| Welcome to Next Africa, a twice-weekly newsletter on where the continent stands now — and where it’s headed. Sign up here to have it delivered to your email. Over the six decades since diamonds were discovered in Botswana, the southern African nation has been a model of how an abundant natural resource can be used to benefit its people. Now, it’s become a cautionary tale of what can happen to an economy overly reliant on a single export. As the price of lab-grown gems plunged, demand for the natural stones — of which Botswana is the world’s biggest producer by value — has slumped.  WATCH: Matthew Hill reports on the crisis affecting Botswana’s economy on Bloomberg TV. In the sparsely populated desert country of 2.5 million people, medicine is running short and construction companies are firing workers. The economy is shrinking, foreign reserves are being drained and the government is taking on debt. Its status as one of the richest nations per capita on the African mainland is under threat, as is the continent’s best credit rating. The downturn is a poisoned chalice for President Duma Boko, who’s coalition in October ousted the party that had ruled since independence in 1966. While he’s hired Malaysian consultants to advise on diversifying the economy and is touting a nebulous $12 billion investment pledge from a little-known Qatari businessman, he’s likely to find there are no quick fixes.  A lab diamond (left) and a mined stone. Photographer: Elias Williams/Bloomberg Boko’s predecessors funded health and education, but face criticism that they didn’t focus enough on widening the sources of revenue. A copper revival is just getting underway after an earlier industry collapse, coal reserves went largely untapped and more could be done to lure tourist dollars to some of the world’s best wildlife parks. The catchphrase “A diamond is forever” was coined for De Beers, the diamond-mining monolith that helps run Botswana’s mines, in 1947. Boko is finding out, in 2025, that may not be true. — Matthew Hill and Mbongeni Mguni Key stories and opinion:

Lab-Grown Gems Are Robbing Botswana of Its Diamond Riches

Debswana Curbs Diamond Output to Save Cash During Downturn

Anglo’s Handling of De Beers Sale Irks Stakeholder Botswana

Crisis at De Beers Is a Warning for $80 Billion Diamond Market

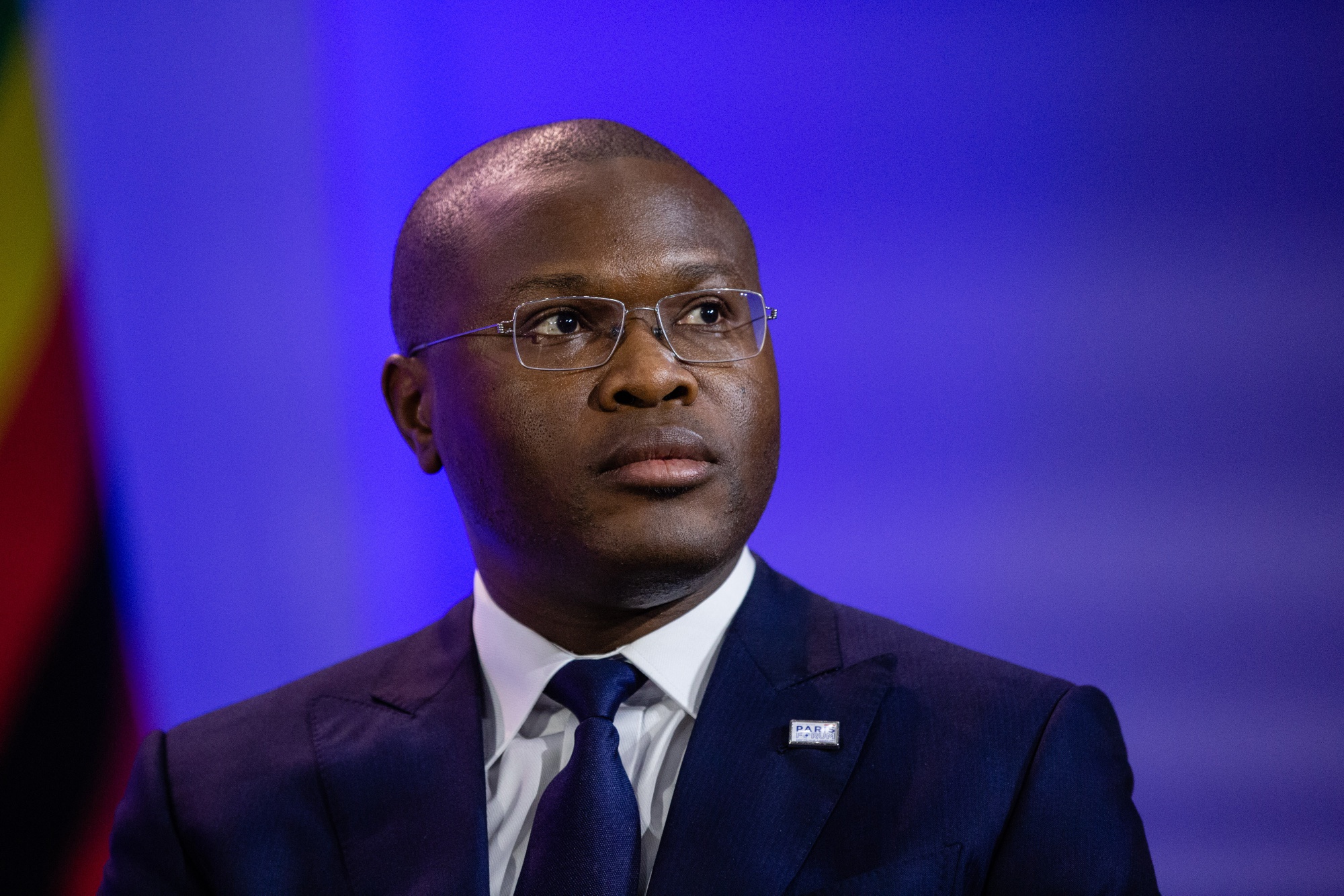

Botswana Declares Health Crisis After Diamond Revenue Slumps People affected by a large-scale toxic spill at a mine in Zambia are demanding $420 million in compensation from the Chinese state-owned company that operates the site. Two separate groups have sent letters of demand to Sino Metals Leach Zambia. The claims follow reports that the February spill of highly acidic mine-waste laden with heavy metals may have been worse than initially thought.  A breach at a Sino-Metals Leach Zambia tailings dam mine near Kitwe in northern Zambia. Photographer: Richard Kille/AP Photo Guinness Nigeria and other consumer-goods giants are turning to startups to crack Africa’s vast informal retail market. Flour Mills of Nigeria has bought a stake in OmniRetail, a startup that provides inventory management and payment services through a mobile platform and connects 130 manufacturers, banks and logistics providers to 150,000 mom-and-pop stores. Those businesses offer the potential to open up an estimated market of 8 million informal traders for consumer-goods makers in the country. Benin’s ruling coalition chose Finance Minister Romuald Wadagni as its candidate for next year’s presidential election as incumbent Patrice Talon prepares to step down after two terms. The 49-year-old Harvard alumni was endorsed by the Progressive Union for Renewal and the Republican Bloc parties. One of Africa’s top cotton producers, Benin is set to start exporting oil from offshore blocks. In neighboring Togo, security forces on Saturday blocked a protest by opposition parties and civil groups against the rule of Faure Gnassingbé and his family, now in its 58th year.  Romuald Wadagni. Photographer: Marlene Awaad/Bloomberg Kenya’s quest to secure new funding from the International Monetary Fund will likely be drawn out as the parties negotiate fresh reforms, and money may only begin flowing after 2027 elections, analysts say. An IMF team is expected in Nairobi this month to begin talks. The East African nation previously agreed a four-year, $3.6 billion program that expired in April, but missed out on a final payment of about $850 million after struggling to meet targets. Sudan’s army-backed government accused its paramilitary foes of attacking facilities used to export oil from neighboring South Sudan. The Rapid Support Forces’ assault around the Heglig fields claimed the lives of a number of workers, the foreign ministry said. The RSF has been battling Sudan’s military for control of the North African nation since April 2023. Separately, the rebel group said a landslide flattened an entire village in the country’s western Darfur region, leaving at least 1,000 people dead.  A fighter patrols a market area in Khartoum, Sudan. Photographer: AFP/Getty Images Angola’s Cabinda oil refinery is expected to begin commercial operations by year-end, helping reduce the nation’s reliance on imported fuels. The plant, the first to be built since independence in 1975, will initially process 30,000 barrels of crude a day and supply sufficient diesel, kerosene, fuel oil and naphtha to meet about 10% of national demand. Angola’s push to refine its own oil is similar to that of Nigeria, where Aliko Dangote has built a 650,000 barrels-a-day facility. Thank you for your responses to our weekly Next Africa Quiz and congratulations to multiple-winner Altan Ari, who was first to identify Capitec as the bank that (briefly) overtook FirstRand last week to become Africa’s most valuable lender. South African business sentiment deteriorated last month on sluggish demand as US tariffs began taking a toll on exports. Absa’s PMI declined to 49.5 in August, signaling a contraction. “Even if they themselves are not directly impacted, some mention knock-on implications of impacted clients,” the bank said, referring to respondents’ views on President Donald Trump’s import duties. South African shipments of vehicles, citrus fruit and other goods to the US have been hit with 30% levies. Thanks for reading. We’ll be back in your inbox with the next edition on Friday. Send any feedback to gbell16@bloomberg.net |