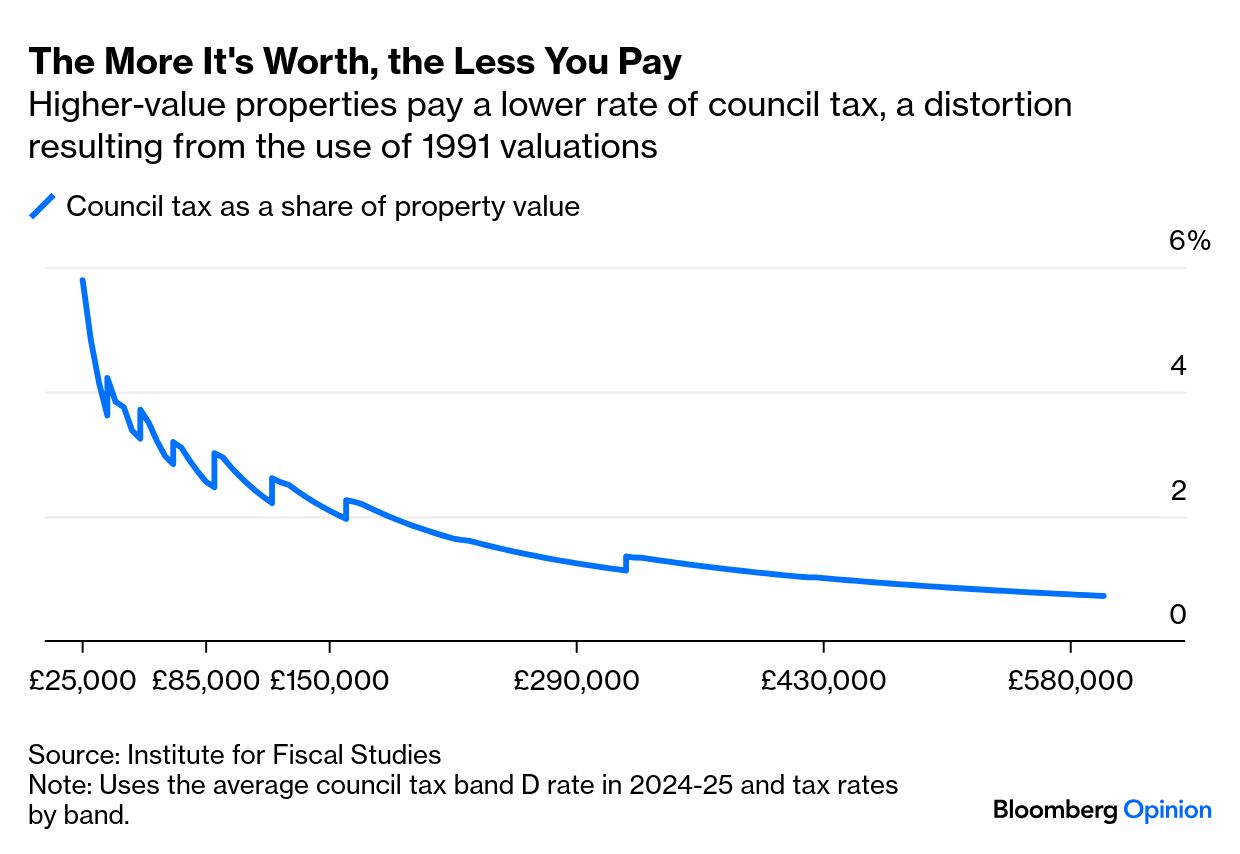

| This is Bloomberg Opinion Today, a crisis-crunching cavalcade of Bloomberg Opinion’s opinions. Sign up here. How Long Life May Rain on China’s Parade | Amid the military precision during Beijing’s celebration of the 80th anniversary of the end of World War II, a hot-mic moment revealed what unscripted authoritarian chit-chat is like. On the walk to the Tiananmen parade viewing platform, China’s President Xi Jinping quipped to Russia’s President Vladimir Putin and North Korea’s Supreme Leader Kim Jong Un that human beings might soon live up to 150 years. Putin responded that biotechnology might even allow humans to “achieve immortality.” Considering the trio are their countries’ likely bosses for life, advocates of democracy may not be amused. But the prospect of China’s citizenry being blessed with almost twice their current life expectancy could come with a macroeconomic curse. In her latest column, Shuli Ren says that China is already in a demographic crisis: its shrinking population hard-pressed to prop up a dramatically growing cohort of retirees and oldsters. Shuli notes: “In 1990, for every new retiree, China had about 3.6 workers entering the labor force. By 2045, that number will fall to 0.4 — there will be only 9 million job entrants starting to contribute to social security, but 21 million who begin to receive pension benefits.” Xi’s government has raised the retirement age and increased child subsidies to try to encourage families to reproduce. But those measures may not be enough to secure the safety net — especially if many eventually live way past 100. Despite being wary of volatility, Xi may be turning to China’s currently buoyant stock markets for help — and that may buoy the market even more.  Late last year, says Shuli, China came out with its version of the Individual Retirement Account to invest tax-free in the stock market. “But,” she asks, “will they bother to enroll if the stock market is perpetually in bear territory?” That’s where equities will have to play a role. Writes Shuli: “Investors are expecting a Xi put — a belief that the state will purchase Chinese stocks in the event of a rout.” Indeed, China’s big state-owned insurance companies and divisions of the country’s sovereign fund have recently become huge participants in the market — a clear sign of a central directive. Will 401(k)s be available in China soon? Long life is always a blessing. But, if Chinese workers are now retiring when they reach their 60s, can even the most upwardly-mobile of bull markets support them through next nine decades of retirement? A week ago, riots erupted in major cities of Indonesia, including the immense capital Jakarta, spurred by the sumptuous housing allowances legislators voted in for themselves. Those subsidies — 10 times Jakarta’s minimum wage — have since been repealed. Amid the disturbances, the country’s president, Prabowo Subianto, delayed his visit to China, missing the Shanghai Cooperation Organization summit, but getting to Beijing in time to join Xi Jinping as the People’s Liberation Army put on its big parade. Karishma Vaswani warns Prabowo’s fix may not be enough to end discontent. In 1998, the country threw out long-time dictator Suharto after putting up with decades of economic inequality. But, says Karishma, “many of the grievances reformists once raised about the Suharto-era — entrenched corruption, concentration of political power, and deep inequality — are prevalent today. Politicians and business tycoons from the previous era still have clout, through dynastic parties, family-owned businesses, and patronage networks.” Prabowo — a high-ranking military officer — may feel he still has free rein in the third most populous nation in Asia after India and China. Writes Daniel Moss: “The president’s allies have a tight grip on parliament, he has enlisted the troops in his social welfare agenda at the risk of blurring the line between civil and military functions, and pushed the central bank to embrace his go-for-growth strategy. A powerful new sovereign wealth fund, which reports directly to him, has stakes in several top state companies.” Daniel suggests Prabowo has more challenges in store and that “the defining moments of his presidency are probably still some way off.” He’d better take the temperature of the streets. “Britain’s property-based tax for funding local services is a travesty — unfair, arbitrary and regressive. Stamp duty, which is levied on real estate transactions, distorts the housing market and discourages people from moving... Council tax, as the local levy is known, is the more objectionable of the two. There is no conceivable justification for a system that imposes a higher burden on the inhabitants of a terraced house in Burnley, a deprived town in the northwest, than on a mansion in London’s Kensington and Chelsea, the UK’s richest borough.” — Matthew Brooker in “The UK's Property Taxes Are an Irrational Mess.”  “In almost every area of the energy transition, one country dominates: China. Wind power, where the People’s Republic still has less than half the global market, is a rare exception. President Donald Trump is doing his best to change that. … [H]e’s striking at a time when Chinese companies, which for many years have struggled to compete outside their home market, are finally on the brink of breaking through. By weakening the US and European wind industry at such a critical time, Trump may guarantee that developed economies lose their early lead in wind power as decisively as they did with solar energy, batteries and electric cars.” — David Fickling in “America’s Wind Crusade Hands an Industry to China.” How the US outsourced its Gaza policy. — Andreas Kluth The West is making it easy for China to look good. — Marc Champion Who can Bolsonaro blame? Himself. — Juan Pablo Spinetto Does Europe have an après le deluge plan? — Lionel Laurent The UK’s teflon home secretary. — Rosa Prince American lessons in corporate fundraising. — Chris Hughes Walk of the Town: Poetry Does Not Die | In my column this week about Peter Thiel’s obsession with the Antichrist, I mention the monstrously beautiful images William Blake created for an illustrated edition of the Book of Revelation. The poet-painter-engraver is one of my idols, and every time I get a chance to walk through Bunhill Cemetery here in London, I stop and sit by his grave.  The stone slab marks the poet’s grave. Photograph by Howard Chua-Eoan/Bloomberg Or at least the spot where he was buried. Bunhill — or “bone hill” — was the graveyard of close to 125,000 people for more than two centuries. Blake’s coffin was the fifth of eight to go into the same plot. At the time of his death in 1827, he was magisterially talented, if eccentric, but not well-known. And so, there was no celebrity-inspired reason to keep accurate records about him after his passing. A tombstone simply declared Blake and his wife, Catherine Sophia, were buried “nearby.” Fame would accumulate posthumously a generation later, with the help of admirers in the Victorian age. For a long time, the exact place where he was interred was a matter of surmise. But in the 21st Century, Blake aficionados Carol and Luis Garrido spent 14 years going through documents and maps to figure out where he’d been buried. And in August 2018, a new marker was unveiled in Bunhill.  Blake’s older tombstone. Photograph by Howard Chua-Eoan/Bloomberg The old tombstone still stands. It was poignant in its own way, pointing nebulously to an indefinite “nearby,” the poet being nowhere but everywhere, perhaps even right next to you. Patience is a virtue, but sometimes...  “What did you think I meant when I said ‘Bear with me.’” Illustration by Howard Chua-Eoan/Bloomberg Notes: Please send arctophile feedback and other bearish advice to Howard Chua-Eoan at hchuaeoan@bloomberg.net. Sign up here and find us on Bluesky, TikTok, Instagram, LinkedIn and Threads. |