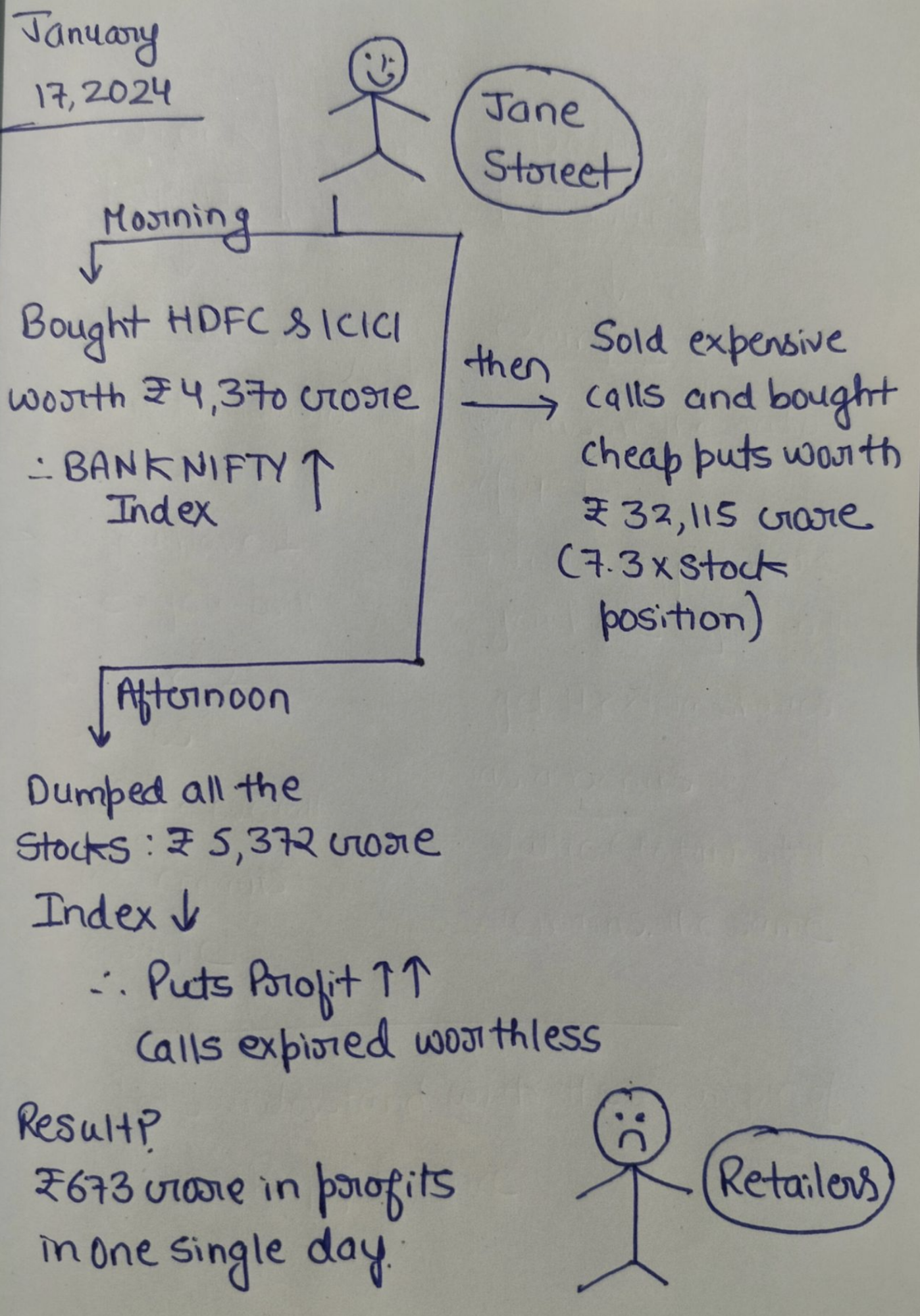

| All week I’ve been hearing about Jane Street this, Jane Street that. But I still haven’t figured out: Where do I find this street? Who is this mysterious Jane? And why is everyone talking about her? Apparently, Jane is not a person. Nor is she a street. She is an algorithmic trading firm with offices alllll over the world, yet none of them appear to be located on streets named Jane. Weird! Even weirder, this saga involves the world’s largest options market — stick with me here — which just so happens to be India. During the pandemic, Robinhood and GameStop gamified finance. In India, where digital assets are taxed to high heaven and capital controls force most household wealth to stay at home, options became “a full-blown mania,” Andy Mukherjee says. Now, four out of five equity options contracts traded every day are coming out of the country. “It’s weird to have an options market that is much bigger than the underlying stock market. The explanation here seems to be largely that Indian retail investors enjoy a gamble, and the best way to gamble on stocks is with options,” Matt Levine writes. Where does Jane Street come into India’s retail options boom? This little doodle making the rounds on LinkedIn captures it well enough:  Source: Ganesh Nayak via LinkedIn A lot of people, including the officials at the Securities and Exchange Board of India — SEBI — see that diagram of events and say Jane Street manipulated the options market (hence why SEBI imposed a temporary trading ban on the firm). But Matt has a different theory: “This does not look like manipulation; it looks like arbitrage. This is: Jane Street came in one Friday morning and noticed that Indian retail traders were buying options on the Nifty Bank index at much higher prices than where the index was actually trading. So Jane Street got to work doing what it does: It sold options to retail traders who wanted them, and bought the underlying stocks to hedge, until the arbitrage closed,” he writes. Read the whole thing. On Tuesday morning, Trump told the world in all caps that “TARIFFS WILL START BEING PAID ON AUGUST 1,” no ifs, ands or buts. The message arrived on the heels of his “letters,” which appear to just be .pngs posted to Truth Social. Although Trump’s missive to Japan did not contain typos — that honor went to Željka Cvijanović, the chairwoman of the presidency of Bosnia and Herzegovina, who is most certainly not “Mr. President” — Gearoid Reidy says Prime Minister Shigeru Ishiba is outraged all the same. “Japan was among the first countries to begin talks,” he writes, and somehow they’re ending up “with a tariff rate 1 percentage point higher than first proposed three months ago.” Still, John Authers says “it’s hard to call this an escalation. Nor is it the full-fledged retreat that some had predicted. That’s partly because events in the last three months have strengthened the chances that tariffs stay in force.” Just look at how much money the US has raked in since Trump’s Liberation Day: What will long-term tariffs mean for stocks? “In the last 20 years, investors got away with some home bias because US stocks outperformed, and markets were relatively correlated because they were so integrated,” writes Allison Schrager. “That will no longer be true if countries trade less and cross-border capital flows decrease. Since diversification won’t be built in anymore, investors will need to seek it out.” Free read: Trump’s Justice Department can’t just strip away someone’s US citizenship. — Noah Feldman The horrific truth about British politics? Things are worse than they look. — Adrian Wooldridge Congress is addicted to megabills, despite history showing they’re loaded with risks. — Ronald Brownstein Chairing BP is a thankless job that no one wants to take on. — Javier Blas Netanyahu will never have a better moment to claim victory than now. — Marc Champion You get to keep your shoes on at the airport. Jack Dorsey is cooking up a chat app. Amazon’s Prime Day sales slump. Ben Shelton got Morgan Stanley to give his sister more PTO. Love Island USA is the summer’s hottest show. Chefs are sneaking vegetables into your sweet treats. |