Economist Pierre-Olivier Gourinchas said. “But it’s worse than we anticipated a year ago and worse than we need.” It’s next year when a turn for the worse may arrive. Growth is seen edging down to 3.1% in 2026 as the IMF notes increasing signs that the impact of high levies is starting to be felt. This includes in the US, where both inflation and unemployment are rising. Inflation is above central bank targets in other countries as well, and the outlook for prices remain uncertain, all of which complicates the job of monetary policymakers. And finally, there is the ongoing borrowing binge. Governments will need to find ways to cut spending, particularly in Europe, given the additional costs linked to aging populations, increased defense spending and energy security. “The calculus of post-pandemic debt sustainability is complicated by elevated debt ratios, worsening primary balances, higher interest rates and a weakening growth outlook,” the IMF said. But at least there’s that silver lining. —Jordan Parker Erb and David E. Rovella | |

What You Need to Know Today | |

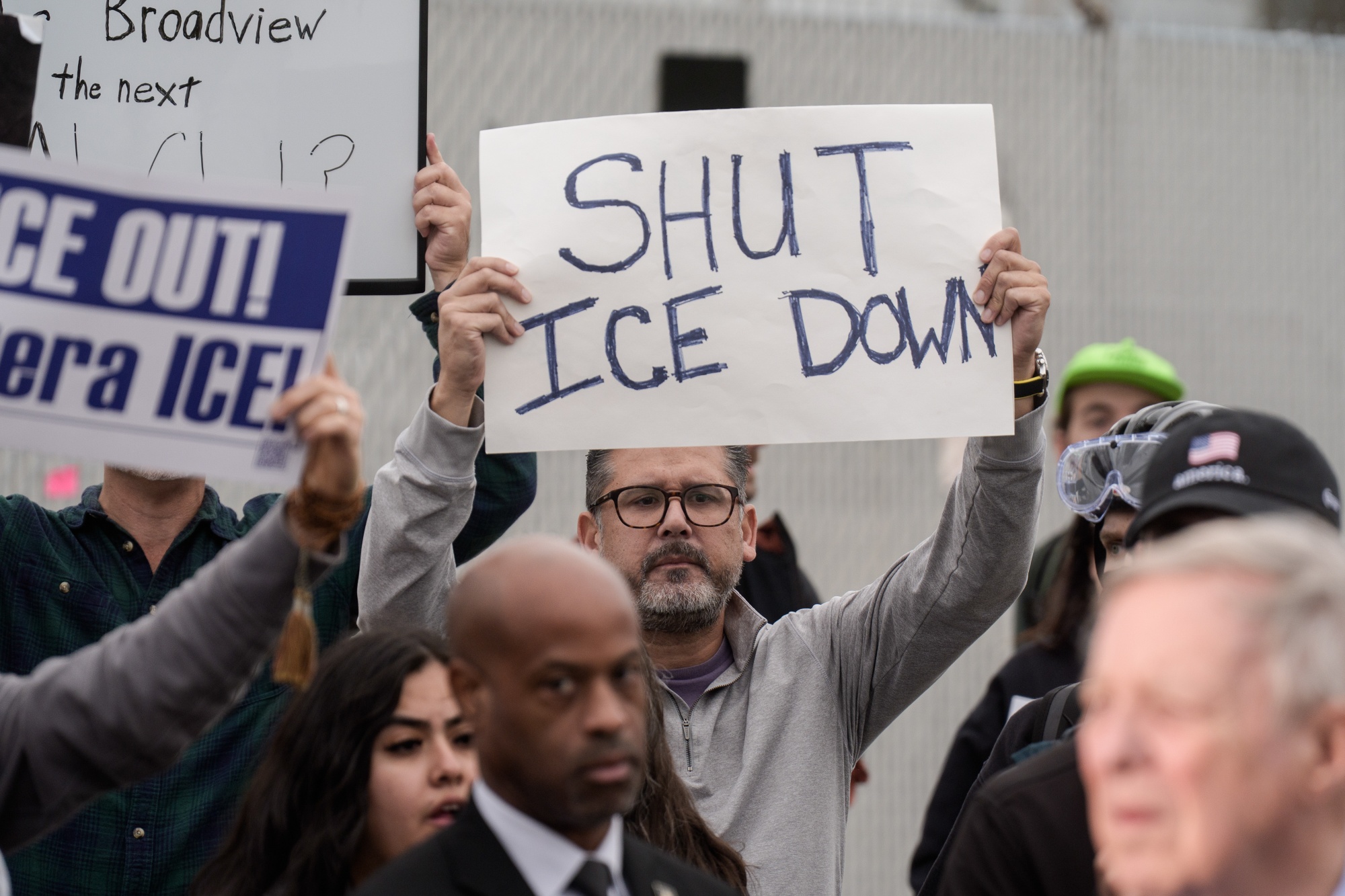

| Heavily armed members of the US Border Patrol and other paramilitary forces tied to federal agencies are increasingly applying military tactics against America’s citizens. Sent by Trump to Democratic-run cities ostensibly to facilitate his nationwide immigration dragnet, they are moving through city streets in facemasks and body armor while carrying automatic weapons in densely populated neighborhoods. All the while, migrant crossings at the Mexico border are at their lowest level in five decades. Democratic opponents and even local police officials have accused the administration of instigation—showily militarizing US cities to foment violence and in turn justify a broader crackdown. The once-unthinkable flood of federal forces onto otherwise peaceful city streets has already inflamed volatile situations, as protesters often crowd around federal agents detaining people. Trump administration agents have shot dead one man in the Chicago area while shooting and injuring a woman. In both cases, the government claimed justification but has yet to make public evidence in the face of videos raising doubts in both cases.  Demonstrators hold signs outside an Immigration and Customs Enforcement processing facility in Broadview, Illinois, on Oct. 10. Immigration raids and street protests have escalated around Chicago and its suburbs. Photographer: Adam Gray/Bloomberg | |

|

| Federal Reserve Chair Jerome Powell signaled the central bank may stop shrinking its balance sheet in the coming months. The Fed chair also indicated US labor-market prospects continue to worsen, a message that supports investors’ expectations for another interest-rate cut this month. Fed officials have been winding down the central bank’s balance sheet since 2022—a process known as quantitative tightening—reversing trillions of dollars of asset purchases designed to stimulate the economy after the pandemic struck. Earlier this year, the Fed slowed the pace by reducing the amount of bond holdings it lets roll off every month. Here’s your markets wrap. | |

|

| JPMorgan Chief Executive Officer Jamie Dimon is sounding warnings on the potential for a deterioration in credit quality, a cautionary note that put a damper on the firm’s surge in trading and investment-banking revenue. The US economy remains resilient but there are “signs of a softening, particularly in job growth,” Dimon said Tuesday as the bank reported third-quarter results. The Wall Street giant added $810 million to its reserves for potentially soured loans, citing loan growth and updates to macroeconomic variables, with most of the addition tied to card services. JPMorgan beat analysts’ estimates for trading and investment-banking fees, driven by a pickup in dealmaking and underwriting, with market revenue climbing 25% and investment-banking fees rising 16%.  Jamie Dimon Photographer: Jose Sarmento Matos/Bloomberg | |

| |

|

| Goldman Sachs meanwhile told employees that some of them will soon be fired. The firm said it is planning a “limited reduction in roles across the firm,” according to a memo to staff Tuesday morning seen by Bloomberg News. The announcement of a new round of terminations comes as the bank posted record third-quarter revenue, boosted by a rapid pace of growth in its investment bank that eclipsed Wall Street rivals. The firm reported $2.66 billion in investment banking fees, a 42% surge on the same period last year. That pace beat rivals and helped the company as a whole report revenue of $15.18 billion, its largest haul for that quarter in its history and its third highest overall for all quarters. | |

|

| The European Union might just force Chinese firms to hand over technology to European companies if they want to operate locally, an aggressive new push to make the bloc’s industry more competitive. The measures would apply to companies seeking access to key digital and manufacturing markets like cars and batteries. The rules would also require the firms to use a set amount of EU goods or labor, and to add value to the products on EU soil. | |

| |

| |

|

| Army officers in Madagascar took control of the country after lawmakers impeached President Andry Rajoelina, who went into hiding when soldiers joined anti-government protests demanding his resignation. The impeachment vote on Tuesday defied a declaration by Rajoelina hours earlier dissolving parliament, and came after he fled to an undisclosed location, becoming the latest ruler to be imperiled by young protesters demanding change. Demonstrations erupted in Madagascar last month over water and power shortages, sending thousands of people into the streets and leading to clashes with security forces in which at least 22 people died. | |

|

| |

What You’ll Need to Know Tomorrow | |

| |