|

||

| PRESENTED BY THE COALITION TO STRENGTHEN AMERICA’S HEALTHCARE | ||

| Axios Vitals | ||

| By Peter Sullivan, Maya Goldman and Tina Reed · Oct 01, 2025 | ||

|

Hang on for lots of news. Today's newsletter is 1,214 words or a 4.5-minute read. |

||

| 1 big thing: Pfizer deal blindsides other drugmakers | ||

| By Caitlin Owens and Peter Sullivan | ||

|

||

|

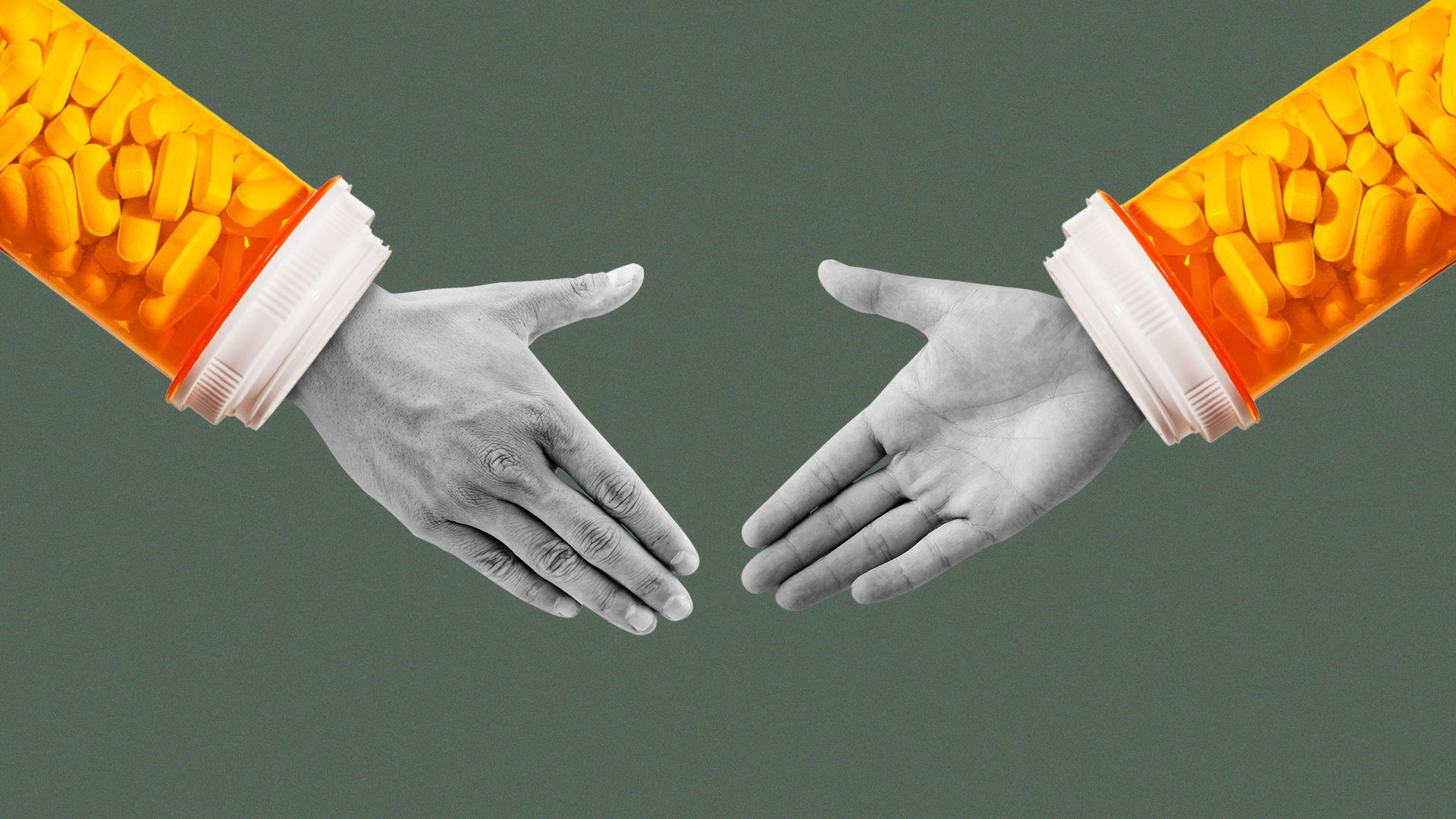

Illustration: Shoshana Gordon/Axios |

||

|

Pfizer's decision to announce a deal with the Trump administration on drug prices yesterday caused an uproar within much of the pharmaceutical industry, most of which was caught off guard by the announcement. Why it matters: Pfizer CEO Albert Bourla's acquiescence to President Trump's demands — broadcast live from the Oval Office as the two men stood side by side — puts much more pressure on other drug companies to fall in line after months of unified resistance to Trump's "most favored nation" pricing plan. Driving the news: Pharmaceutical lobbyists said the agreement was more far-reaching than they expected and would put pressure on other companies to reach similar terms on international pricing parity and other issues.

Between the lines: "The interesting element to me is how many companies sort of knew something was going on but refused to allow themselves to believe a deal would get cut," said one source familiar with the negotiations between drug companies and the administration.

The big picture: The drug industry still could stave off new pricing regulations if enough companies opt to cut deals with the White House.

|

||

|

|

||

| 2. Shutdown freezes some telehealth and home care | ||

| By Maya Goldman | ||

|

||

|

Illustration: Annelise Capossela/Axios |

||

|

The government shutdown left some seniors without access to telehealth, while others receiving hospital-level care at home are being discharged or sent back to inpatient units. The big picture: Congress only authorized Medicare to pay for expanded telehealth care and the Acute Care Hospital at Home initiative through yesterday — meaning additional legislation is required to restore the services.

Where it stands: All hospitals participating in the hospital-at-home initiative had to discharge patients or move them to physical hospitals yesterday after government funding lapsed without Congress renewing the program, per a recent notice from Medicare administrators.

Providers can still offer telehealth services to all Medicare enrollees — they just won't get paid for it. Congress could authorize back pay for claims made during the shutdown if it chooses to extend the programs.

|

||

|

|

||

| 3. ACA premiums to double without renewal | ||

| By Peter Sullivan | ||

|

||

|

Illustration: Sarah Grillo/Axios |

||

|

Premiums will more than double for millions of Affordable Care Act enrollees next year if Congress does not renew enhanced marketplace subsidies by year's end, according to a new analysis. Why it matters: The tax credits that help people afford premiums are at the center of the showdown over government funding, and the latest findings underscore the stakes if they are not renewed, as Democrats insist they must be. Driving the news: Average premiums would increase 114%, from $888 to $1,904 per year, the analysis from KFF finds.

The big picture: Congressional Democrats have made renewing the enhanced tax credits their key ask in the standoff over funding the government.

|

||

|

|

||

|

A MESSAGE FROM THE COALITION TO STRENGTHEN AMERICA’S HEALTHCARE |

||

| Care that doesn’t clock out — through thick and thin | ||

|

|

||

|

Tell Congress: Protect Access to 24/7 Care — because when the doors close, it is too late. More than 300 hospitals are now at risk of closure, threatening access to critical care. We’re here to heal, but we need your help to stay here. |

||

| 4. Trump orders $50M in AI-driven cancer research | ||

| By Tina Reed | ||

|

||

|

Illustration: Sarah Grillo/Axios |

||

|

President Trump signed an order yesterday directing his administration to invest $50 million in AI-driven pediatric cancer research. Why it matters: The move is part of a broader embrace of artificial intelligence across federal agencies but comes as the administration is slashing biomedical research spending and pausing grants. Driving the news: The order directs the presidentially appointed Make America Healthy Again Commission to work with the Office of Science and Technology Policy to harness data from a childhood cancer data initiative Trump established during his first term, OSTP director Michael Kratsios said.

Between the lines: A White House official said the effort builds on existing technology but declined to name any companies or specific software. |

||

|

|

||

| 5. Catch up quick | ||

|

⚕️ The Trump administration issued a final plan for how it will carry out the third round of the Medicare drug price negotiations, despite ongoing opposition from the drug industry. (Bloomberg Law) |