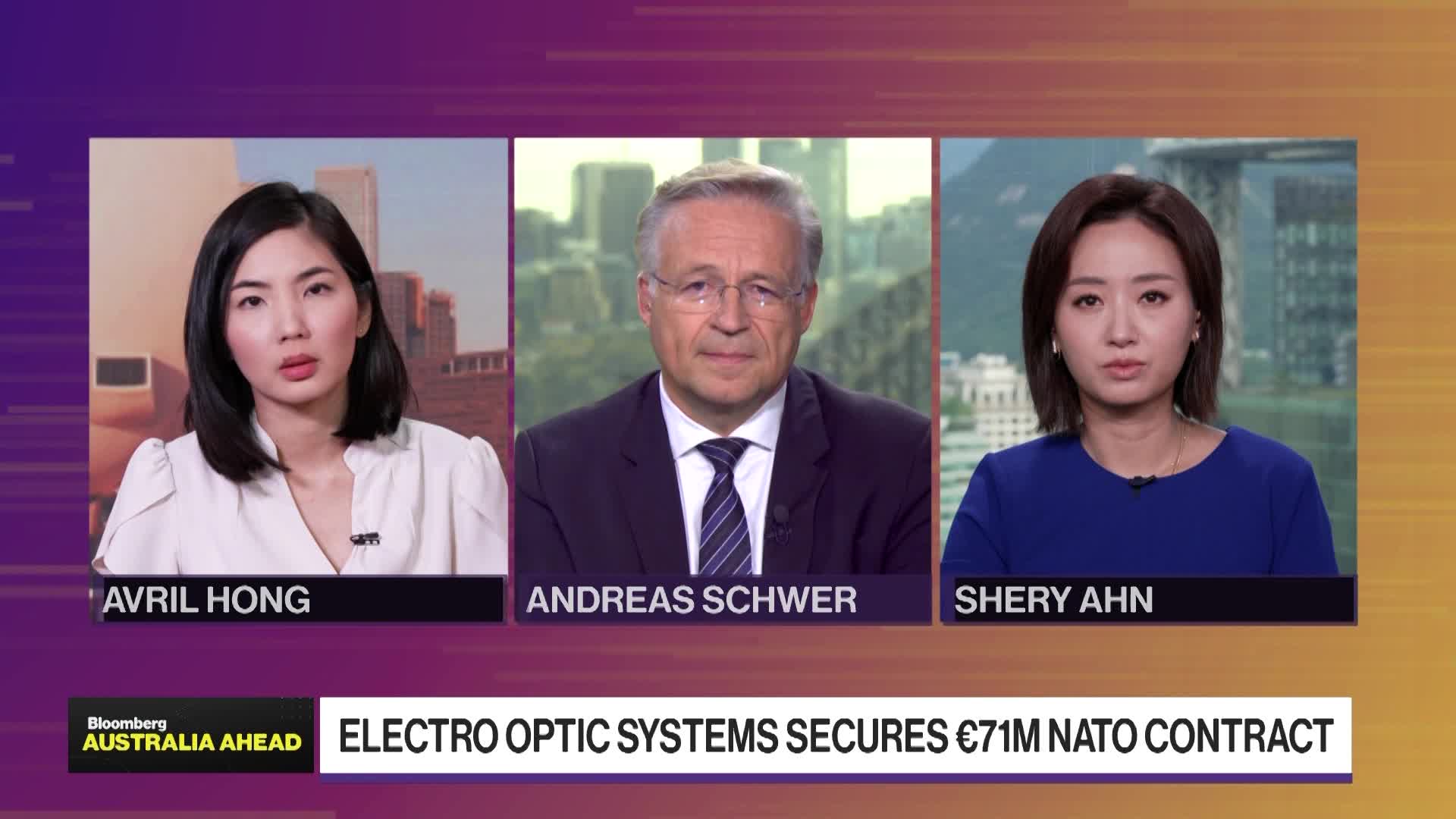

| AustralianSuper has earmarked A$40 billion for local investments in the next five years, according to comments Chief Executive Officer Paul Schroder is set to deliver today in Canberra. The fund identified energy and tech infrastructure and corporate debt as potential targets. Westpac is on a hiring spree. The lender is set to add 350 bankers to its business and wealth unit by the 2027 financial year after adding 135 in the first half of 2025. Woodside Energy Chief Executive Officer Meg O’Neill brushed off concerns over liquefied natural gas demand in Asia following news that Russia will build a pipeline to China. Australian defense contractor Electro Optic Systems has landed a €71 million NATO drone-defense deal against the backdrop of intensifying geopolitical pressures. On Bloomberg TV’s Australia Ahead, EOS Chief Executive Officer Andreas Schwer discusses prospects for growth. Click image to play.  Click image to play. Bloomberg Amazon launched cloud services in New Zealand and resurfaced a plan initially touted in 2021 to invest more than NZ$7.5 billion in data centers in the country. New South Wales Treasury Corp, the state’s investment-management unit, is benefitting from a move several years ago to reduce its US dollar exposure and sees a further 10% slide in the greenback. A recycling startup backed by Lululemon Athletica has opened its first commercial-sized facility outside Canberra to process materials that will be used by the athleisure brand. |