|

|

Investing today is easier than ever.

With a single click, you own a piece of hundreds of companies through an ETF.

But here’s the dirty little secret: Most ETFs aren’t nearly as diversified as you think.

The essence of an ETF

Imagine you walk into a grocery store. Instead of buying apples, bananas, and oranges separately, you grab a pre-packaged fruit basket. Convenient, right?

That’s how ETFs work. Instead of picking individual stocks, you buy a ready-made basket. It sounds great. And for years, ETFs have been sold as the best way to invest: low fees, broad exposure, easy diversification.

No wonder investors have poured trillions into them.

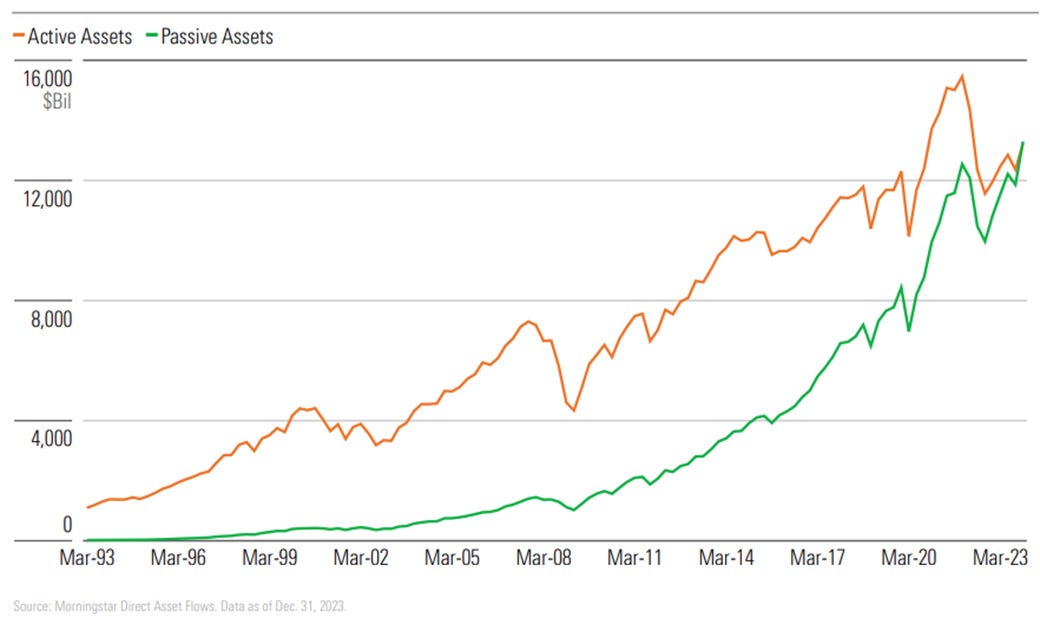

In fact, for the first time last year, there’s more money (Assets Under Management) in passive funds versus active funds:

If you want to learn more about the essence of ETFs, you can download this free course:

More risk than you think

The stock market has done really well in the recent past.

The S&P 500 returned 14% per year over the past 13 years.

If you invested $10,000 in 2012, you’d have $50,000 today.

|

But you know what the problem is?

Most indices are way too concentrated.

Since 1996, it has never happened that the top 10 position had such a high weight.

Apple, Nvidia, Microsoft, Amazon, Meta Platforms, Alphabet, and Tesla account for 32.7% of the S&P 500.

36.3% is invested in the top 10 stocks:

|