| | In today’s edition: Saudi prioritizes Riyadh Air, KKR’s Gulf views, and Semafor columnist Lara Setra͏ ͏ ͏ ͏ ͏ ͏ |

| |   Riyadh Riyadh |   Stockholm Stockholm |   Washington, DC Washington, DC |

| Gulf |  |

| |

|

- US AI chip exports to UAE

- KKR sees Gulf opportunities

- Riyadh Air takes flight

- ADNOC boosts dividends

- Relentless Dubai real estate

- Naturalized Saudis shine

- The UAE’s longevity quest

What TikTok’s new investors are getting, and other weekend reads. |

|

UAE’s chips, with big catch |

US President Donald Trump during his visit to the UAE in May. Brian Snyder/Reuters. US President Donald Trump during his visit to the UAE in May. Brian Snyder/Reuters.G42 said it has the protocols in place to safely house — and own — the world’s most advanced semiconductors despite reportedly being left out of the Trump administration’s deal to export Nvidia chips to the UAE, a spokesperson told Semafor. The AI conglomerate is relying on “gold-standard” security measures to prevent semiconductors from being diverted to China, the person said, as further export licenses for cutting-edge Nvidia chips remain in limbo. The US green-lit chip exports to the UAE, but only for American companies such as Oracle in deals worth billions of dollars, Bloomberg previously reported. With Biden-era export rules that allowed chip exports to G42 scrapped by US President Donald Trump, the UAE has had to intensify its negotiating efforts to reassure China hawks in Washington. But it has little room to maneuver because its existing protocols already meet industry standards, leaving it few options to trumpet potential upgrades to its security. — Kelsey Warner |

|

KKR finds discounts in the Gulf |

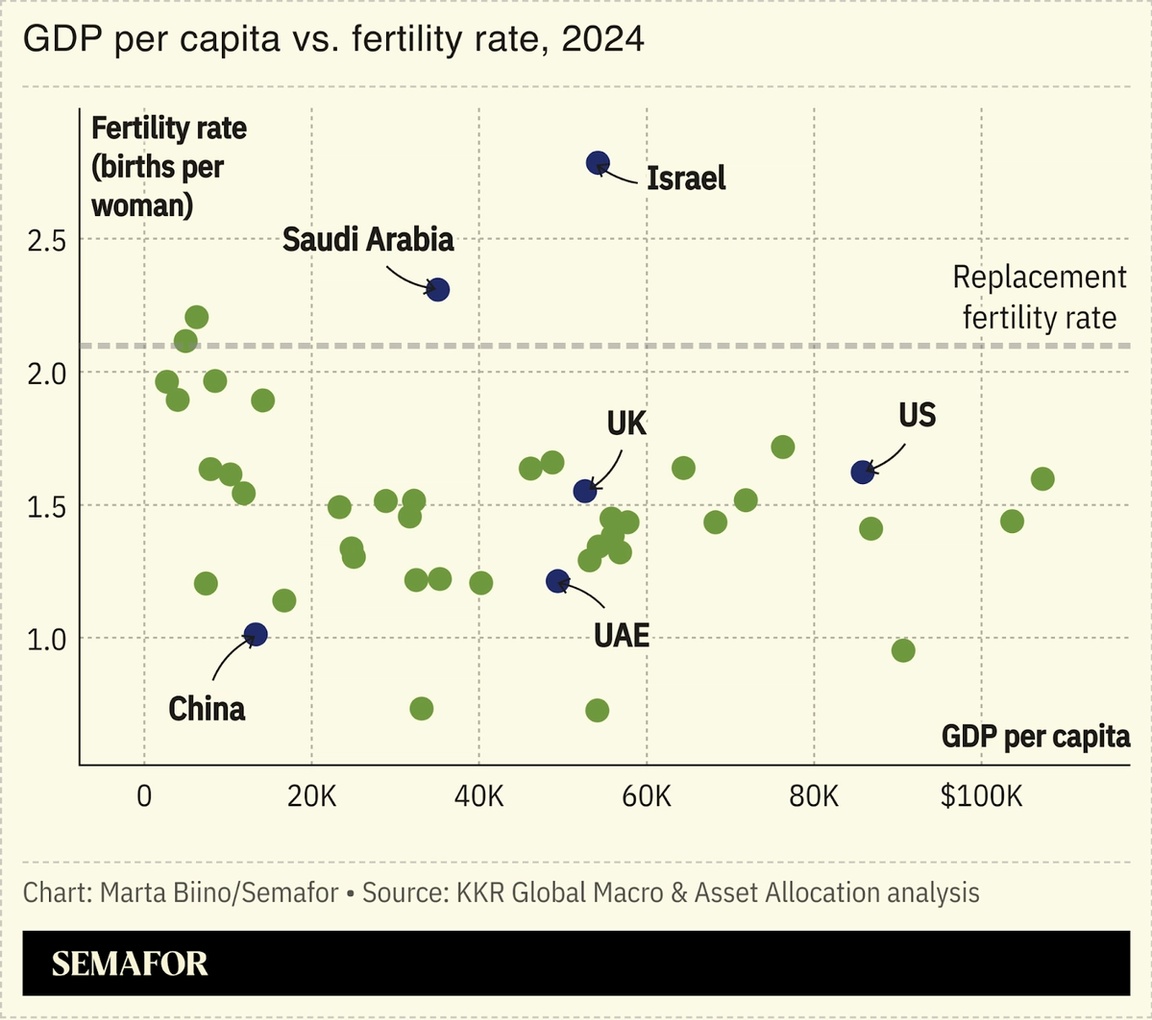

Gulf countries are on the cusp of reaping rewards from decades of investment and regulatory overhauls and may soon challenge global financial hubs. That assessment comes from Henry H. McVey, head of global macro and asset allocation at investment giant KKR, who told Semafor he sees the region as “moving from being an area where people came just to raise capital to one where it’s becoming a hub of investment.” McVey noted that Saudi Arabia shares a curious trait with Israel: Both countries have growing, relatively wealthy populations, which is an important baseline for future growth. But to compete on a global scale, Gulf countries will need to deploy capital more efficiently, and their companies and workforce will have to boost productivity. Organizations that focus on retraining and continuously “upskilling” employees are key to helping developing markets take off. “The crown jewel of any emerging market,” McVey said, “is when you can combine labor-force growth with productivity.” — Mohammed Sergie |

|

Saudi prioritizes new airline’s budget |

Riyadh Air CEO Tony Douglas. Fayez Nureldine/AFP via Getty. Riyadh Air CEO Tony Douglas. Fayez Nureldine/AFP via Getty.Riyadh Air, the new national airline backed by Saudi Arabia’s sovereign wealth fund, has not seen any impact on its business plans from a government review of spending commitments, its chief executive told Semafor. The launch of Riyadh Air is “beyond super important,” CEO Tony Douglas told Semafor. The airline, which has announced it will start its maiden route with flights to London on Oct. 26, is exploring financing options for the 182 aircraft it has on order. The carrier is crucial for Saudi Arabia’s wider strategy to become a travel and logistics hub, as part of Crown Prince Mohammed bin Salman’s plan to diversify the economy away from oil. Making Riyadh Air a profitable endeavour will be a challenge, not least because of competition from well-entrenched rivals next door that also benefit from deep-pocketed owners and already have vast infrastructure in place. Yet it will also be impossible to achieve the crown prince’s greater ambitions without a world class airline to support them. That should give Douglas plenty of runway to get Riyadh Air going, even if government support won’t last forever. — Matthew Martin |

|

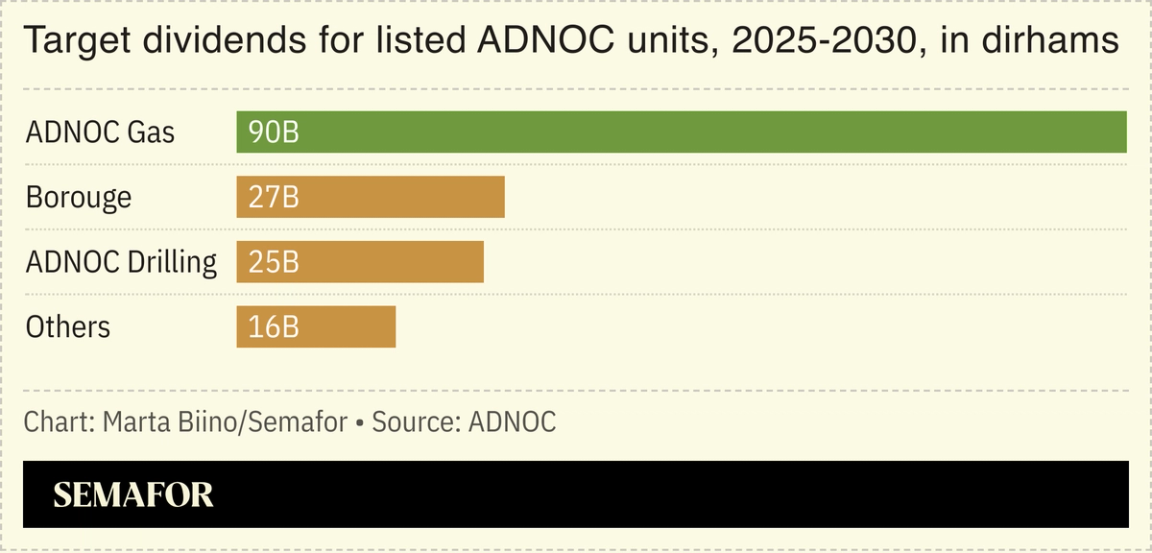

ADNOC dangles $43B dividend carrot |

ADNOC plans to distribute 158 billion dirhams ($43 billion) in dividends across its six publicly listed companies by 2030 — nearly double what’s been paid since its first units were listed in 2017. The announcement gives “investors and shareholders clear visibility of dividend distributions,” Sultan Ahmed Al Jaber, UAE Minister of Industry and Advanced Technology and ADNOC’s Group CEO, said at the company’s inaugural Investor Majlis in Abu Dhabi. (It was a hospitable affair, with Arabic coffee and finger sandwiches flowing.) The listed units — including ADNOC’s liquefied natural gas producer, petrol stations, petchems, drilling, and logistics firms — have a combined market capitalization of about $150 billion and already account for nearly 40% of dividends on the Abu Dhabi bourse. ADNOC said the payout represents a minimum target, as its companies aim to boost productivity through AI tools that have cut maintenance downtime and sped up exploration timelines. — Mohammed Sergie |

|

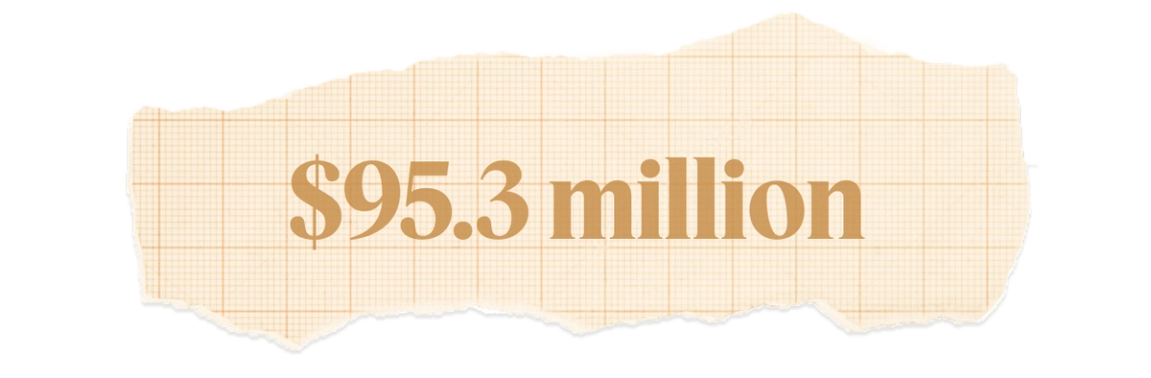

Record luxury home sales in Dubai |

The highest-priced home sale in Dubai in the third quarter, for a seven-bedroom mansion in the city’s La Mer district, according to real estate consultancy Knight Frank. The city recorded 17 deals valued at more than $25 million, as the luxury housing market notched another record quarter for homes sold above $10 million. Dubai has “cemented its status as a safe haven for international and local buyers,” Faisal Durrani, head of Middle East and North Africa research at Knight Frank, said in a statement. The wealthiest buyers from China, Hong Kong, India, Saudi Arabia, Singapore, and the UK have expressed interest in paying more than $80 million for a home in the city this year, highlighting a “clear gap in the market of uber-luxury housing.” |

|

A Saudi citizenship spree |

Danish Siddiqui/Reuters Danish Siddiqui/ReutersSaudi Arabia has trumpeted claims to more than one adopted son this week. Uber co-founder Travis Kalanick and CEO of Red Sea Global John Pagano were both granted Saudi citizenship as part of a years-long drive by the kingdom to attract top global talent. Kalanick has been backed by Public Investment Fund both for Uber and his latest venture, CloudKitchens, which is mulling an IPO in the Gulf. And Pagano, who has converted to Islam, has been at the helm of one of Saudi Arabia’s most successful forays into tourism since 2018. Meanwhile, Saudi Arabia, Jordan, America, Palestine — everyone wants a piece of Omar Yaghi. The chemist, born in Jordan to Palestinian parents, won the 2025 Nobel Prize in Chemistry this week, the first for Saudi Arabia, which granted him citizenship in 2021. |

|

View / UAE bets on longevity medicine |

Al Lucca/Semafor Al Lucca/SemaforUAE clinics — once known for cosmetic care — are now fusing AI, genomics, and precision medicine, making the country a global hub for longevity, Lara Setrakian, UAE-based journalist and media entrepreneur, writes in her debut Semafor column. “The UAE’s appeal is obvious: After years of investment and strategic planning, the country has built arguably the world’s most luxurious single-payer health care system,” Setrakian wrote. “Its promise, embedded in the national social contract, is that oil wealth should deliver the best medicine for its citizens — and a premium experience for anyone else willing to pay.” |

|

Exploring opportunities for mutual growth and global reach. Convening for a full day in New York City, the Dubai Business Forum USA will advance conversations that assess how the future of business and innovation will be shaped in a new era of global expansion. Amidst shifting economic landscapes and AI disruption, this highly curated gathering of CEOs, senior executives, and policymakers, featuring Semafor’s senior editors, will explore new ideas, create meaningful cross-border connections and examine the strategic opportunity Dubai provides for adaptive, forward-thinking companies. Request your delegate invitation here. The Dubai Business Forum USA, powered by Dubai Chambers, is produced in partnership with Semafor’s events and marketing teams. The program will also feature select editorial sessions, independently developed and led by Semafor’s newsroom. |

|

Debt- Saudi Arabia kicked off talks with banks to raise a $10 billion loan as it seeks to fill a budget deficit set to be $65 billion this year, more than double what the government had originally planned. — Bloomberg

|

|

|