| This is Bloomberg Opinion Today, the mover of mountains of Bloomberg Opinion’s opinions. On Sundays, we look at the major themes of the week past and how they will define the week ahead. Sign up for the daily newsletter here. Is the Nobel Peace Prize political? Hah — of course it is! “Peace” is just about as political a term as you can come up (well, yeah, after “politics,” but you know what I mean). And the Norwegian Nobel Committee has turned out some doozies over the years. A few have been largely forgotten, thank goodness, including US Secretary of War Elihu Root in 1912 for “organizing affairs in Cuba and the Philippines after the Spanish-American War,” which in large part was brutal repression of independence movements in America’s non-imperial Empire. Then there was Aristide Briand, the 11-time prime minister of France, [1] a co-winner in 1926 and mastermind of the Locarno Treaties, which trail only the Munich Agreement of 1938 in the annals of diplomatic idiocy that led to World War II. Then consider this rogues’ gallery of abusers, abettors, enablers and thieves: UN Secretary-General and “oil-for-palaces” mastermind Kofi Annan; Palestine Liberation Organization leader and secret billionaire Yasser Arafat; Amnesty International Ambassador of Conscience Award revokee Aung San Suu Kyi of Myanmar; accused ethnic cleanser Abiy Ahmed Ali of Ethiopia. And let’s not even get started on Henry Kissinger — I leave that fight to Niall Ferguson. Perhaps worst of all was the the committee’s failure to find “any living human” worthy of the honor in 1948, leading to a pretty definite conclusion that Mahatma Gandhi was the intended recipient but the panel stuck to some silly rule barring posthumous honors. Whatever. Then there was Barack Obama in 2009: He might have been a fine president, but plenty of critics believed that he received a prize simply because his name was not George W. Bush. Hard to get more political than that. Which brings us to Friday, when some members of Team Trump had a meltdown: Politics over peace? That’s practically a Nobel tradition. Tell me honestly: Did you or anyone you know or even White House Communications Director Steven Cheung truly believe that President Donald Trump was going to win this prize? Of course not. All the buildup from the MAGA crowd — what Andreas Kluth calls “a brazen and global lobbying effort, enlisting allies and supplicants at home and abroad to nominate and second him” — was intended to do one thing: Give Trump supporters yet another reason to rally against globalists or bank cabals or sharks or whatever. Thing is, this year the committee played politics pretty well. “The well-deserved Nobel Peace Prize awarded to Venezuelan opposition leader María Corina Machado carries both a powerful moral message and a call for action,” writes Juan Pablo Spinetto. “But this award is more than a tribute ... Machado’s Nobel has the potential to shift the regional dynamic, opening the eyes of those who still refuse to see Venezuela’s tragedy for what it is: the biggest political disaster of our generation in the Western Hemisphere.” Machado played the politics pretty well, or perhaps cynically, herself — taking a call from the US president and praising his “decisive support for our cause.” Maybe Secretary of State Marco Rubio will figure out whether he’s for or against her. For Trump, there’s always next year, and Andreas has laid out a path for the president to secure the prize: “If you do manage to pacify Gaza, it’s because you finally applied real pressure not just to Hamas but also to Israel’s Benjamin Netanyahu. So try that approach with Vladimir Putin in Russia. Also, be nicer to your allies, because you’ll need them to deter Moscow, Beijing and Pyongyang, and deterrence is good for peace.” Machado is many things according to the Nobel committee: an extraordinary example of civilian courage, a unifying figure in a political opposition, a woman steadfast in her support for a peaceful transition to democracy. Less noted: She is the first Venezuelan citizen and resident to win any Nobel, nonetheless the peace prize. [2] Indeed, it was a fitting end to a week full of firsts. And since Machado will receive a medal of a certain metal, let’s start there. “Gold has never been more expensive, and for the first time costs more than $4,000 per ounce,” John Authers writes. He also points out that the US stock market reached a new peak as well, which seems a bit contradictory: “The rally in gold — which gains when people are pessimistic — casts a different light on stocks, the choice of optimists.”  Getting more valuable by the minute. Photographer: Jonathan Nackstrand/AFP/Getty Images Allison Schrager’s explanation brings some sociology into the mix. “The jaw-dropping spike in gold prices is a reminder of what primal creatures we humans are — especially the species among us known as active traders. But the surge should also remind us of the importance of calling on the more evolved parts of our brain,” she writes. “Its price tends to go up when the world looks uncertain — it is supposedly a (redundancy alert) ‘safe haven’ — as an alternative to the dollar. But why does gold have this status? A dollar can buy things. The stock market offers ownership in profitable companies. A bond promises a stream of payments. What does gold offer?”  Among the skeptics is Ken Griffin, the hedge-fund honcho of Citadel. “Griffin is taking aim at gold, saying it’s sending a cautionary message,” Jonathan Levin informs us. “The shiny haven metal has appreciated by about 121% since the end of 2022 ... historically, the type of market development you might associate with inflation risks, extreme geopolitical uncertainty or even a financial crisis. Call it a ‘yellow flag’ at this stage.” Meanwhile, Ferrari is taking the checkered flag: For the first time, the sportscar maker has zoomed to the top of the European market, despite selling fewer than 14,000 vehicles a year. (And, yep, you can get one in gold.) “This reflects the ability of its ultra-wealthy clients to pay high prices, as well as how Ferrari isn’t as exposed to the very competitive Chinese market, which accounts for less than 10% of its sales,” writes Chris Bryant. “With the stock priced at more than 40 times this year’s anticipated earnings, similar to luxury goods company Hermes International SCA, Ferrari can’t afford any missteps. Ultimately, the surest way to protect residual values is to sell vehicles that buyers covet, and produce and price them at levels the second-hand market will bear. Ferrari has work to do.” Finally, there is the most important but most tenuous first of the week: A “signed off” cease-fire between Israel and Hamas that Trump calls “HISTORIC and UNPRECEDENTED.” Marc Champion isn’t convinced this deal will break new ground. “Will we now see Gaza’s reconstruction under an Arab-led international force as both Hamas and the Israeli Defense Forces disappear into the night? Not even close,” writes Marc. “The fact that statements announcing the deal said nothing about the disarmament of Hamas or full withdrawal of the IDF does not inspire confidence.” Nonetheless, Marc gives credit to the man in the White House: “Without Trump applying intense pressure on Benjamin Netanyahu, Israel’s prime minister would not have agreed to any stage of a plan that in essence reverses the US administration’s previous acquiescence in Gaza’s occupation and de facto ethnic cleansing. Nor would Netanyahu have apologized to Qatar for bombing it, without which Doha and Ankara wouldn’t have helped make the deal possible.” Well done, Mr. President, but is it enough to win Nobel gold in 2026? Bonus For the First Time in Forever [3] Reading: - Sports Bets at the Stock Exchange — Matt Levine

- A Chart Climate Denialists Can’t Ignore — Mark Gongloff

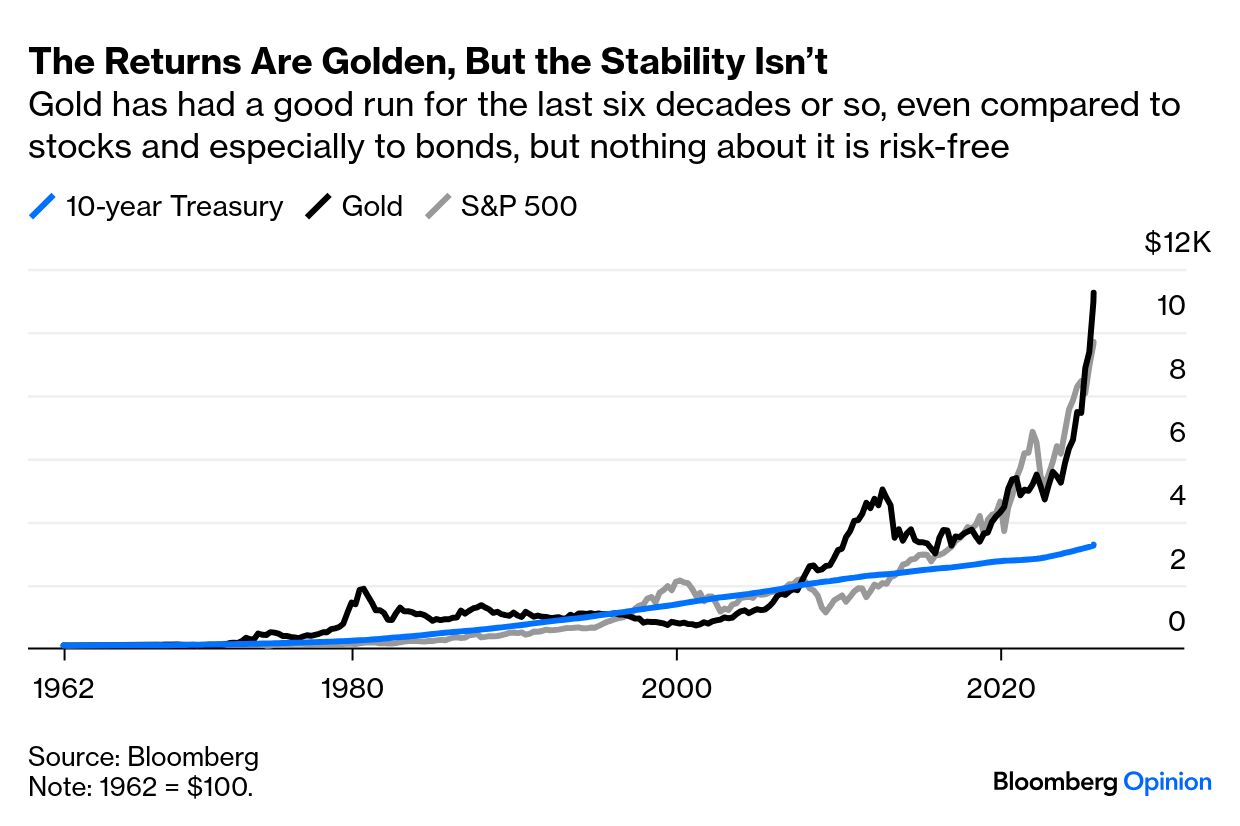

- Tether Might Be Your Plumber’s Preferred Payment Soon — Paul J. Davies

What’s the World Got in Store ? - Milei White House visit, Oct 14: The US Gives Argentina’s Milei Dollars and Hopes for Votes — Juan Pablo Spinetto

- ASML earnings, Oct. 15: Smart AI Investing Isn’t About Chasing the Big One — Shuli Ren

- Christine Lagarde at IMF-World Bank meetings, Oct. 16: Europe May Need to Fight a Currency War to Weaken the Euro — Lionel Laurent

Then there is a first-ever that is just around the corner: “Private domestic investment in information processing equipment (split here between computers and peripheral equipment and the rest) and software was 4.4% of GDP in the second quarter, just below its 4.6% peak in the final quarter of 2000,” Justin Fox writes. “If the pace of increase over the past two quarters were to continue, it would leap past that by the end of this year.” Bill Dudley is cautious: “In the longer term, the impact of AI will be transformational. … This doesn’t, however, mean that investors will come out as winners in the long run. Providers of AI services must at some point generate very large revenues to achieve a sufficient return on their substantial investments.” I’m cautious too: I’m old enough to remember — and to have had a brokerage account — in 2000. Take your pick: You can blame absurdly high valuations, easy money, laughable business plans, unquenchable “burn rates” and so forth. I blame the first-ever sock puppet to have a Super Bowl commercial.  The Pets.com mascot lost his doghouse in November 2000. Photographer: Chris Hondros/Hulton Archive via Getty Images Note: Please send Goldschläger and feedback to Tobin Harshaw at tharshaw@bloomberg.net |